Looking at the session for Thursday, there isn’t too much to move the markets as far as economic announcements are concerned. There is a retail sales coming out of the United Kingdom, but really if anything we think that the initial jobless claims announcement out of the US will be the focus of the marketplace. Having said that, we believe that the technical setups are the things that we will have to pay attention to.

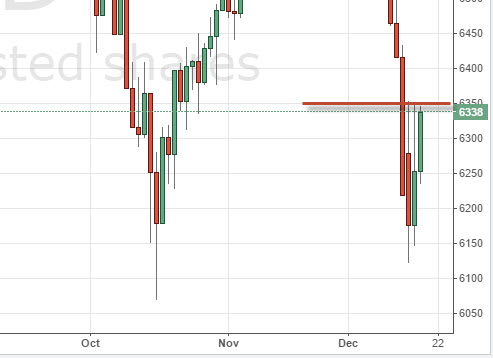

Looking at the FTSE, we can see plainly that the 6350 level is a spot of resistance, but it appears that during the Wednesday session we have hung onto enough of the gains in order to show a bit of bullish aggression. If we can get above the 6350 level, we feel that the market then breaks out to the upside, heading to the 6750 level given enough time. We would be buyers of calls on that move obviously.

The EUR/USD pair broke down from the 1.25 level, which is significant resistance, as we stay within the recent consolidation area. Ultimately, we think that the market will drop down to the 1.23 level, so we like buying puts on short-term rallies as the Euro continues to look very soft.

The metal markets will continue to fall, so therefore we continue to buy puts on short-term rallies in that particular market as well as it should continue to suffer with the US dollar continuing to strengthen over the longer term.