Despite the Federal Reserve’s general stance that inflationary pressures will only be transitory, over the last few months signs that the economy is heating up have caused investors to take some of their hard-won profits off the table, pressuring the large-cap, growth-oriented, and stay-at-home stocks. Investors have been rotating out of the high-flying issues and picking up out-of-favor, value-oriented, interest-rate sensitive, and in some cases, international issues.

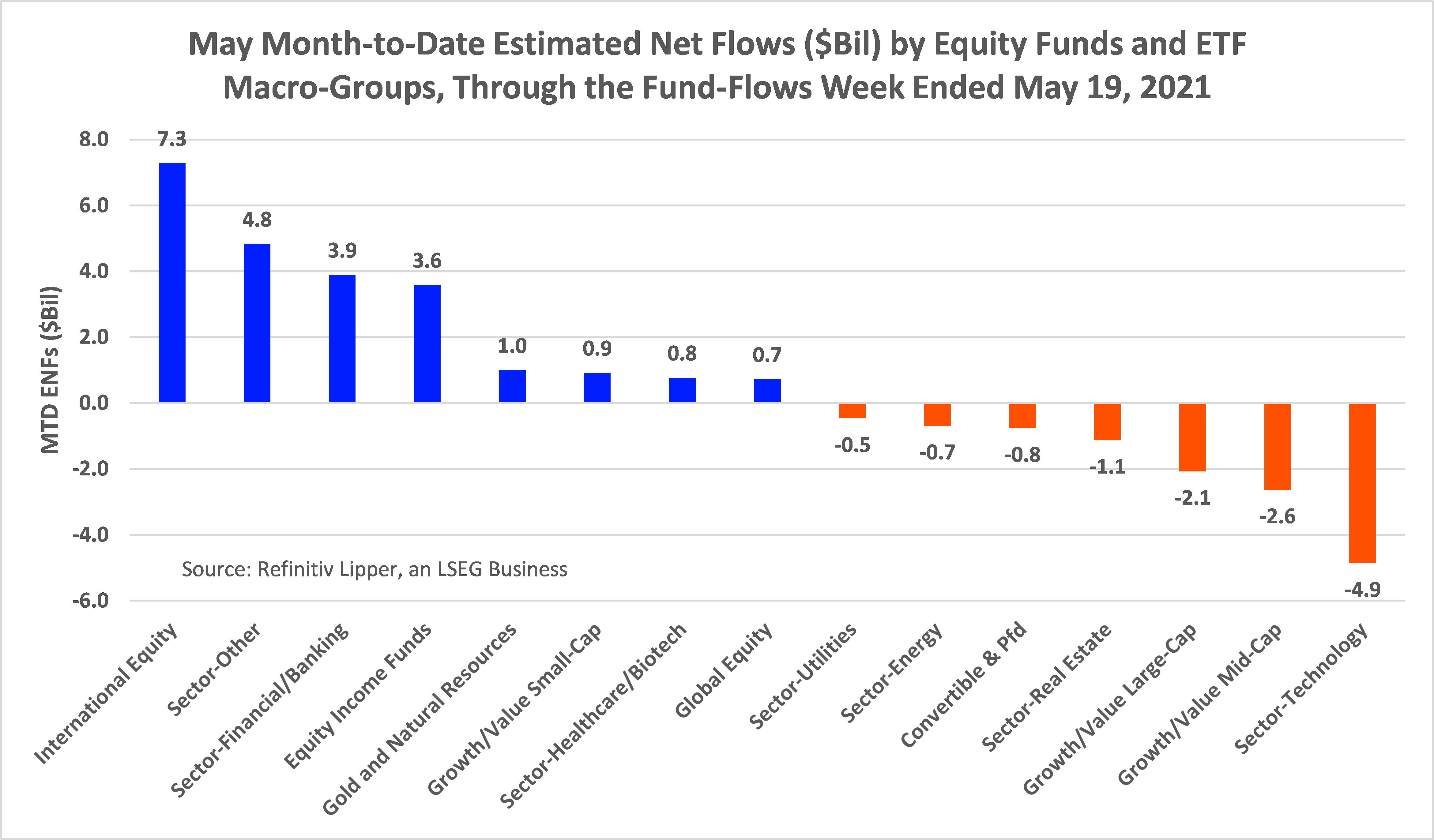

While for the month of May through the Refinitiv Lipper fund-flows week ended May 19, mutual fund and ETF investors have injected $10.3 billion into equity funds (including ETFs), there have been some investor withdrawals. Sector-technology funds (-$4.9 billion), mid-cap funds (-$2.6 billion), and large-cap funds (-$2.1 billion) have experienced the largest net redemptions of the macro-group.

The primary attractors of investors’ assets on the equity side so far this month have been international equity funds (+$7.3 billion), sector-other funds (+$4.8 billion)—comprised of commodity-related and consumer-focused funds—sector-financial/banking funds (+$3.9 billion), equity income funds (+$3.6 billion), and gold and natural resources funds (+$1.0 billion).

On the international equity side of the equation, investors have embraced some of the regions that didn’t rally to the extent of their U.S. counterparts over the last year and perhaps appear to be a little less lofty in price, padding the coffers of International Multi-Cap Core Funds (+$3.3 billion), European Region Funds (+$2.8 billion), and Emerging Markets Funds (+$2.1 billion).

Supporting the notion that rotation is being driven by a move to out-of-favor issues, a broader market rally, and inflationary concerns, Basis Materials Funds (+$2.3 billion), Commodities General Funds (+$1.5 billion), Commodities Precious Metals Funds (+$941 million), and Consumer Goods Funds (+$608 million) have been the primary attractors of net new money in the sector-other funds space.

