2017 marks the first time the United States has been hit by back-to-back Category 4 storms. Depending on who you ask, Harvey and Irma are estimated to have caused between $30 and $90 billion in combined damage.

Chuck Watson, an analysts with Enki Research, went even further by saying that going back to normal after Irma alone could cost over $170 billion. Well, the exact sum is still unknown, but it is definitely going to be a big one. And someone will have to pay it. Bad news for insurers, which might end up covering between $50 and $80 billion in claims.

Does this mean we should expect a selloff in insurance stocks? Let’s see if the Elliott Wave Principle supports the negative outlook.

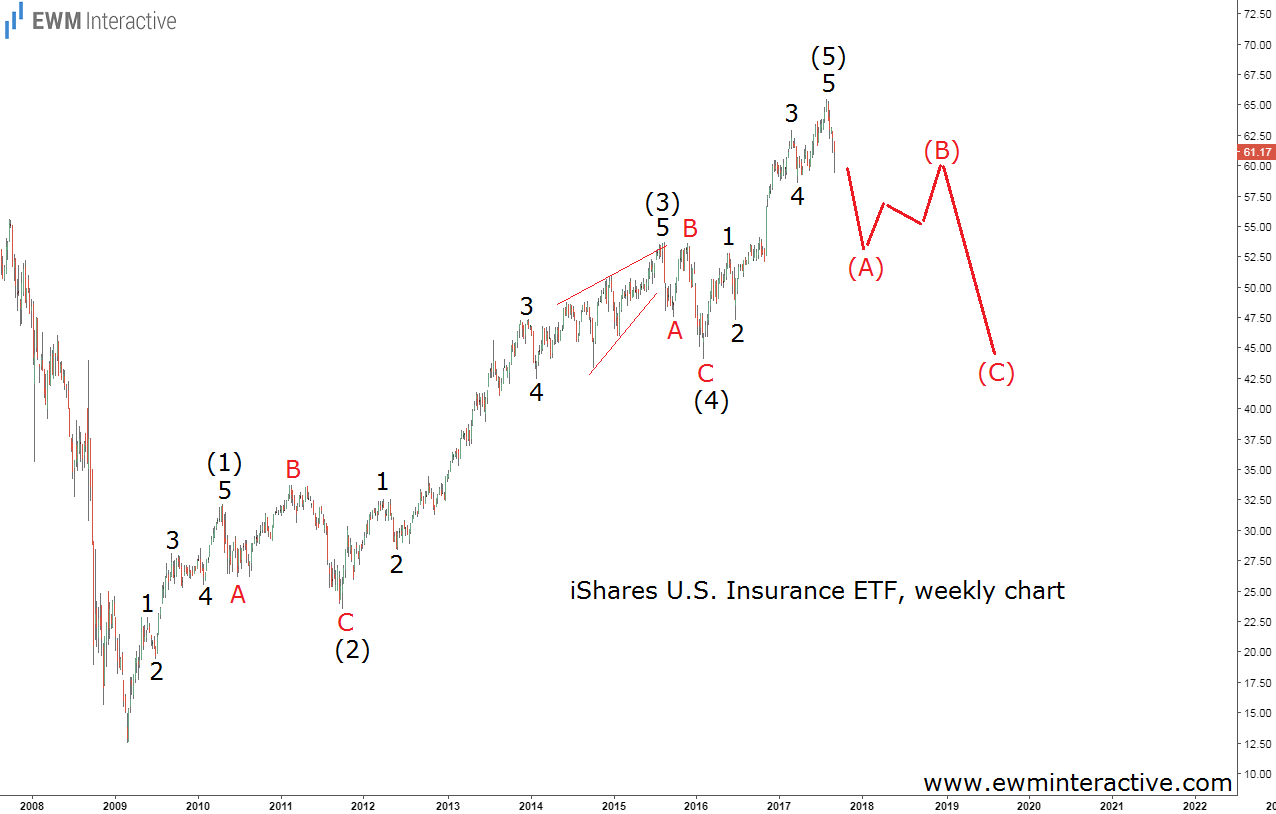

Above, the weekly price chart of the iShares US Insurance ETF (NYSE:IAK). It illustrates the industry’s impressive recovery from the bottom of the Financial crisis in 2009.

During the past eight and a half years, the index rose from below 12.50 to nearly 65.50. What is even more important is the structure of this uptrend. As you can see, the Insurance ETF has drawn a textbook five-wave impulse. The sub-waves of each of the five waves is also clearly visible. Wave (1), (3) and (5) are typical impulses, while waves (2) and (4) obey the guideline of alternation, since wave (2) is an expanding flat correction, while wave (4) is a simple zig-zag. The Fibonacci proportion between the impulsive waves is also very interesting. Wave (3) is 1.618 times longer than wave (1), while waves (1) and (5) are equal in length.

Now, according to the theory, a three-wave correction follows every impulse. This means the stage is set for a major decline in insurance stocks. In this respect, this year’s unusually active hurricane season could be the bearish catalyst investors have feared. If this is the correct count, the anticipated plunge could drag the iShares U.S. Insurance ETF down to the support area of wave (4), located in the mid- to low-40s.

In other words, this ETF could lose a third of its value from current levels. Consider taking shelter.