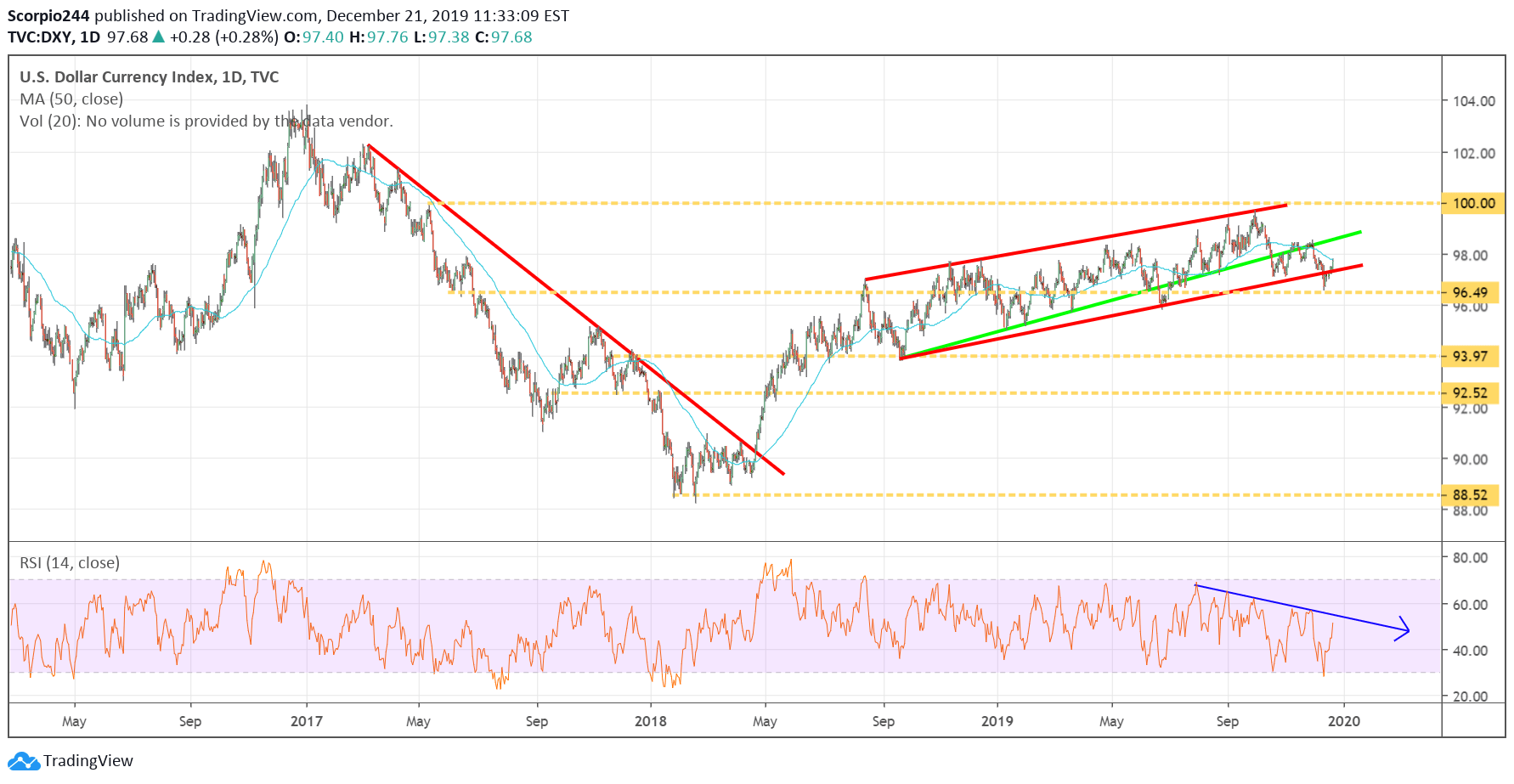

With global growth returning, the U.S. economy surging to a 3% growth rate, U.S. rates on the rise, and the U.S. dollar sinking, it will lead to the return of inflation in 2020.

