Intel Corporation ( (NASDAQ:INTC) ) just released its fourth-quarter fiscal 2017 financial results, posting adjusted earnings of $1.08 per share and revenues of $17.1 billion.

Currently, INTC is a Zacks Rank #2 (Buy) and is up 3.97% to $47.10 per share in trading shortly after its earnings report was released.

Intel:

Beat earnings estimates. The company posted non-GAAP earnings of $1.08 per share, beating the Zacks Consensus Estimate of $0.86. Factoring in a charge related to the recent tax reform bill, Intel posted a GAAP loss of $0.15 per share in the quarter.

Beat revenue estimates. The company saw revenue figures of $17.05 billion, beating our consensus estimate of $16.31 billion. Excluding McAfee, fourth-quarter revenue grew 8% year-over-year, with data-centric revenue up 21%.

Revenues in the Client Computing Group were $9.0 billion, down 2% year-over-year. Revenues in the Data Center Group were $5.6 billion, up 20% year-over-year.

“We have and may continue to face product claims, litigation, and adverse publicity and customer relations from security vulnerabilities and/or mitigation techniques, including as a result of side-channel exploits such as ‘Spectre’ and ‘Meltdown,’ which could adversely impact our results of operations, customer relationships, and reputation,” the company noted in its press release.

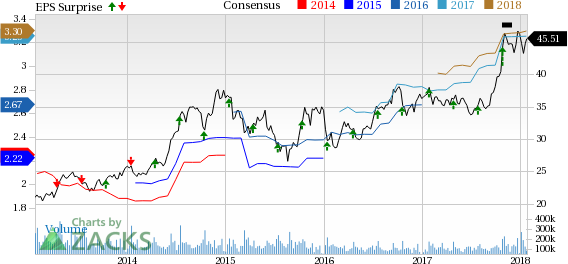

Intel expects first-quarter revenues of $15.0 billion and earnings of $0.70 per share. The company projects full-year 2018 revenues of $65.0 billion and earnings of $3.55 per share. Our current consensus estimates are calling for first-quarter earnings of $0.73 per share and revenues $15.05 billion; our full-year consensus estimates are calling for revenues of $63.68 billion and earnings of $3.30 per share.

Here’s a graph that looks at Intel’s earnings surprise history:

Intel Corporation is one of the world's largest semiconductor manufacturers. The company develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. It also develops platforms, which it defines as integrated suites of digital computing technologies that are designed and configured to work together to provide an optimized user computing solution compared to components that are used separately.

Check back later for our full analysis on Intel’s earnings report!

Want more analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research