India-based tech concern Infosys Ltd (NYSE:INFY) is set to report its first-quarter earnings before the open this Friday, July 12, and options traders are already flocking to the stock. Over 4,300 puts have crossed the tape, which is 257 times what's typically seen at this point. While calls are trailing behind, the 108 that have been exchanged so far is still almost two times the norm.

The July 11 put is by far the most popular, with most of the activity of the buy-to-open variety. Looking closer, it appears that these contracts are being purchased for a volume-weighted average price of $0.68. If this is the case, the underlying stock would need to fall beneath breakeven at $10.32 (strike minus premium paid) by the time the contract expires next Friday, July 19, for these bears to begin to profit.

Looking back at INFY's post-earnings moves during the last eight quarters, the security has ended positive three times. Over the past two years, the shares have swung 3.6%, on average, the day after earnings, regardless of direction. This time around, the options market is pricing in a much wider-than-usual 8.9% swing for Friday's trading.

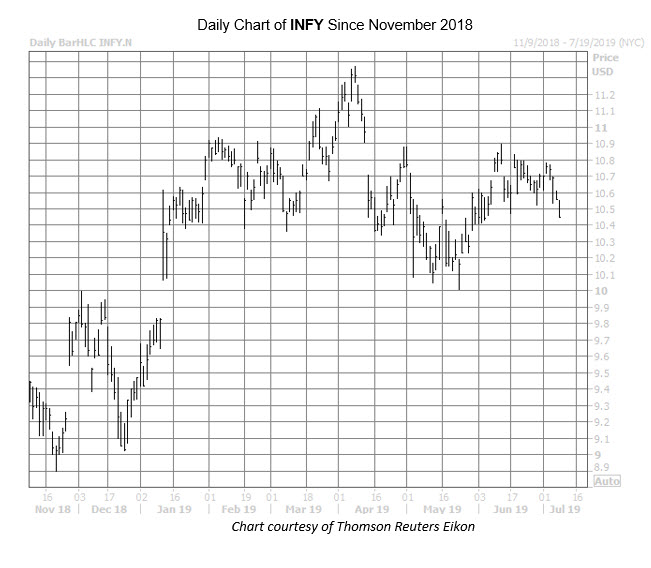

Taking at look at the charts, the equity is inching lower today, down 0.9% at $10.46, at last check. Overall, however, INFY has seen mostly positive price action on the charts. The equity is still trading well atop support at its mid-January post-bull gap levels, and has added an impressive 10.5% year-to-date.

Despite this analysts haven't been as convinced of INFY, with 12 of the 14 following the stock calling it a "hold" or worse. Plus, the consensus 12-month target price of $10.80 is right in line with current levels. Should INFY's quarterly results impress on Friday, a round of upgrades and/or price-target hikes could create tailwinds for the tech stock.