EUR/USD has started the week quietly, as the pair trades at 1.0754 in the Monday session. It’s also subdued on the release front, with no major releases on the schedule. German CPI slipped to 0.2%, well off the forecast of 0.7%. In the U.S., President Trump will speak at an event in Louisville, Kentucky. As well, FOMC member Charles Evans will deliver a speech in New York City.

The Federal Reserve raised rates by a quarter-point last week, but the U.S. dollar responded with broad losses. EUR/USD jumped on the bandwagon, climbing to 5-week highs late last week. Why the negative response? Firstly, there was disappointment in the markets with the Fed policy statement, which was more dovish than expected. The rate move was priced in at over 90 percent, and there had been speculation that a red-hot U.S. economy would propel the Fed to accelerate its pace of monetary tightening, with possibly four rate hikes this year. Instead, Fed Chair Janet Yellen reiterated that further rate hikes would be “gradual” and the Fed made no changes to its “dot plot”, with a projection for three rate hikes in 2017. As well, the U.S. dollar may have lost ground due to traders and investors acting on “buy on rumor, sell on fact”.

What’s next for Janet Yellen and Co? Analysts do not expect another rate move in May, while a hike in June is currently priced in at 50%. The markets will be looking for clues about the Fed’s monetary plans. A host of FOMC members will be speaking this weak, highlighted by Janet Yellen’s speech on Thursday at an event in Washington. The market will be looking for clues regarding monetary policy. In the past, Fed policymakers have presented conflicting positions, and if the market senses divisions within the Fed, the U.S. dollar could lose ground.

Last week’s Dutch election was good news for backers of the EU. There had been fears that the far right-wing Freedom Party of Geert Wilders would make substantial gains. Wilders is a fierce critic of the EU and pledged to hold a referendum on the Netherland’s membership in the EU (with the catchy slogan “Nexit”). Dutch Prime Minister Mark Rutte won the election handily, bringing a sigh of relief from governments in Western Europe. Still, Wilders commands the second largest party in the country and his party will be a major player on the Dutch political scene.

Next stop is France, which goes to the polls in April. Polls have far rightist Marine Le Pen and centrist Emmanuel Macron and running neck and neck in the first round of the presidential election on April 23. Still, Macron is expected to win in the second-round vote in May.

One-Minute Round Up: A ‘Less Hawkish’ Fed Has the Market Rethinking Strategy

EUR/USD Fundamentals

Monday (March 20)

- 3:00 German PPI. Estimate 0.4%. Actual 0.2%

- 7:00 German Buba Monthly Report

- 12:45 German Buba President Jens Weidmann Speech

- 13:10 U.S. FOMC Member Charles Evans Speech

- 19:30 U.S. President Donald Trump Speech

Tuesday (March 21)

- 6:00 FOMC Member William Dudley Speech

- 8:30 U.S. Current Account. Estimate -129B

*All release times are EST

*Key events are in bold

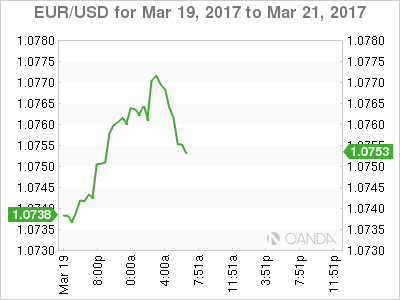

EUR/USD for Monday, March 20, 2017

EUR/USD March 20 at 6:00 EST

Open: 1.0742 High: 1.0777 Low: 1.0741 Close: 1.0754

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0506 | 1.0616 | 1.0708 | 1.0873 | 1.0985 | 1.1097 |

EUR/USD edged higher in the Asian session. In European trade, the pair has ticked higher but has retracted

- 1.0708 is providing support

- 1.0873 is the next resistance line

Further levels in both directions:

- Below: 1.0708, 1.0616 and 1.0506

- Above: 1.0873, 1.0985 and 1.1097

- Current range: 1.0708 to 1.0873

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Monday session. Currently, short positions have a majority (59%), indicative of trader bias towards EUR/USD breaking out and heading lower.