Innate’s partner Bristol Myers Squibb has started two large Phase I studies with the anti-KIR antibody IPH2102 given in combination with Yervoy (ipilimumab) and separately with the high-profile anti-PD-1 antibody nivolumab in solid tumours, marking a significant expansion of the programme. Innate has also started a Phase II trial of IPH2102 in AML, following promising Phase I data. A single-agent Phase IIa trial of IPH2101 in MM has rendered disappointing data, but interim results from a Phase I trial in combination with lenalidomide were more encouraging.

Two new Phase I combo trials for solid tumours

BMS has initiated two large Phase I trials with IPH2102 (BMS-986015) in combination with two different immunotherapies, ipilimumab and anti-PD-1 (nivolumab), in solid tumours. These include non-small cell lung cancer (NSCLC), renal cell carcinoma (RCC), melanoma, colorectal cancer and serous ovarian carcinoma. Results of both studies are expected in Q415. Ipilimumab is approved as monotherapy for advanced melanoma, while nivolumab is in Phase III trials for NSCLC, RCC and melanoma.

Phase II trial in AML starts

Meanwhile, Innate has started a Phase II trial of IPH2102 monotherapy in acute myeloid leukaemia (AML), following encouraging Phase I data. Data are expected in Q316. The Phase I trial demonstrated median progression-free survival (PFS), relapse-free survival (RFS) and overall survival (OS) of 7.7, 10.8 and 12.7 months respectively. Single-agent Phase IIa trial results in smouldering and multiple myeloma (MM) did not show significant reductions in M-protein levels, but interim Phase I data from an MM trial with IPH1201 and lenalidomide (Revlimid, Celgene) appeared more encouraging.

Funded to 2015

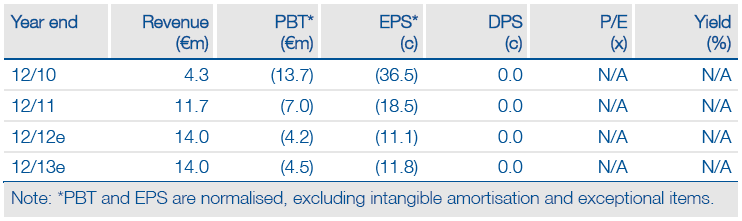

Innate ended Q3 with cash of €32.3m. Our financial model suggests Innate will not need to raise capital until 2015.

Valuation: Risk-adjusted NPV of €110m

We have revised our valuation and now indicate a risk-adjusted NPV of €110m (including cash), based on prudent assumptions of probabilities of success, launch dates, pricing and market penetration. While the share price is approaching its fair value, we view the investment case more positively as a result of Innate’s low-risk profile associated with its partnerships. The rNPV will rise as products successfully progress through development.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Innate Pharma BMS Initiates Two First Phase Trials

Published 01/29/2013, 11:35 PM

Updated 07/09/2023, 06:31 AM

Innate Pharma BMS Initiates Two First Phase Trials

Kir Royale

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.