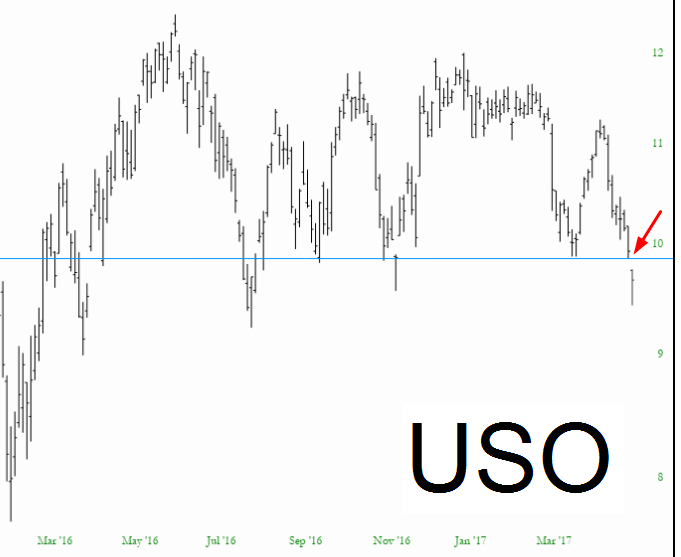

The highlight of last week for me was energy’s breakdown (well, the real highlight was the launch of SlopeCharts, but the trading highlight was energy). Looking at the USO (NYSE:USO) chart, you can see the clean break. I consider it plausible that crude oil will see the upper 30s before a meaningful reversal.

I trimmed my Direxion Daily Energy Bear 3X Shares (NYSE:ERY) long position about 40% on Thursday, but I intend to get back in at hopefully better prices. The cup and handle pattern is still quite clean.

I did a day trade on Direxion Daily S&P Oil & Gas Exp & Prod Bear 3X Shares (NYSE:DRIP) on Thursday for a small profit, and I’m glad I got out, since it slipped over 10% the next day. These patterns are both quite similar (for obvious reasons, since they are both triple-bearish energy funds), but I think I’m going to stick with ERY.