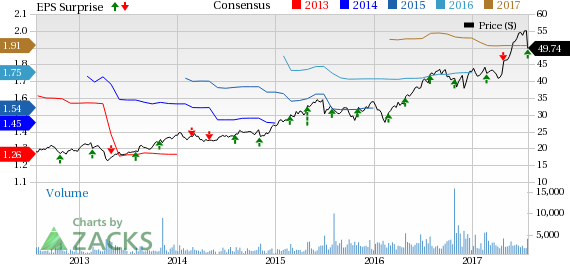

New Jersey-based medical device manufacturer, Integra LifeSciences Holdings Corporation (NASDAQ:IART) reported adjusted earnings per share (EPS) of 45 cents in the second quarter of 2017, which marked an increase of 12.5% from the year-ago number.

Adjusted EPS however was in line with the Zacks Consensus Estimate. Including one-time items, the company reported earnings of 14 cents per share, down 12.5% from the year-ago quarter.

Revenue Details

Total revenue in the reported quarter increased 13.2% year over year to $282.2 million, which missed the Zacks Consensus Estimate by 0.24%. Excluding the contribution of revenues from acquisitions, discontinued products and the effect of currency exchange rates, organic revenues rose 4.6% year over year.

The solid revenue growth in the second quarter was primarily driven by strong contribution from the company’s Specialty Surgical Solutions and Orthopedics and Tissue Technologies segments.

In terms of product categories, revenues from the company's Specialty Surgical Solutions segment inched up 1.1% (down 6.5% organically) to $159.9 million.

Orthopedics and Tissue Technologies’ revenues came in at $122.3 million in the second quarter, up 34.2% year over year and 23.7% organically.

Margin Trend

Gross margin expanded 80 basis points (bps) to 64.9% in the reported quarter on lower purchase accounting adjustments from the TEI acquisition. Adjusted gross margin contracted 80 bps to 68.4% primarily due to dilution at Derma Sciences.

Selling, general and administrative expenses increased 21.6% to $145.0 million in the reported quarter, and research and development expenses rose 7.3% to $15.7 million. Adjusted operating margin (excluding amortization of intangible asset) saw a 242-bps contraction to 7.9% in the second quarter.

Financial Position

Integra LifeSciences exited second-quarter 2017 with cash and cash equivalents of $154.6 million, up from $124.1 million recorded at the end of first-quarter 2017. As of Jun 30, 2017, net cash flow from operating activities was $57.8 million, down from $63.1 million in the year-ago quarter.

2017 Outlook Tweaked

Management has raised the low end of the earlier provided full-year 2017 revenue guidance from the range of $1.120 billion to $1.140 billion to $1.125 billion to $1.140 billion. Meanwhile, the full-year 2017 organic revenue growth range was lowered to 6.0% to 7.0% from 7% to 8.5%. The Zacks Consensus Estimate for full-year 2017 revenues is $1.13 billion, within the guided range.

The company has reaffirmed its full-year 2017 adjusted EPS at $1.88 to $1.94. The Zacks Consensus Estimate for 2017 adjusted earnings is pegged at $1.91 per share, within the company’s guided range.

Our Take

Integra LifeSciences exited the second quarter of 2017 on a disappointing note with revenues missing the Zacks Consensus Estimate. We are concerned about the currency headwind that is expected to affect the company’s financial performance in the rest of 2017. Also, contraction in adjusted operating margin and adjusted gross margin adds to the woes.

However, the strong year-over-year increase in revenues on the back of its Orthopedics and Tissue Technologies’ segment buoys optimism. Also, we are encouraged to note that both the company’s segments saw year-over-year revenue growth in the quarter. Nonetheless, we believe the company is trying to execute its growth plan through product launches and an efficient management team.

Zacks Rank & Key Picks

Integra LifeSciences currently has a Zacks Rank #3 (Hold).A few better-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock has gained around 5.7% over the last three months.

Mesa Laboratories has a positive earnings surprise of 2.84% for the last four quarters. The stock has added roughly 4.1% over the last three months.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 32.1% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Integra LifeSciences Holdings Corporation (IART): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research