Gold futures are up 0.2% this afternoon to trade at $1,352.20 per ounce, after Goldman Sachs issued a bullish note on the precious metal. The brokerage firm raised its outlook on the EMEA metals and mining sector to "attractive," and said gold looks set to "outperform" amid rising inflation concerns and jitters in the equities market.

Optimism over Goldman's bullish call on bullion has pushed the SPDR Gold Shares (HK:2840) ETF (NYSEARCA:GLD (NYSE:GLD)) up 0.7% to $128.45. Meanwhile, the VanEck Vectors Gold Miners ETF (NYSEARCA:NYSE:GDX) has rallied 1.7% to $22.48, and one options trader today sold premium into the rally.

Shortly after 1:00 PM Eastern, per International Securities Exchange (ISE) data via Trade-Alert, a short straddle was opened on GDX at the January 2019 22 strike. The trader sold 5,000 of the LEAPS calls for $2.58 per contract, and 5,000 of the corresponding puts for $1.79 each. The total net credit on the position is $4.37 for each put/call pair -- which, after accounting for 100 shares per contract and 5,000 straddles sold, shakes out to $2.185 million.

Given that the ISE flags these trades as firm-generated, this isn't necessarily a speculative play on gold miners. In fact, 110,000 GDX shares traded at roughly the same time for $22.44 each, and the transaction appears tied to the short straddles.

For what it's worth, at-the-money implied volatility on the GDX weekly 3/29 strike has jumped 4.7 percentage points today to 29.33%. After this week's expiration, volatilities drop back into the 24-25% range, but gradually rise to 27.63% by the aforementioned January 2019 series. Unlike equity volatility, gold option volatility has historically increased on rallies in gold prices -- so it would seem the options market is, like Goldman, pricing in a bullish long-term forecast for the precious metals sector.

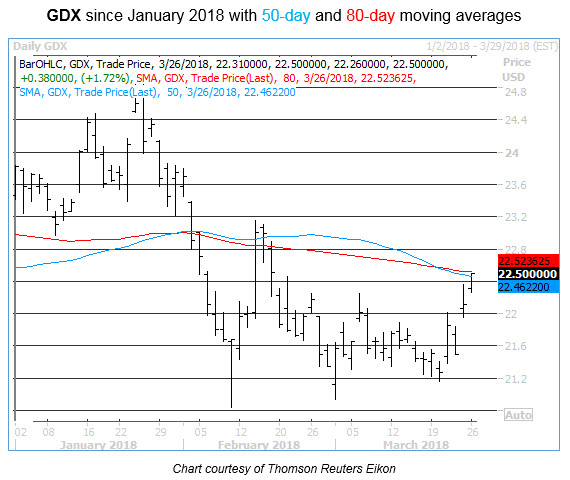

On the charts, GDX topped out at $22.50 earlier -- right in the neighborhood of a recently completed bearish cross by its 50-day and 80-day moving averages.