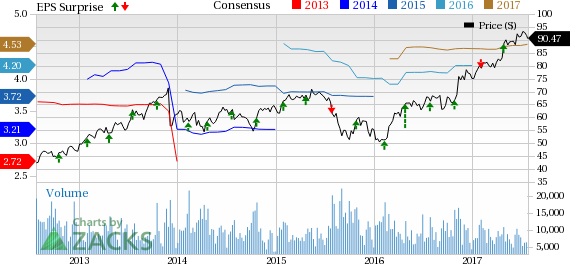

Industrial goods manufacturer Ingersoll-Rand Plc (NYSE:IR) reported solid second-quarter 2017 results with adjusted earnings per share (EPS) of $1.49 compared with $1.38 in the year-earlier quarter. Adjusted earnings beat the Zacks Consensus Estimate of $1.46.

The company’s GAAP earnings were $1.38 per share compared with $2.86 in the year-ago period. The year-over-year decrease despite higher revenues was primarily due to rise in operating expenses.

Quarterly revenues were $3,908.4 million, up from $3,688.2 million in the year-ago quarter. Revenues beat the Zacks Consensus Estimate of $3,795 million. Organic revenues improved 7% year over year. Organic revenues from North America were up 10% while that from International markets were relatively flat.

Segmental Performance

The climate segment recorded sales of $3,144 million compared with $2,935 million in the year-ago quarter. The upside was driven by solid revenues from commercial and residential HVAC (heating, ventilation and air conditioning)businesses.

The Industrial segment reported revenues of $765 million in the quarter, up from $753 million in the prior-year quarter.

Margins

Operating margin was 14.3% compared with 13.9% in the year-ago quarter. Adjusted operating margin improved to 14.4% from 14% in the prior-year quarter. Adjusted operating margin for the Climate segment was 16.8% compared with 16.9% in the year-ago quarter. Adjusted operating margin for the Industrial segment was 12.5%, up from 10% in the year-ago quarter.

Balance Sheet and Cash Flow

As of Jun 30, 2017, cash and cash equivalents totaled $1,310.1 million while long-term debt was $3,704.5 million. Net cash used in operating activities in the first half of the year was $405.5 million compared with $428.1 million in the prior-year period. Working capital was 5.1% of revenues for 2017 compared with 5.6% in 2016.

Outlook

Ingersoll reaffirmed its guidance for 2017. It expects adjusted EPS from continuing operations to be in the range of $4.35 to $4.50 while revenues are expected to rise 2%. Cash flow from operating activities is expected to be $1.4–$1.5 billion while free cash flow is projected within $1.1–$1.2 billion.

Ingersoll currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the sector include Omnicom Group Inc. (NYSE:OMC) , Publicis Groupe S.A. (OTC:PUBGY) and WPP (LON:WPP) plc (NASDAQ:WPPGY) . All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicom has a long-term earnings growth expectation of 7.5% and is currently trading at a forward P/E of 16.18x.

Publicis Groupe has a long-term earnings growth expectation of 12.9% and is currently trading at a forward P/E of 13.83x.

WPP plc has a long-term earnings growth expectation of 9.8% and is currently trading at a forward P/E of 12.69x.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.See Zacks' 3 Best Stocks to Play This Trend >> Source:

Omnicom Group Inc. (OMC): Free Stock Analysis Report

WPP PLC (WPPGY): Free Stock Analysis Report

Publicis Groupe SA (PA:PUBP) (PUBGY): Free Stock Analysis Report

Ingersoll-Rand PLC (Ireland) (IR): Free Stock Analysis Report

Original post

Zacks Investment Research