Shares of industrial goods manufacturer Ingersoll-Rand Plc (NYSE:IR) scaled a new 52-week high of $93.52 during Friday’s trading session, before closing a tad lower at $93.25 for a healthy year-to-date return of 25.5%. Barring minor hiccups, the company’s share price has been on an uptrend since April. This Zacks Rank #2 (Buy) stock has the potential for further price appreciation with long-term earnings growth expectations of 9.8%.

Growth Drivers

The U.S. manufacturing activity was robust in June as the manufacturing index measured by the Institute for Supply Management recorded 57.8%, indicating growth of 2.9 percentage points on a sequential basis. This serves as a harbinger to the solid economic growth expected in the near future. With the Trump administration’s pledge to spend $1 trillion in infrastructure projects over a period of 10 years, companies like Ingersoll that operate in the Zacks categorized Machinery-General Industrial sector are poised to benefit.

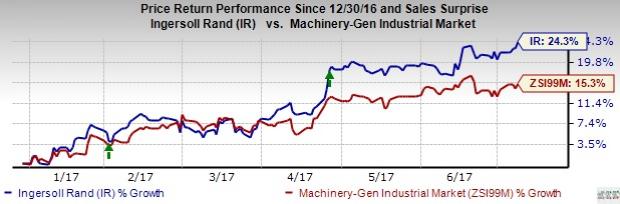

Ingersoll has outperformed the industry with an average year-to-date return of 24.3% compared with 15.3% gain for the latter. In order to capitalize on the future market potential, it is focusing on improving the efficiencies and capabilities of products and services within its core businesses. The company is also concentrating on its strategic priorities. These include a disciplined capital allocation, strong and flexible balance sheet position and cash flow enhancement to support dividend growth. The structural changes in the company are further expected to unlock additional value. We believe that such moves along with its robust operating platform and an efficient management team will help in the execution of these strategic priorities and drive net asset value and dividend growth in the future.

In addition, the geographic and industry diversity coupled with a large installed product base provide ample growth opportunities within service, spare parts and replacement revenue streams. Additionally, the company’s complementary portfolio of products and services is likely to assist it in strengthening the market position and achieving high productivity. Ingersoll is further likely to achieve steady improvement in operating profitability with new product developments, healthy investments in IT platform and enhancement of channel services footprint and product management capabilities.

For full-year 2017, management has offered a relatively bullish guidance. The company anticipates organic revenues to improve 3% while reported revenues are expected to be up 2% year over year. Ingersoll expects adjusted earnings from continuing operations to be in the range of $4.30–$4.50 per share, representing year-over-year growth of 4–9%. Such bullish outlook reinforces the favorable growth dynamics and has probably driven the company’s shares to a fresh 52-week high.

Other Stocks to Consider

Some other stocks worth considering in the industry include Barnes Group Inc. (NYSE:B) , DXP Enterprises, Inc. (NASDAQ:DXPE) and Luxfer Holdings PLC (NYSE:LXFR) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Barnes Group has a long-term earnings growth expectation of 9%. It topped estimates in each of the trailing four quarters with an average earnings surprise of 8.9%.

DXP Enterprises has a long-term earnings growth expectation of 20%. It topped estimates thrice in the trailing four quarters with a stellar average earnings surprise of 368.9%.

Luxfer Holdings topped estimates twice in the trailing four quarters with an average earnings surprise of 9%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Ingersoll-Rand PLC (Ireland) (IR): Free Stock Analysis Report

Luxfer Holdings PLC (LXFR): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE): Free Stock Analysis Report

Original post

Zacks Investment Research