Hindered by project delays and rupee devaluation

Infrastructure India Plc's, (IIP) two main projects suffered construction delays in H1FY14 caused by debt disbursement issues. IIP may be able to resolve the problems at VLMS internally, but for SMHPCL it is awaiting a directive from the government committee now overseeing the project. The other investments performed in line with expectations, but IIP’s NAV showed a 19% sequential fall in H1 to 63p, as a direct result of the weaker Indian rupee and the higher risk-free rate assumptions used for asset valuations. If the exchange rate alone had remained stable, IIP’s £217m NAV would have been £49m higher. We have downgraded our forecasts to reflect the lower values, which leaves the stock trading on a 72% discount to 2014e NAV.

H1FY14 hit by construction delays and weak rupee

IIP’s two main projects suffered construction delays in H1FY14. Vikram Logistics & Maritime Services (VLMS) had problems securing debt disbursements from public sector banks, which delayed the construction schedules for its new terminals. At the Shree Maheshwar project (SMHPCL), the lead lender will make recommendations to the government committee now overseeing the project to try to resolve the delay. IIP’s H1 NAV fell 19% sequentially (9% y-o-y) to £217m (63p per share). This was mainly due to the 23% devaluation of the Indian rupee in H1 and an increase in the assumed Indian risk-free rate. Profits were also hit by £48m of negative fair value movements, contributing to a pre-tax loss of £51m (loss per share of 14.8p).

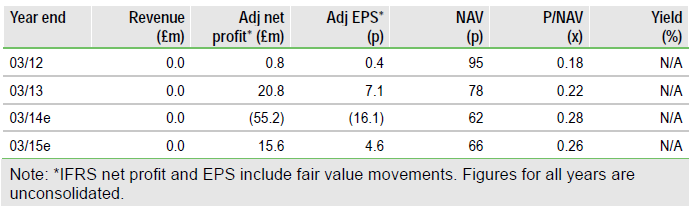

Financials: Forecasts downgraded for FY14

We have downgraded our forecasts for FY14 (NAV cut from 79p to 62p) to reflect the negative fair value movements in the first half. We do not expect any valuation upgrades until FY15, when there is a decent chance of asset revaluations, as projects under construction reach completion for VLMS and IHDC, providing there is no further local currency devaluation. We are assuming fair value gains from the projects in FY15 and that improved project cash flows could be reflected in a first dividend contribution from the investment portfolio to the group level.

To Read the Entire Report Please Click on the pdf File Below