Intel Corp. (NASDAQ:INTC) just released its second quarter fiscal 2017 financial results, posting earnings of 72 cents per share and revenues of $14.8 billion. Currently, INTC is a #4 (Sell) on the Zacks Rank, and is up 1.74% to $35.58 per share in trading shortly after its earnings report was released.

Intel:

Beat earnings estimates. The chip maker reported non-GAAP earnings of 72 cents per share, topping the Zacks Consensus Estimate of 68 cents per share. This number excludes 14 cents from non-recurring items.

Beat revenue estimates. The company saw record revenue figures of $14.8 billion, surpassing our consensus estimate of $14.41 billion and growing 9% year-over-year thanks to strong performance in client computing and data-centric businesses.

Breaking down Intel’s key business units, its Client Computing and Data Center Groups grew 12% and 9% year-over-year, respectively. Internet of Things Group grew 26% from the year-ago period, while Non-Volatile Memory Solutions Group surged 58%. Programmable Solutions Group, however, fell 5% year-over-year.

Looking ahead, Intel has raised its full-year revenue outlook by $1.3 billion to $61.3 billion, and raised its full-year GAAP EPS outlook by 10 cents to $2.66 per share and non-GAAP EPS by 15 cents to $3.00 per share.

“Q2 was an outstanding quarter with revenue and profits growing double digits over last year,” said Brian Krzanich, Intel CEO.”

“We also launched new Intel Core, Xeon and memory products that reset the bar for performance leadership, and we’re gaining customer momentum in areas like AI and autonomous driving. With industry-leading products and strong first-half results, we’re on a clear path to another record year,” he continued

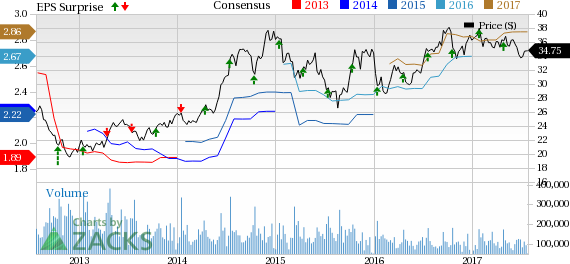

Here’s a graph that looks at Intel’s price, consensus, and EPS surprise:

Intel is one of the world's largest semiconductor chip makers. The Company develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. It also develops platforms, which it defines as integrated suites of digital computing technologies that are designed and configured to work together to provide an optimized user computing solution compared to components that are used separately. Intel is based in Santa Clara, California.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research