Global leader in consulting and technology services, Infosys Limited (NYSE:INFY) recently announced that it has entered into a strategic seven-year partnership with the CMA CGM Group. Notably, this deal will make the company more innovative and flexible. The technological collaborations will help transform CMA CGM’s IT applications as well as improve customer service experience.

Per the agreement, Infosys will offer CMA CGM high value-added technologies and the skills needed to support applications and develop SAP projects. Infosys’ technology solution includes Nia's artificial intelligence platform and its scalable automation platform, AssistEdge that will boost CMA CGM’s internal performance, process execution as well as improve customer service.

Additionally, Infosys has decided to open a Delivery Center in Marseille, which will facilitate enhancement of local expertise. Further, the company also intends to acquire CMA CGM's Innovation and Delivery Center in Dubai, allowing Infosys to expand presence in the Middle East.

In recent times, Infosys has been strengthening core competencies by pursuing strategic acquisitions that enable it to leverage emerging technologies in a mutually beneficial and cost-competitive manner. In the past few quarters, the company has entered into several strategic partnerships with other technology behemoths to boost digital, cloud, legacy modernization and automation business.

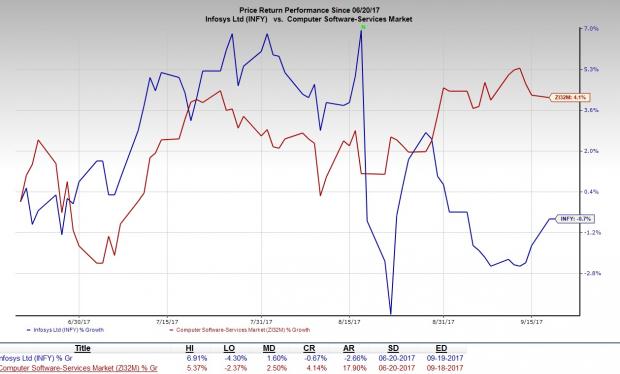

However, it seems that escalating costs, President Trump’s anti-immigration stance and on-site expansion are likely to affect performance. Notably, the company’s stock has yielded a negative return of 0.7% in the past three months, underperforming the industry’s average gain of 4.3%.

Nevertheless, we believe that the Zacks Rank #2 (Buy) is likely to benefit from its Renew New program, strong innovation, greater operational efficacy, robust revenue growth and increased cash generation, in the upcoming quarters.

Stocks to Consider

Some better-ranked stocks from the same space are Nutanix Inc. (NASDAQ:NTNX) , CoStar Group, Inc. (NASDAQ:CSGP) and Axcelis Technologies, Inc. (NASDAQ:ACLS) . Nutanix, CoStar Group and Axcelis Technologies each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nutanix has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 12.9%.

CoStar Group has outpaced estimates in the preceding four quarters, with an average earnings surprise of 15.4%.

Axcelis Technologies has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 35%.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

CoStar Group, Inc. (CSGP): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

Infosys Limited (INFY): Free Stock Analysis Report

Original post

Zacks Investment Research