IIP’s focused portfolio of Indian transport and power infrastructure assets is starting to approach maturity, which should result in cash flows flowing through to the parent, in turn enabling IIP to provide dividend guidance to investors. Increasing clarity on the timing of this process and on the further potential value accruing from the VLMS subsidiary’s acquisition of Freight star, should help to close the discount to both NAV and the peer group. Longer term, the discount could also be addressed by the reduction of the 51% controlling stake of GGIC (also managed by GFPM, the asset manager), thereby increasing the free float and, potentially, stock liquidity.

Portfolio: Projects’ maturity to improve cash flows

Management’s strategy is to pay dividends when the projects reach a level of maturity capable of sustaining the payout. With four of its five investments expected to be cash flow generating by year-end and only one still in the construction phase, IIP anticipates providing clarity about the timing of dividends once VLMS is fully operational. The recent Freightstar acquisition provided an NAV boost in FY13, but VLMS has four container terminals due for substantial completion during FY14 and the potential for further synergies. Evidence of funding progress at SMHPCL would also be positive, but in our view less likely to move the share price in the short term.

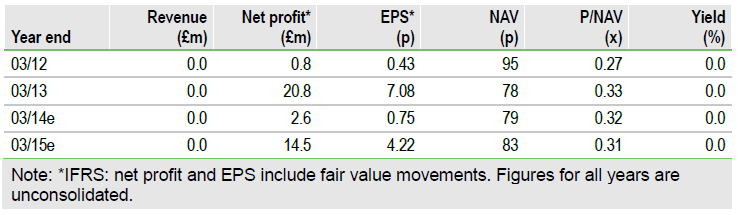

Financials: Fair value gains to offset costs from FY15

IIP has a strong capital structure, with no debt at the fund level as at FY13 and, after agreeing a US$17m working capital facility with GGIC recently, sufficient funding for the foreseeable future. IIP has adopted the amendment to IFRS 10 from FY13, before its mandatory introduction in January 2014. It therefore does not now consolidate its wholly owned subsidiaries, which means anticipating the timing of project dividends is more difficult for investors. Therefore, the main income driver will remain fair value movements, which should start to offset the management and administration expenses from FY15, assuming the local currency stabilises.

Valuation: Large discount to NAV and peers

IIP trades on a discount of 67% to FY13 NAV of 78p and a wide discount to its peer group, which can be partly explained by its small free float and low stock liquidity, with the two main shareholders controlling 64%, as well as the lack of yield and the unclear dividend timing. We are not forecasting dividends for FY14-15, although the projects should start to be cash flow positive from FY15. Closing the discount is likely to require a clearer payout strategy, further financial visibility and a simpler corporate structure, as borne out by the developed market peers’ premium to NAV.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Infrastructure India: Approaching Maturity

Published 08/29/2013, 06:05 AM

Updated 07/09/2023, 06:31 AM

Infrastructure India: Approaching Maturity

Maturing portfolio not reflected in valuations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.