Inside the Minds of the RBA:

Ex Reserve Bank of Australia governor Ian Macfarlane was in the Australian media overnight speaking about the direction global growth is headed and what effect that is having on monetary policy decisions at home.

It was his comments around on the Aussie dollar and why current governor Glenn Stevens and the RBA felt they ‘had to’ cut rates earlier this month that pricked my trading interest.

“Their problem is that financial markets, particularly offshore, assume a mechanical application of what they regard as the standard model.”

When the 2-3% target band was introduced, it wasn’t within a global environment of weak inflation and zero interest rates.

Neither were financial markets running the constant news cycle that we see now where even the smallest of central bank leaning can have monumental effects on where traders push markets.

“The inflation targeting approach says that if inflation forecasts are below target, we should run an easy monetary policy – we already have that. It doesn’t say that each time we receive an inflation statistic showing it is below target, we have to cut interest rates.”

But the fact is, that’s just how things are now and have to be taken into account. And Stevens knows this. The RBA are one of the more conservative central banks in the world and any decision to continue cutting rates wasn’t ever taken lightly (as the minutes showed).

But as we highlighted in our RBA Preview blog back in early May, the fact that the Aussie dollar would have rocketed to 80c would have been a HUGE concern for the RBA and Macfarlane is highlighting the issue of warning/pleasing markets over good policy.

It’s an excellent topic and hugely relevant to the way I try to encourage ‘trading market expectations’ and finding out where the greatest risk lies.

Check out the full AFR article that I tweeted earlier:

Charts of the Day:

