Delivering strong growth

Inspired Energy Plc (LONDON:INSEI) delivered impressive growth in FY14 with results ahead of expectations. Management remains confident on the outlook for the business, as evidenced by the 47% increase in the DPS, and we expect further growth in FY15 and FY16 based on strong performances from the corporate and SME divisions. Given the undemanding valuation, continuing earnings growth should help drive share price appreciation.

FY14 results demonstrate strong growth

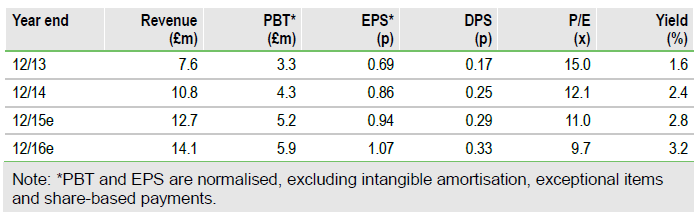

Inspired Energy’s FY14 results demonstrated impressive year-on-year growth: revenue +42% to £10.8m (Edison full-year estimate £10.3m), adjusted EBITDA +28% to £4.6m (Edison FY estimate £4.4m) and adjusted PBT (excluding restructuring costs, acquisition costs and the amortisation of intangible assets) +31% to £4.3m (Edison FY estimate £4.1m). This was achieved as a result of year-on-year growth in both the SME (168%) and the corporate divisions (17%). Net debt of £3.1m was marginally higher than our forecast of £2.9m but interest cover remains in excess of 20x. The DPS was increased by 47%, to 0.25p/share for the year, significantly higher than our forecast of 0.20p/share.

Outlook remains attractive

As shown by the 47% increase in the dividend, management remains confident of the outlook for Inspired Energy. The strong momentum in the SME division (EBITDA H114: £0.30m, H214: £0.86m) has continued into 2015, with this business outperforming expectations. Further growth in the corporate division will be underpinned by the order book, which stood at £14m at the year end (2013: £11m), Based on continued strong performance from the SME division and further growth in the corporate division (we assume order book sales of £10m for FY15 – in line with FY14) we forecast EPS increases of 9% in FY15 and 14% in FY16.

Valuation: Growth to drive valuation

Our DCF analysis highlights that at a share price of c 11p the market is discounting cash flows at a rate of c 10% and is assuming a perpetuity growth rate of c 0.5%. A DCF valuation using an 8% discount rate and a perpetuity growth rate of 2% would yield a valuation of 16p. Our PEG analysis indicates that IE is trading on a multiple broadly in line with the FTSE All-Share (c 0.9x). However, using more aggressive assumptions on order book sales (14% growth in FY15 and FY16 – the same rate of growth as achieved in FY14), suggests that a share price of c 16p would be needed to equalise the PEG ratio with that of the FTSE All-Share.

To Read the Entire Report Please Click on the pdf File Below