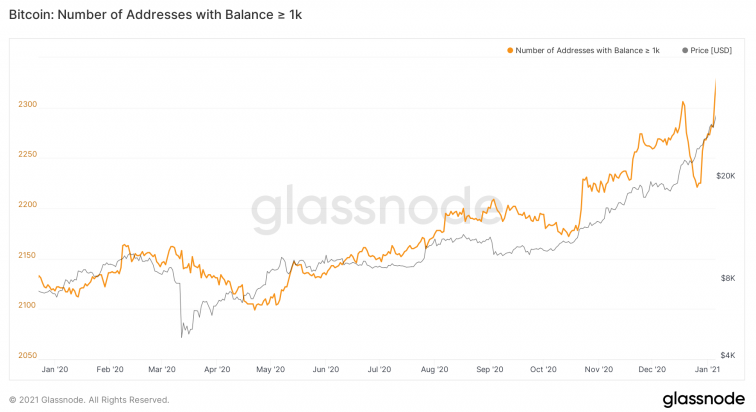

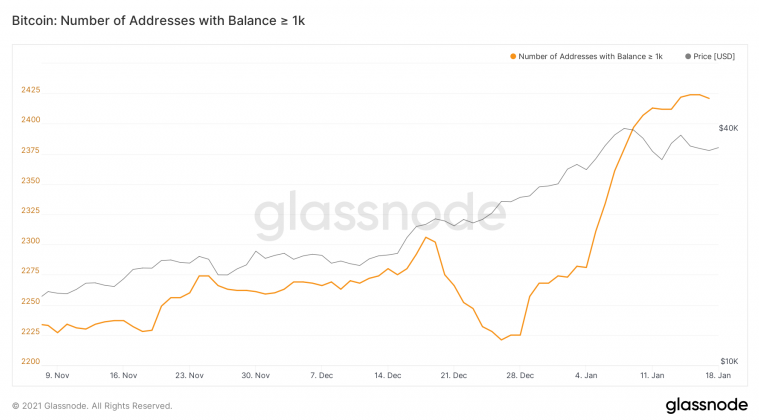

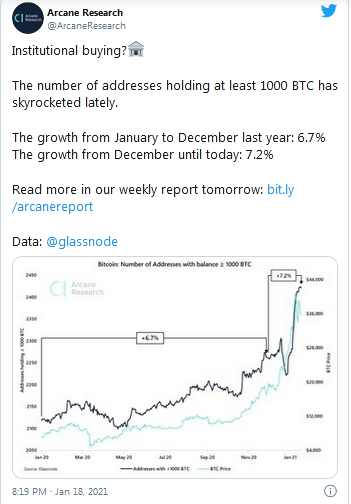

Growth in the number of wallets with over 1000 BTC in the last 30 days outpaced growth in all of 2020. Institutional investors may be behind the sudden boom in high-net-worth BTC balances. The Bitcoin bull run may just be beginning, and Glassnode data indicates that institutional investors and high-net-worth investors are leading the charge. On Jan. 1, 2020, there were 2,118 wallets with a balance of over 1,000 BTC. On Dec. 31, 2020, that number had grown to 2,268, a 6.9% increase. That data alone looks promising to those building a case for further upward price momentum. However, from Dec. 1, 2020, to today, growth in these high-net-worth wallets has exceeded 7.2%. There were 2,259 of these wallets at the start of last month compared to 2,421 today, a major increase in just six weeks. This data was brought to light by Arcane Research, an analytics firm that posted their data on Twitter ahead of a wider report due for release tomorrow. Arcane measured wallet growth from Jan. 1 to Dec. 1, 2020, showing 6.7% growth in more than 1,000 Bitcoin wallets. Arcane’s Head of Research, Bendik Schei, spoke to Crypto Briefing to provide more details on the findings. “The number of addresses holding at least 1,000 BTC has skyrocketed lately, and there are no signs of whales selling their bitcoin,” said Schei. The Arcane Research report may point to big players entering the market, and Schei stated “it is not unreasonable to assume that this is institutional buying.” “We have not seen any particular signs of this activity based on Glassnodes numbers,” said Schei.Key Takeaways

Institutional Money Behind Bitcoin Boom?

Schei offered an alternative explanation, saying the data could be partially due to large players in the space restructuring their holdings. However, this seems unlikely.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Institutional Investment May Be Behind Boom In Bitcoin Whale Wallets

Published 01/19/2021, 01:30 AM

Institutional Investment May Be Behind Boom In Bitcoin Whale Wallets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.