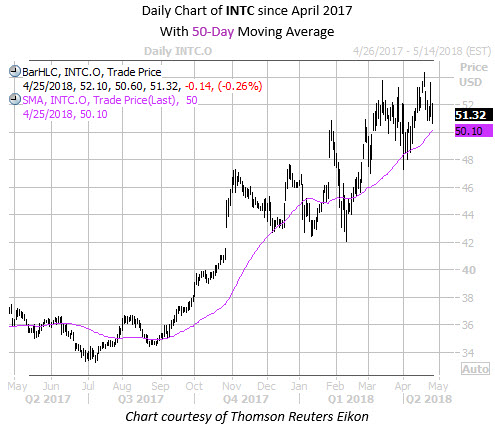

Semiconductor giant Intel Corporation (NASDAQ:INTC) is slated to report its first-quarter earnings after the close tomorrow. The stock notched a 17-year high of $54.35 on April 18, before pulling back amid a broader chipmaker sell-off, and today is fractionally lower amid reports of a Justice Department probe into possible violations of Iran sanctions by Huawei (subscription required). INTC shares have been in a long-term trend higher since July, with a pullback earlier this month contained by their 50-day moving average. The blue chip was last seen trading at $51.32.

Looking at its earnings history, INTC stock has finished higher the day after reporting in four of the past five quarters, including a 10.6% jump following its last report. The stock's average post-earnings daily price move is 4.3%, regardless of direction, looking back two years. This time around, the options market is pricing in a 7% next-day move in either direction, per at-the-money implied volatility data.

Digging deeper, put open interest currently stands at 651,493 contracts, ranking in the low 3rd percentile of its annual range. Call open interest, meanwhile, stands at more than 1 million contracts -- in the 81st percentile of its 12-month range. This indicates that Intel options traders are much more call-heavy than usual ahead of earnings, with bears practically M.I.A.

Echoing that, the stock's Schaeffer's put/call open interest ratio (SOIR) stands at 0.61, and ranks in the lowest percentile of its annual range. This suggests near-term traders have rarely shown a greater preference for INTC calls over puts in the last year.

Intel has handily rewarded premium buyers over the past year. The semiconductor stock currently sports a Schaeffer's Volatility Scorecard (SVS) of 81 out of 100. This means the equity has tended to register bigger price swings than its options premiums have priced in over the past 12 months.