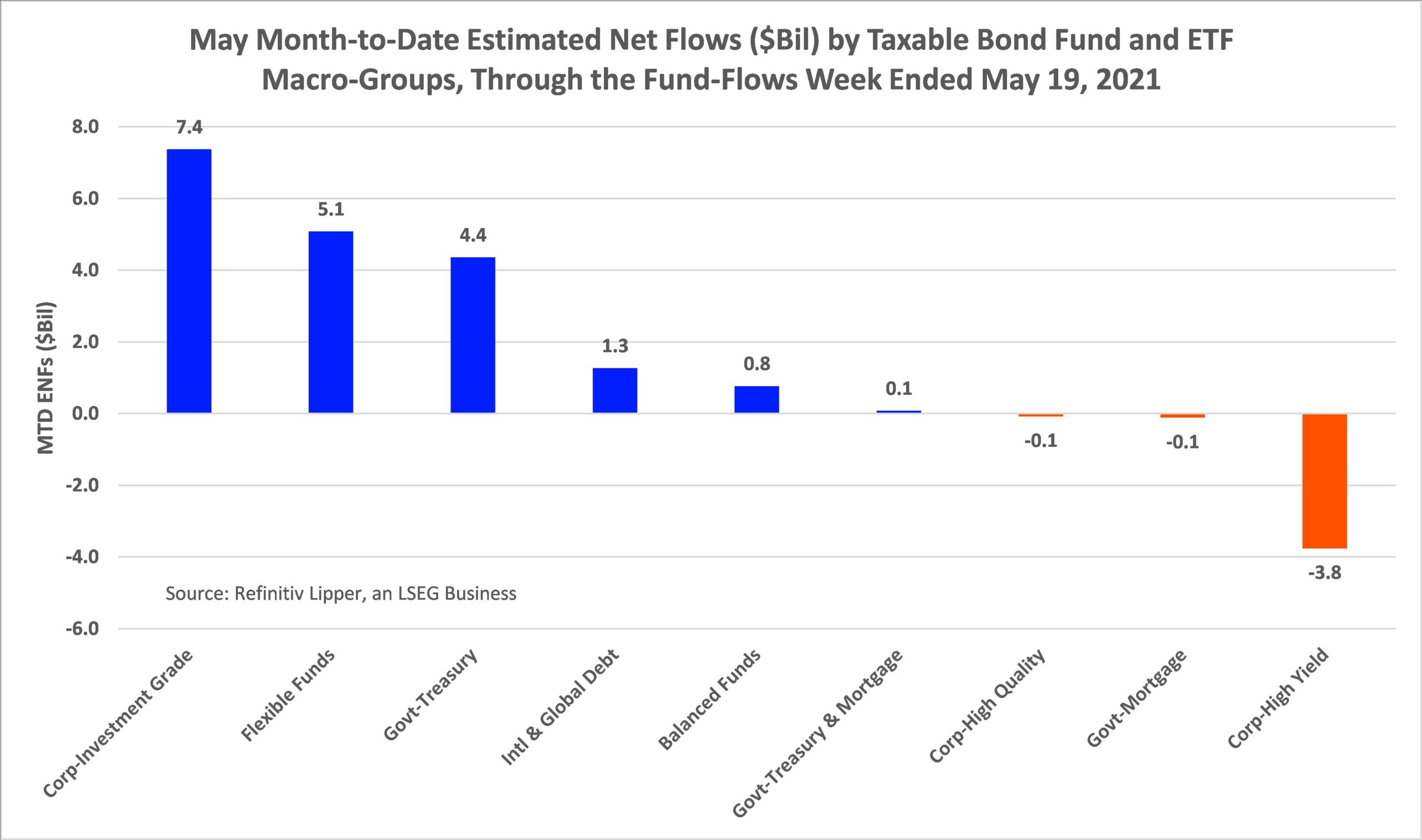

Even flows into fixed-income securities this month have a tilt toward inflation-related issues and, of course, investors’ continued search for yield. Month to date, investors have injected some $15.0 billion into taxable bond funds, with the corporate investment-grade debt funds macro-group (+$7.4 billion) attracting the largest amount of inflows, followed by flexible funds (+$5.1 billion), government-Treasury funds (+$4.4 billion), and international & global debt funds (+$1.3 billion).

While Multi-Sector Income Funds (+$3.0 billion), Core Bond Funds (+$2.9 billion), and Core Plus Bond Funds (+$1.8 billion) continued to be the primary attractors of investors’ assets in the corporate-investment grade funds macro-group, Loan Participation Funds (aka, leveraged loan or bank loan funds)—a subset of the macro-group—took in $2.3 billion month to date—extending its weekly inflows streak to 19 consecutive weeks this past week.

On the government-Treasury side of the ledger, Inflation Protected Bond Funds, taking in $3.5 billion month to date, attracted the largest sum of net inflows in this space, followed by Short U.S. Treasury Funds (+$1.1 billion), while the longer-dated General U.S. Treasury Funds unsurprisingly suffered net redemptions, although only to the tune of $241 million for the month so far.

During the most recent fund-flows week, stocks continued their slide after investors pored over the Federal Reserve’s April policy-setting meeting minutes, which showed increasing awareness among members that they need to begin discussions on when to pull back on their asset purchases. As a result, investors will continue to keep a keen eye on inflationary data and comments from Federal Reserve officials going forward.