The SPDR Insurance ETF, KIE, reached a new all-time high in September, helped by a solid job market, increasing wages and rising consumer confidence. The price is up 630% since the Financial Crisis low at $4.77 in March 2009. The question is, can investors trust the uptrend to continue?

Regardless of what pundits say, we don’t believe the market cycle has been tamed for good. The Fed will not be able to prolong the expansion forever. When the next recession begins, the above-mentioned fundamental factors which have been fueling the insurance sector for the past decade are going to take a turn for the worse.

Insurance Investors Need a Healthy Economy

With numerous recession red flags already in place, there is probably not much left of the Insurance ETF’s bull market. Let’s see if the Elliott Wave principle can help us confirm this assumption on the chart below.

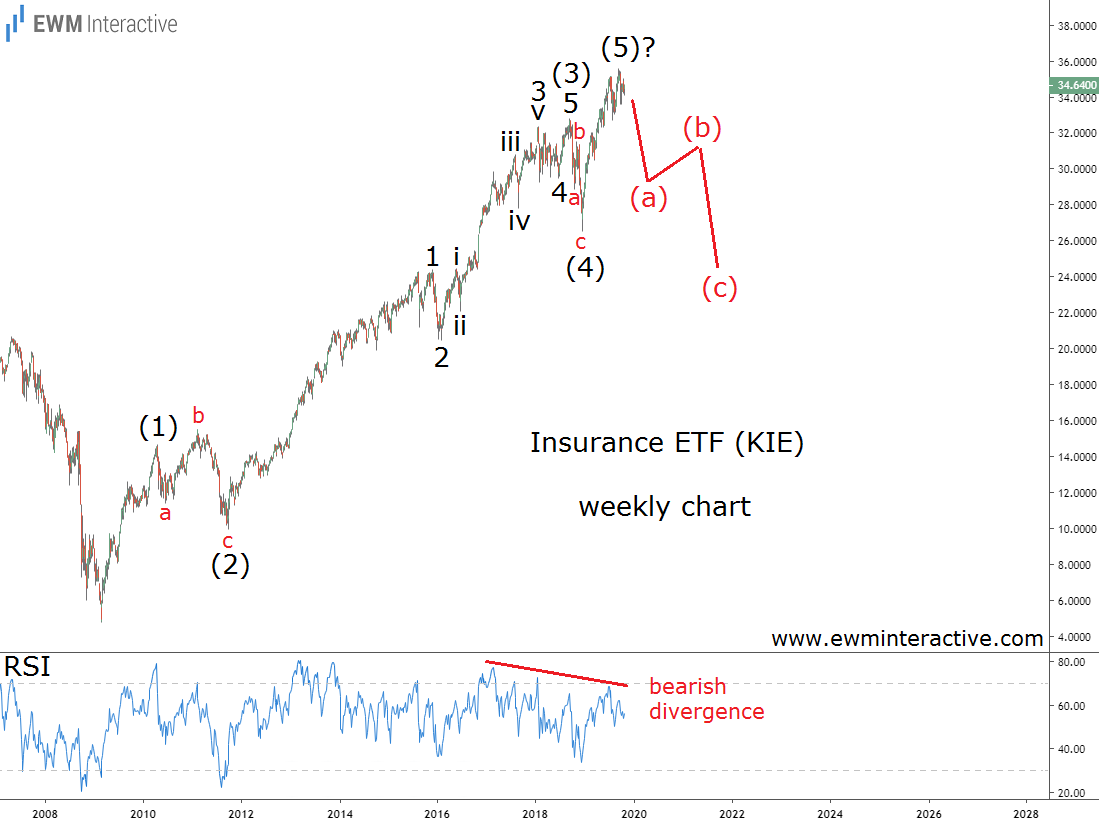

The weekly chart reveals that the entire uptrend since 2009 looks like a complete five-wave impulse. The pattern is labeled (1)-(2)-(3)-(4)-(5), where the sub-waves of wave (3) are also visible. The guideline of alternation has been taken into account, too. Wave (2) is an expanding flat correction, while wave (4) is a sharp zigzag.

According to the theory, a three-wave correction in the opposite direction follows every impulse. If this count is correct, a ~30% decline to the support of wave (4) can soon be expected. The RSI indicator backs the negative outlook with a bearish divergence between waves (3) and (5).

As the Oracle (NYSE:ORCL) in “The Matrix” trilogy says, “everything that has a beginning has an end.” Fortunately, we don’t need an oracle to tell us that the uptrend in the Insurance ETF won’t last forever, either.