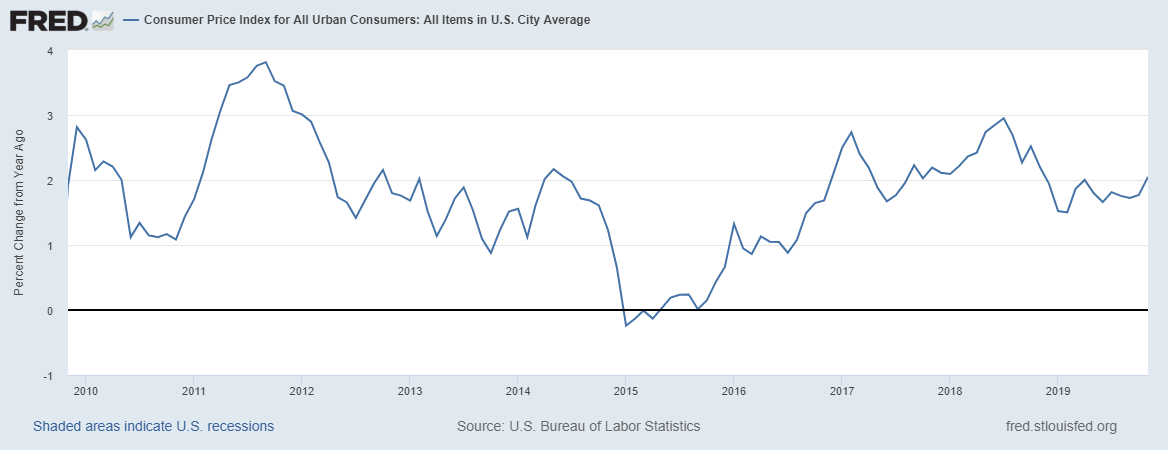

Since peaking at 2.94% in July 2018, the y/y change in the consumer price index has been steadily declining. The falling rate of inflation can be directly tied to the strengthening of the U.S. dollar, with the dollar index surging by 11.5% since May 2018.

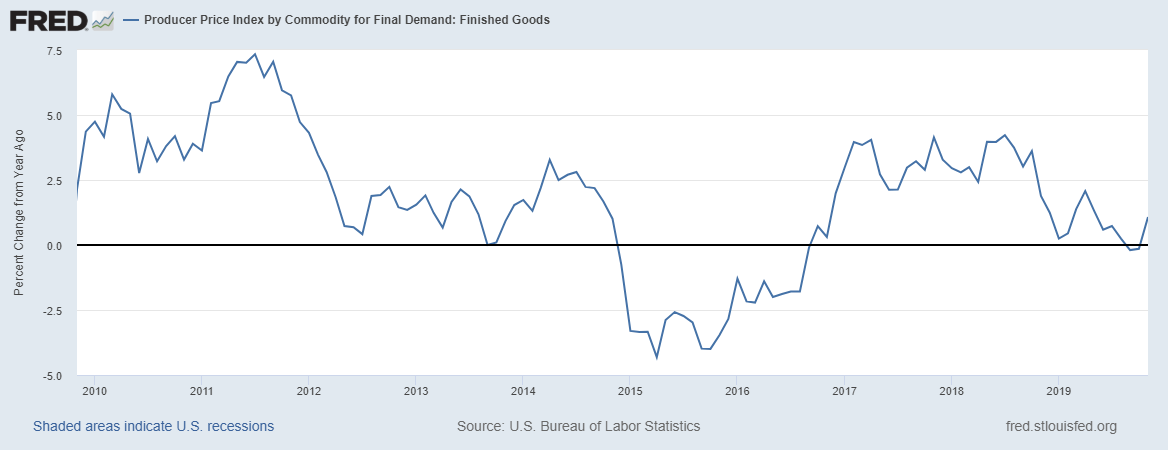

Additionally, the y/y changes in the producer price index have declined sharply as well since July 2018 after peaking at roughly 4.2%.

The declining rates of inflation can directly be tied to the value of the dollar index, which has soared in value starting in April 2018. If the dollar weakens as we have previously noted in prediction 7, then it seems likely that inflation rates should rise as well.

Then there is the reality that the Fed has noted it was willing to let inflation run ahead of its symmetric 2% target, which means even if CPI and PPI run hotter and approach their 2018 highs, the Fed is unlikely to raise rates.

It means that inflation rates in 2020 are likely to jump with CPI year-over-year rates pacing around 3%.

In this low inflation world a 3% rate is welcomed and unlikely to do much if any damage to the overall US economy or the stock market.