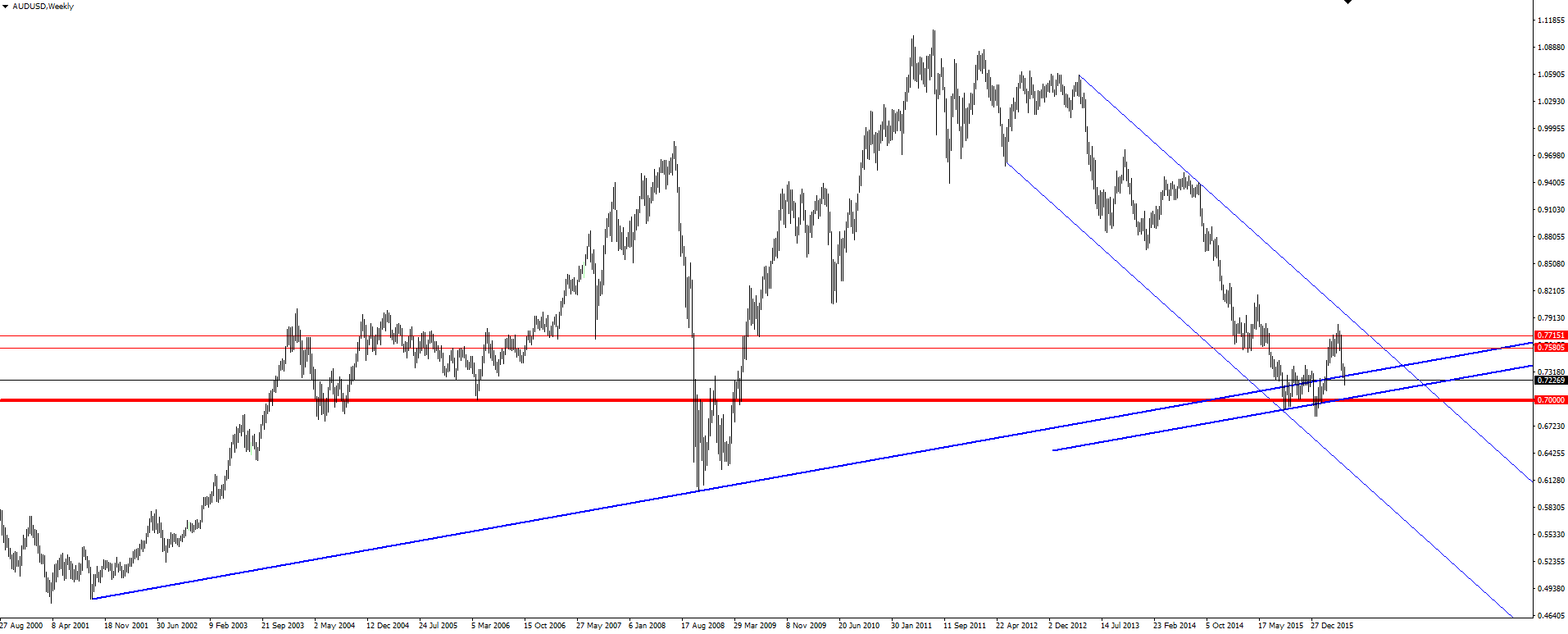

But here on the Vantage FX News Centre, we’ll go down the technical analysis route on the Aussie, and take a look at the charts. As always, we begin with the higher time frame weekly level for context.

AUD/USD Weekly:

Price is back into the weekly buy zone and also re-testing the top of the lower range that price printed between August 2015 and March 2016.

Weekly support: Tick!

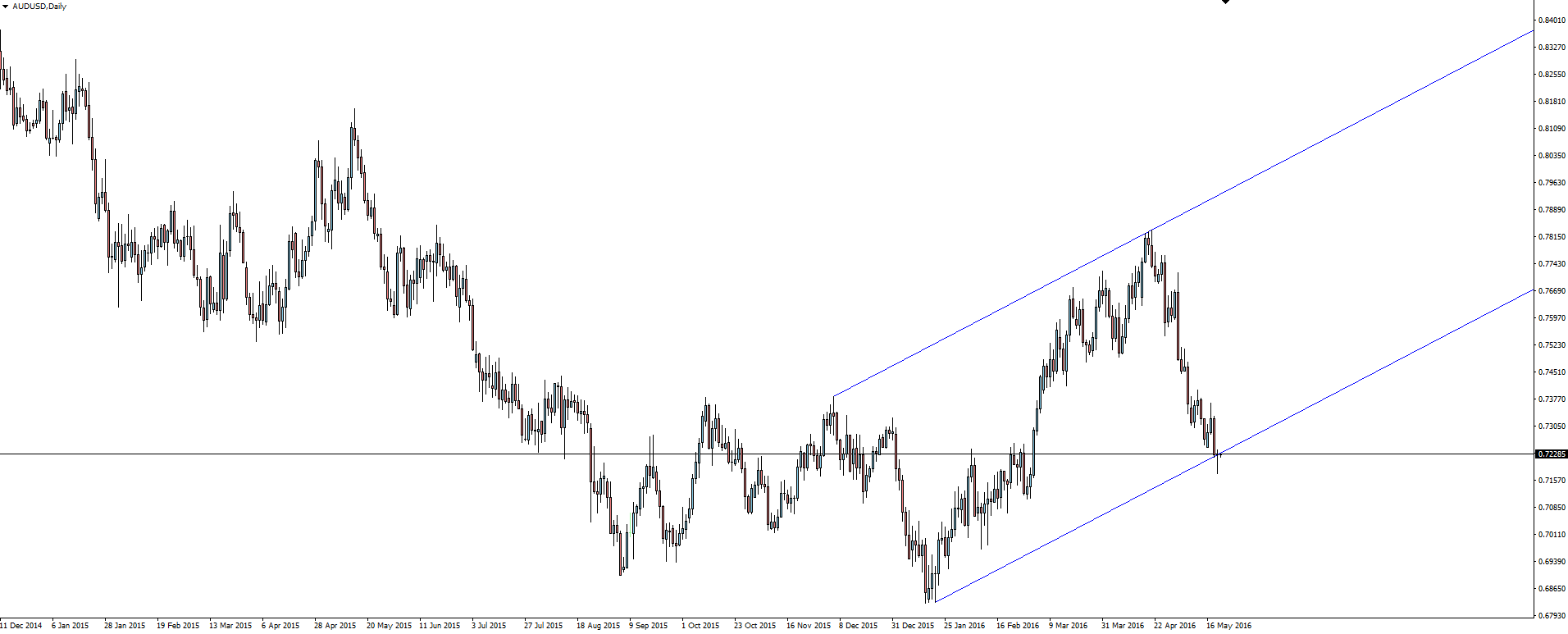

AUD/USD Daily:

Dig down a level deeper to the daily and we have a nice counter-trend channel which price is hitting support within. The range I mentioned above is a lot easier to see on this chart too.

