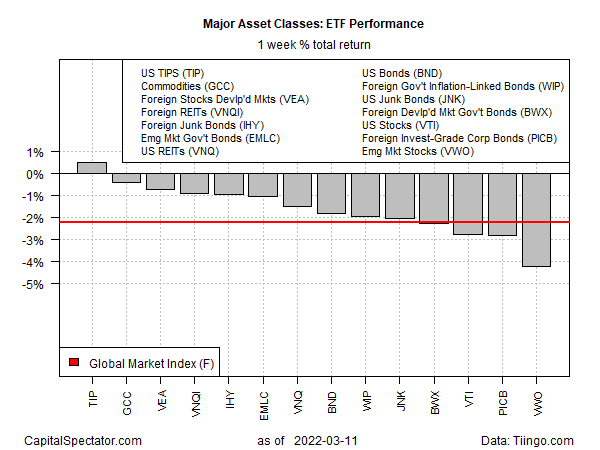

In another week of widespread selling of the major asset classes, U.S. inflation-indexed Treasuries continued to rise, based on a set of ETFs through Friday, March 11.

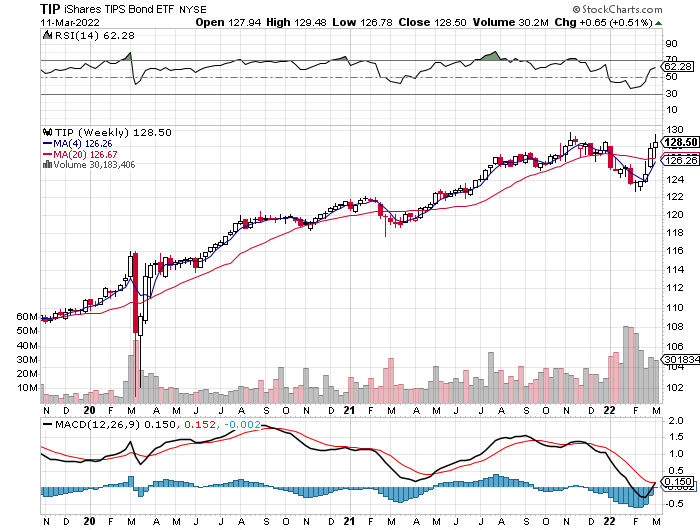

The iShares TIPS Bond ETF (NYSE:TIP) gained 0.5% last week, offering a gain as blowback from the Ukraine war continued to roil financial markets around the world. TIP’s advance marks its fifth straight weekly gain.

Last week’s news that U.S. consumer inflation continues to rise is stoking concern that pricing pressure is still trending higher. The Consumer Price Index rose 7.9% in February vs. the year-earlier level, a new 40-year high. Because the data does not yet reflect global supply shortages triggered by the war in Ukraine, it’s likely that CPI inflation has yet to peak, a prospect that’s providing an ongoing tailwind for TIP.

The rest of the major asset classes fell last week. The selling was especially harsh for stocks in emerging markets, which posted the biggest weekly setback. Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) tumbled 4.2%, marking the third straight week of hefty loss.

Analysts say that a perfect storm of headwinds is blowing for emerging markets, ranging from tightening global liquidity, a flight to safe assets and slowing economic growth.

The broad-based selling last week continues to weigh on the Global Market Index (GMI.F), which last week shed 2.2%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETF proxies.

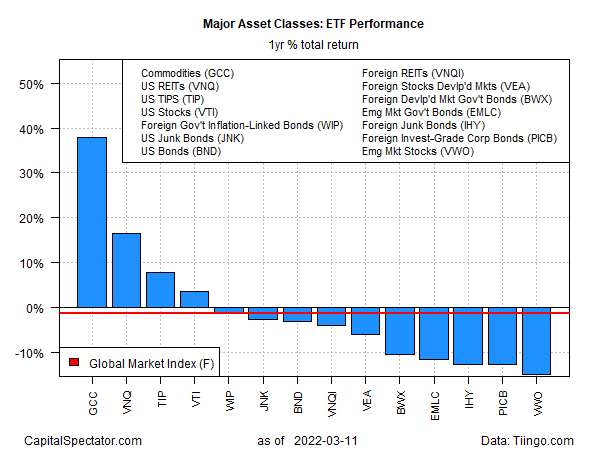

Turning to the one-year return profile, a broad measure of commodities remains the clear leader for the major asset classes. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) is up 37.9% over the 12-month window through Friday’s close.

Meanwhile, emerging markets stocks (VWO) are now posting the biggest one-year loss for the major assets via a 15.0% year-over-year decline.

GMI.F is slightly in the red over the past year, shedding 1.3%.

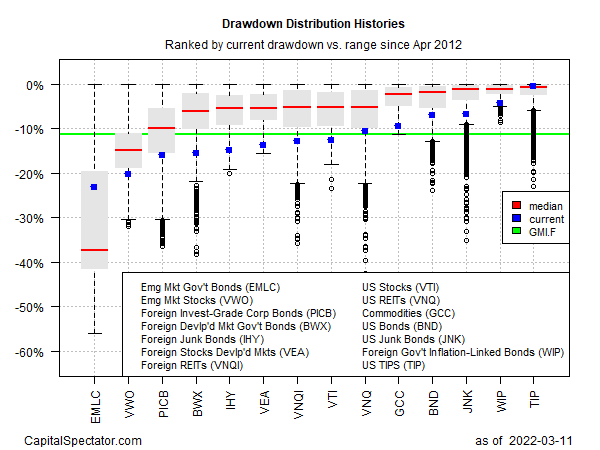

Looking at drawdowns, most of the major asset classes are posting peak-to-trough declines that are deeper than -10%.

GMI.F.’s current drawdown is -11.3%.