It has been about a month since the last earnings report for Inogen, Inc (NASDAQ:INGN) . Shares have lost about 2.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Inogen Beats Earnings and Revenue Estimates in Q2

Goleta, CA-based Inogen reported second-quarter 2017 earnings of $0.38 per share, up 5.6% year over year, which comfortably beat the Zacks Consensus Estimate of $0.28 and the year-ago figure of $0.36.

The upside was driven by roughly 17.5% growth in revenues, which totaled $64.1 million, beating the Zacks Consensus Estimate of almost $60 million.

Q2 Details

Sales revenues surged 27.3% to $58 million, while rental revenues declined 32.3% to $6.1 million.

Business-to-business:Business-to-business domestic sales were up 32.2% on a year-over-year basis to almost $21.2 million, primarily driven by traditional home medical equipment provider purchases and the consistent strength of the private label partner.

Meanwhile, business-to-business International sales rose around 13.9% to almost $14.9 million on the back of solid demand from the company’s partner’s in Europe.

Direct-to-consumer: Direct-to-consumer domestic sales advanced 33.3% to almost $21.9 million.

However, direct-to-consumer rental sales fell 32.3% to $6.1 million. This decline can be attributed to decreased rental reimbursement rates and the company’s increased strategic focus on sales.

Margin Details

In the reported quarter, Inogen registered a gross margin of 49.2% (as a percentage of revenues), up 120 basis points (bps) on a year-over-year basis.

Meanwhile, sales gross margin expanded 240 bps in the quarter to 51.8%, as a percentage of revenues. Per management, an increase in sales gross margin was driven by lower material costs resulting in decreased cost of goods sold in the quarter.

Rental gross margin was 25.0% in the reported quarter, much lower than 41.0% in the second quarter of 2016. This was primarily driven by lower net revenue per rental patient led by fallen reimbursement rate. However, this decline in rental gross margin was partially offset by decreased cost of rental revenue particularly led by lower depreciation and servicing costs.

Adjusted EBITDA rose 5.6% to $14.4 million on a year-over-year basis.

Guidance

Banking on solid performance in the second quarter, Inogen raised its 2017 revenue and adjusted net income guidance. Moreover, the company narrowed its full-year adjusted EBITDA guidance.

Inogen projects revenues in the range of $239–$243 million, higher than the previous range of $233–$239 million. This represents year-over-year growth of 17.8%–19.8%, up from the previously provided range of 14.9%–17.8%. The company expects rental revenue to decline in 2017, courtesy of lower average rental revenue per patient and continued focus on sales.

Adjusted EBITDA is now projected in the band of $48–$50 million, compared to $46–$50 projected previously, thereby presenting an increase of 10.6% to 15.2% from 6%–15.2% year over year.

Inogen expects adjusted net income in the range of $25--$27 million, up from the previously provided range of $22–$24 million. This represents 21.8%--31.6% year-over-year growth compared to the previous range of 7.2%–17%.

How Have Estimates Been Moving Since Then?

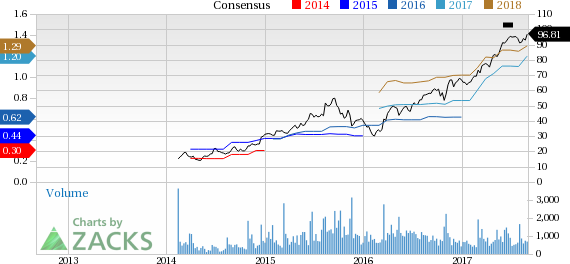

Following the release, investors have witnessed an upward trend in fresh estimates. There have been two revisions higher for the current quarter compared to one lower.

VGM Scores

At this time, the stock has a strong Growth Score of A, though it is lagging a bit on the momentum front with a C. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Interestingly, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Inogen, Inc (INGN): Free Stock Analysis Report

Original post

Zacks Investment Research