Daily support: Tick!

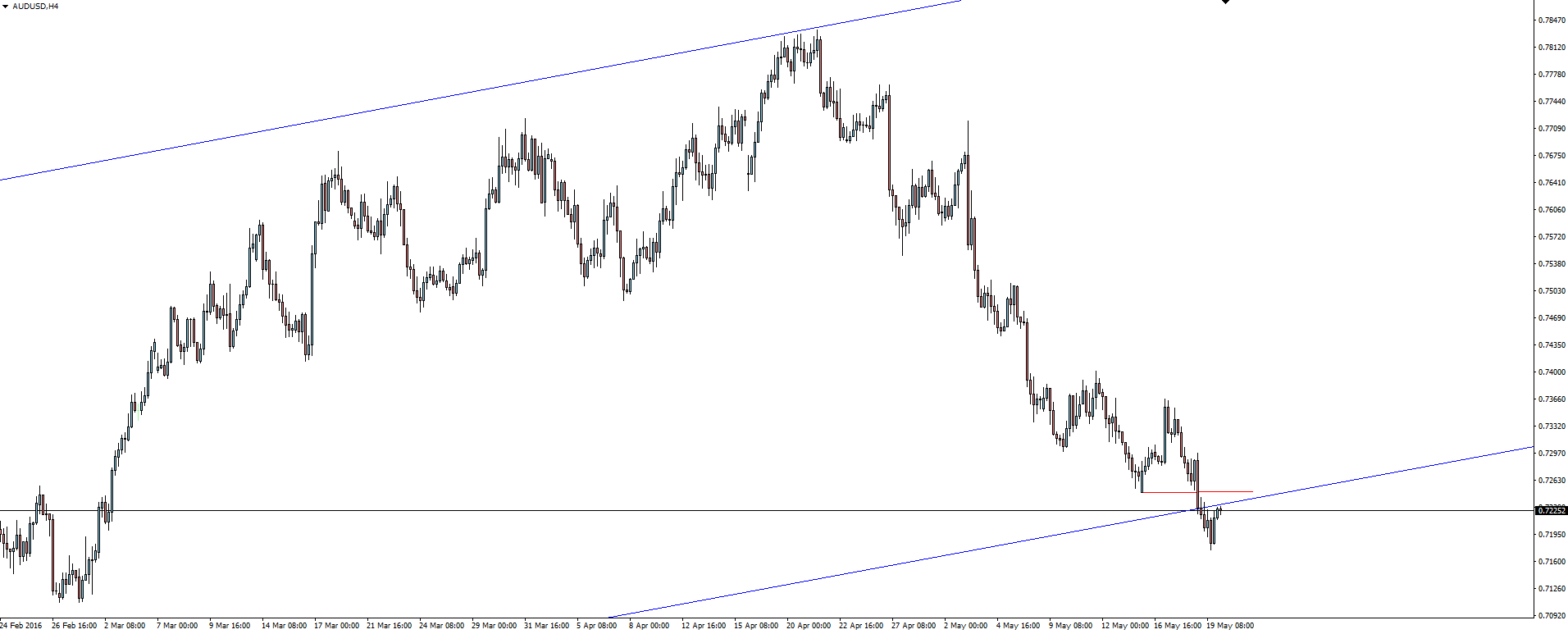

AUD/USD 4 Hourly:

Lastly into the intra-day charts and you can see while price has technically broken the channel, the higher time frames show the break isn’t clear. Coming into weekly support, how often do we see a fake-out before price tucks back in above the trend line again, reactivating it as support. The text-book style re-test of previous support as resistance sounds nice, but in this case, it doesn’t appeal as a high quality setup.

Intra-day support: Pending.

That small red line is going to be key and if price can get back above it, any re-activation of daily trend line support in conjunction with that level could offer an excellent buying opportunity.

On the Calendar Friday:

ALL G7 Meetings

CAD Core CPI m/m

CAD Core Retail Sales m/m

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices, low spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.