Maybe only with the exception of grocery stores, one can hardly find a stock not suffering from the COVID-19 disaster. Insurance companies were not spared either, so it is no surprise that the SPDR® S&P Insurance ETF (NYSE:KIE) crashed, as well.

This ETF, which ranks Progressive (NYSE:PGR) and Brown & Brown (NYSE:BRO) among its top holdings, lost 46.1% in the selloff. And while the pandemic was totally unpredictable, the resulting crash wasn’t. In fact, on November 4th, 2019, we wrote about an upcoming correction in the Insurance ETF. The sole reason for our pessimism was the Elliott Wave chart below.

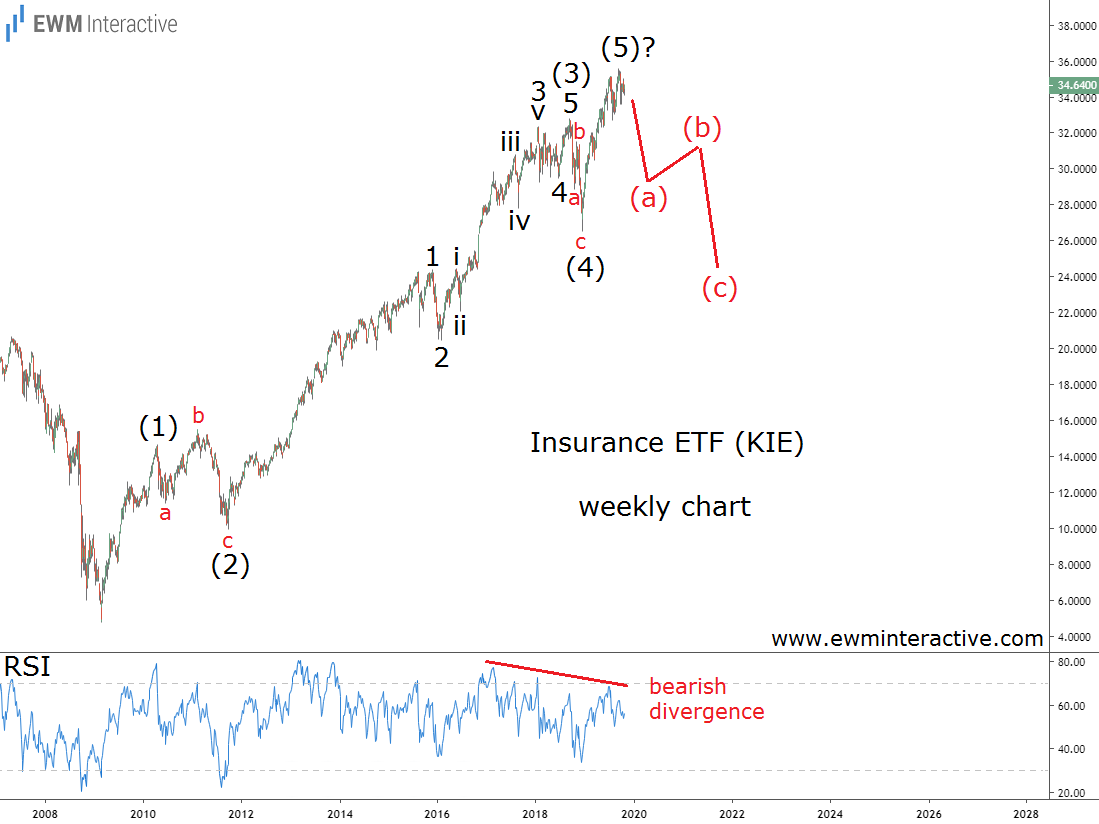

Five months ago, the weekly chart above revealed a complete five-wave impulse pattern from the bottom in March 2009. We labeled it (1)-(2)-(3)-(4)-(5), where the sub-waves of (3) and 3 of (3) were also visible.

Insurance, it seems, is still a cyclical business

The only problem was that according to the theory, a three-wave correction follows every impulse. This meant that a notable bearish reversal was supposed to occur once wave (5) ended. Then, a 30% decline to the support of wave (4) would be very likely. The negative divergence between waves (3) and (5) made the bear case even stronger.

On February 14th, 2020, the Insurance ETF reached $37.57. Then the coronavirus panic arrived.

As it turned out, we were too optimistic about both the size and the speed of the selloff. The price dropped more than expected and in a lot less time. What’s more important, however, is the fact that Elliott Wave analysis warned us to move out of the way before it was too late.

Now, it is possible that the plunge is over and the uptrend is ready to resume. However, the move from $37.57 to $20.23 looks suspiciously like one single wave. Therefore, we think another dip in wave (c) is likely. The 61.8% Fibonacci level near $17-$18 should provide the support the bulls need.