Shares of Inogen (NASDAQ:INGN), Inc. INGN reached a new 52-week high of $71.57 on Jul 12, before closing the session marginally lower at $71.42.

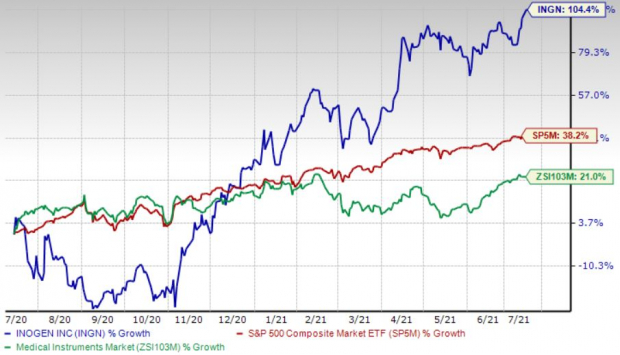

Shares of the company have gained 104.5% in the past year compared with the industry’s 21% growth and the S&P 500's 38.2% rise.

The company is witnessing an upward trend in its stock price, prompted by its strong product portfolio. Inogen’s solid performance in the first quarter of 2021 and its unique direct-to-customer business model buoy optimism. However, continued pandemic-led adverse results and foreign exchange fluctuations are major downsides.

Image Source: Zacks Investment Research

Let's delve deeper.

Key Growth Drivers

Unique Direct-to-Customer Business Model: The sequential improvement in Inogen’s direct-to-consumer sales revenues in the first quarter of 2021 raises market optimism. This uptick was primarily on the back of higher demand for portable oxygen concentrators (POCs). Product sales were also driven by higher vaccination rates within Inogen’s patient population and the relaxation of COVID-19 PHE-related closure orders leading to increased ambulation, additional stimulus payments and improved consumer confidence.

Strong Product Portfolio: Inogen’s expanding product portfolio has been boosting investors’ confidence. The company provides oxygen concentrator solutions for portable and stationary use. Inogen’s flagship product, Inogen One G4, is a single-solution POC. Other notable products offered by the company include Inogen One G5 in the domestic business-to-business arm and Inogen One G3 POC. Inogen has officially launched the Inogen One G5 in its direct-to-consumer channel as well. Inogen At Home is aptly formulated for patients who need oxygen therapy while asleep.

Inogen has also received confirmation that the Inogen One G5 POC was cleared for reimbursement in France and Germany. Management also confirmed Inogen’s plan of incorporating the Tidal Assist Ventilator (“TAV”) directly into the Inogen One POCs and making the Sidekick TAV product compatible with the Inogen At-Home Stationary Concentrator.

Strong Q1 Results: Inogen’s better-than-expected results in first-quarter 2021 buoy optimism. The company saw growth in revenues within its Rental and domestic business-to-business segments during the period. Significant gross margin expansion is another plus. Sequential growth in total revenues is encouraging. A solid product portfolio also acts as a catalyst.

Downsides

Continued Pandemic-Led Adversities: Inogen has been putting up a dismal overall performance over the past few months, primarily due to pandemic-led challenges. In first-quarter 2021, the company witnessed a drop in total revenues as well as softness in segmental revenues. International business-to-business sales also fell significantly, mainly due to the continued pandemic-led impacts, along with intermittent lockdowns in many European countries, and reduced operational capacity of certain European respiratory assessment centers.

Forex Woes: Inogen’s operation in the international market, from which it generates a significant portion of its revenues, raises apprehension. Adverse foreign currency exchange rates are expected to impede revenue growth in the near term, owing to the strengthening of the U.S. dollar against other foreign currencies.

Zacks Rank & Key Picks

Currently, Inogen carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veeva Systems (NYSE:VEEV) Inc. VEEV, AMN Healthcare Services (NYSE:AMN) Inc AMN and National Vision Holdings (NASDAQ:EYE), Inc. EYE.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 6.5%. It currently sports a Zacks Rank #1.

National Vision’s long-term earnings growth rate is estimated at 23%. It currently flaunts a Zacks Rank #1.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services (NASDAQ:HCSG) Inc (AMN): Free Stock Analysis Report

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

National Vision Holdings, Inc. (EYE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research