It has been about a month since the last earnings report for Integra LifeSciences Holdings Corporation (NASDAQ:IART) . Shares have added about 8.5% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Integra LifeSciences Misses Q1 Earnings, Retains View

Integra LifeSciences reported adjusted earnings per share (EPS) of $0.39 in the first quarter of 2017, which marked a 2.6% increase from the year-ago number.

Adjusted EPS however missed the Zacks Consensus Estimate by a penny. Including one-time items, the company reported earnings of $0.08 per share, down 55.5% from the year-ago quarter.

Revenue Details

Total revenue in the reported quarter increased 9.2% year over year to $258.6 million, which exceeds the Zacks Consensus Estimate by 1.4%. Excluding the contribution of revenues from acquisitions, discontinued products and the effect of currency exchange rates, organic revenues rose 6.4% year over year.

The first quarter’s solid revenue growth was primarily driven by strong contribution from the company’s Specialty Surgical Solutions and Orthopedics and Tissue Technologies segments.

In terms of product categories, revenues from the company's Specialty Surgical Solutions segment rose 3.4% (up 4% organically) to $156.3 million, aided by strong performance by the dural repair franchise, which grew in high single digits in the reported quarter.

Orthopedics and Tissue Technologies’ revenues came in at $102.3 million in the first quarter, up 19.6% year over year (up 6.4% organically). Regenerative Technologies (excluding Derma Sciences) revenues, the largest franchise in the segment, increased double digits in the first quarter.

Margin Trend

Gross margin expanded 233 basis points (bps) to 66.5% in the reported quarter. Adjusted gross margin improved 100 bps to 70.2%, driven by the company’s higher margin regenerative products and improved operating efficiency.

Selling, general and administrative expenses increased 27.2% to $142.4 million in the reported quarter, and research and development expenses rose 7.2% to $15.5 million. Adjusted operating margin (excluding amortization of intangible asset) saw a 536-bps contraction to 5.4% in the first quarter.

Financial Position

Integra exited first-quarter 2017 with cash and cash equivalents of $124.1 million, up from $102 million recorded at the end of fiscal 2016. As of Mar 31, 2017, net cash flow from operating activities was $28.8 million, up from $25.0 million in the year-ago period.

2017 Outlook Reiterated

Management has reaffirmed its full-year 2017 revenues in the range of $1.12 billion to $1.14 billion and organic sales growth between 7% and 8.5%. The Zacks Consensus Estimate for full-year 2017 revenues is at $1.13 billion, which is within the guided range.

The company also projects adjusted EPS between $1.88 and $1.94. The Zacks Consensus Estimate for 2017 adjusted earnings is pegged at $1.91 per share, which is within the company forecasted range.

For the second quarter of 2017, the company expects total revenues to be in the range of $282 million-$287 million representing reported growth of between 13% and 15% with organic growth in the range of 6.5% to 7%. The Zacks Consensus Estimate for revenues is $281.7 million which meets the lower end of the guidance.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a upward trend in fresh estimates. There have been two revisions higher for the current quarter compared to one lower.

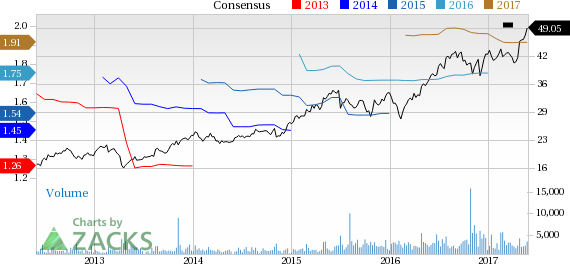

Integra LifeSciences Holdings Corporation Price and Consensus

VGM Scores

At this time, the stock has a subpar Growth Score of 'D', a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of 'C' on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of 'D'. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

While estimates have been broadly trending upward for the stock, the magnitude of these revisions has been net zero. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Integra LifeSciences Holdings Corporation (IART): Free Stock Analysis Report

Original post

Zacks Investment Research