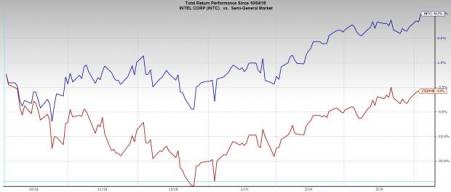

The semiconductor space has had a tough couple quarters, down 4.5% in the last 6 months. This category was hammered hard by the trade war with China. The trade conflict cost the US semiconductor industry tens of millions in additional duties. One firm that has kept its head above semis’ murky water is Intel (NASDAQ:INTC) .

Intel was able to achieve and even exceed their top and bottom line goals for 2018. They are in the midst of a transformation from a PC-centric company to a data-centric one. Nearly half of their growing revenue is now being driven by data-centric revenue streams, which expanded 18% this past fiscal year. Intel’s total accessible market (TAM) grew to more than $300 billion through acquisitions and product innovations. The business is committed to continue investing and developing their cloud computing, 5G networking, AI & analytics, along with the rest of their portfolio.

Intel has been a powerhouse in the computing sector since their origin 50 years ago and they are still able to consistently grow their top-line. Revenue has doubled for Intel in the last 5 years with net income almost 4x what it was in 2009 and there is no definitive sign of this growth stalling.

One concern with INTC is the category becoming oversaturated and market share control being continually driven by the newest innovations. This industry is expected to be declining in the coming quarters with a growth outlook for 2020.

Intel appears to be perpetually ahead of the curve in innovation and knowing what the market wants. Its access to capital is unmatched by any other semiconductor company which should keep them ahead of the game in the coming years.

INTC is currently trading at an equitable valuation of 12x earnings, 22% below the industry average of 15.5. Intel, a long-standing top 10 tech stock with double-digit growth numbers and low valuation makes this stock attractive to even the stingiest investors. With long term EPS estimates adjusting up, INTC is evaluated as a Zacks Rank #2 (Buy).

AMD

Advanced Micro Devices (NASDAQ:AMD) stock price rallies 9% today after analyst David Wong at Instinet estimates it could take market share from competing semiconductor companies like Intel and Nvidia (NASDAQ:NVDA) . According to Wong, AMD’s innovation in microprocessors and GPUs gives them solid footing to gaining market share. Instinet also upgraded Intel to a buy rating.

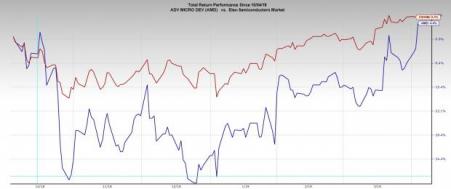

AMD has traded like a crypto over the last 3 years, up over 900%. The question is will it fall off as the crypto market did? There is a tremendous amount of growth priced into AMD, which is trading at 44x forward earnings (4x the industry average). If some of this growth isn’t realized in the coming months, AMD stock could see a bigger downside than the rest of the semi market. The extreme competition in this space makes me hesitant to jump into any semi with that high of a valuation especially one with AMD’s volatility and an unprecedented beta of 3.4. AMD – Zacks Rank #4 (Sell).

AMD (blue) 6-Month return vs. semiconductor market (red).

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research