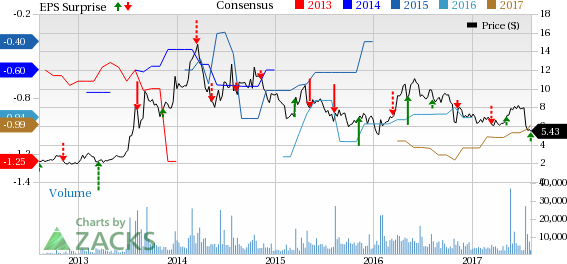

Inovio Pharmaceuticals, Inc. (NASDAQ:INO) reported a loss of 13 cents in the second quarter of 2017, narrower than both the Zacks Consensus Estimate of a loss of 16 cents and the year-ago loss of 26 cents.

However, the company’s shares have massively underperformed the industry so far this year. The stock has lost 18.7% during the period, while the industry has registered an increase of 8.8%.

Quarter in Detail

Inovio reported revenues of $20.4 million in the second quarter, thus surpassing the Zacks Consensus Estimate of $19 million. Also, revenues skyrocketed 229% from the year-ago period. The top-line improvement is mainly attributable to revenues of $13.8 million, recognized from an agreement with AstraZeneca PLC’s (NYSE:AZN) subsidiary, MedImmune, for evaluating the combination of MEDI0457 (previously known as INO-3112) with MedImmune’s PD-L1 checkpoint inhibitor, Imfinzi (durvalumab), for treatment of HPV-related head and neck cancer.

Notably, MEDI0457 was developed by Inovio, licensed to MedImmune in 2015. In May 2017, MedImmune initiated a new phase I/II study, evaluating the combination therapy. The combination study will enroll patients with metastatic HPV-associated squamous cell carcinoma of the head and neck (SCCHN) with persistent or recurrent disease post chemotherapy treatment.

During the quarter, revenues under collaborative research and development arrangements rallied substantially to $16.4 million from $1.9 million a year ago.

Research and development expenses escalated 21.9% to $23.9 million due to higher investment in all product development programs.

General and administrative expenses rose 6.9% to $6.2 million, primarily due to an increase in non-cash stock based compensation costs.

Pipeline Updates

VGX-3100, an HPV immunotherapy, is the most advanced candidate in the company’s pipeline that is currently being developed for the treatment of HPV-16/18-related high-grade cervical dysplasia.

In June, Inovio initiated a phase III study to evaluate VGX-3100 for treatment of cervical dysplasia caused by human papillomavirus (HPV).

Notably, this phase III trial initiation was delayed with the FDA placing a clinical hold on the proposed program in Oct 2016. In April, Inovio submitted a complete response to the FDA for the study’s initiation. The issue was eventually resolved as the FDA lifted the clinical hold after reviewing necessary testing and validation data submitted by the company.

During the same period, the company started a phase II study to examine the efficacy of VGX-3100 in women with HPV-related vulvar neoplasia.

The company is also conducting an independent phase I trial on another pipeline candidate, INO-1800, after Roche (OTC:RHHBY) backed out in Jul 2016. Data from the study is expected in fourth-quarter 2017.

Also, the company is working on the development of Ebola, Zika and Middle East respiratory syndrome virus vaccines. In June, the company announced that it has completed enrollment of its phase I clinical trial in evaluating its Zika vaccine, GLS-5700.

In May, Inovio entered into an immuno-oncology collaboration agreement with Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) . Under this contract, the company will conduct a phase I/II study to evaluate the combination of its T-cell activating immunotherapy, INO-5401, with Regeneron’s PD-1 checkpoint inhibitor, REGN2810.

Zacks Rank

Inovio currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Inovio Pharmaceuticals, Inc. (INO): Free Stock Analysis Report

Original post

Zacks Investment Research