Forex News and Events

South African inflation to tick up in May

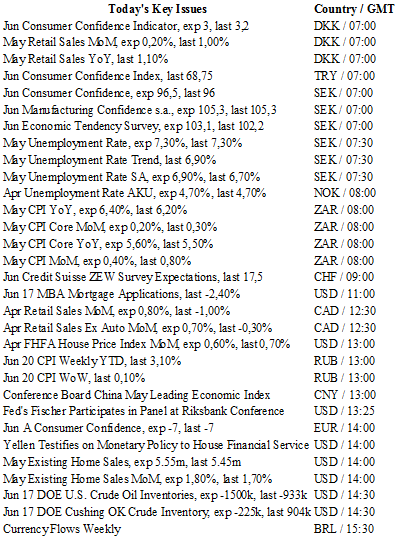

May’s inflation report is due to be released later today in South Africa. Headline inflation is expected to have increased to 6.4%y/y from 6.2% a month earlier, while the market anticipates the core gauge to come in at 5.6%y/y from 5.5%. After a period of stabilisation, which fueled hopes of easing food price pressures and a stronger rand, inflation seems to have resumed its upward momentum amid a severe drought and ever-elevated political risks. After easing from 9.6%y/y in February to 7.2%, we expect the non-durable goods component to take the elevator again as social instability increases ahead of the August municipal election.

Lately, USD/ZAR has taken advantage of a dovish Federal Reserve in the US, which has helped the South African currency to strengthen more than 5% against the greenback. On the downside, the low from April 29th will act as a support, while on the upside a resistance can be found at around 15.55 (high from June 16th). Given the fact that the commodity rally has lost steam and has been consolidating since May, we believe that while the rand will be more sensitive to local developments, the primary driver will remain the Fed rate path.

Brexit – “Only issue that matters”

Risk appetite improved modestly as Federal Reserve Chair Janet Yellen’s semi-annual testimony before the Senate banking committee sounded decidedly dovish. The key take-away was that Yellen’s cautious tone about domestic and global economic outlook intensified, as she suggested that interest rate levels remain appropriate. Yellen’s comments were broadly in line with June’s FOMC meeting and press conference. She indicated that due to weak inflation dynamics a July rate hike was off the table stating (supported by a downward shift in US front end yields): "oil prices continue to act as a drag on annual headline inflation, domestic price pressures, notably from wage growth, also remain muted, reflecting persistent economic slack."

Yellen acknowledged the deceleration in labor markets but remained confident that a modest US recovery would bring employment higher. Yellen provided balanced comments on the UK referendum stating that potential fallout from the vote could weigh on the US economic outlook and that the Fed stood ready to support should conditions warrant. Today Yellen will testify again, this time in front of the House Financial Service Committee, but comments are unlikely to be market moving. It was only yesterday that financial markets were hanging on her every word, now; all eyes are on Britain’s EU referendum. Financial markets have become singularly focused on “Brexit”, ignoring just about everything else. Our base scenario is for a single rate hike in Nov/Dec as global weakness continues to spill over into the US economy. We remain bearish on USD on the midterm but currently it’s all about the EU referendum. As was once said about the Clash they were “the only band that matters.” Right now that honor goes to Brexit.

Canadian retail sales expected higher

April retail sales data will be released early this afternoon. Financial markets are expecting a higher number after March data printed weak at -1% m/m. This data was largely responsible for the weak Q1 GDP results. Crude prices are now fluctuating but mainly saw increases in April which should reflect in the retail sales.

In terms of currency, USD/CAD continues to weaken since its highest level in January as crude oil prices increase. We remain bullish on the loonie against the greenback due to the higher likelihood that the monetary policy divergence between the two central banks will not happen this year. The BoC will meet again on July 13th. Regarding data that are mixed, we believe that no rate change will happen at this meeting. Yet a Brexit vote would hurt Canada and change our view on its monetary policy as Europe is, after the United States, Canada’s main trading partner.

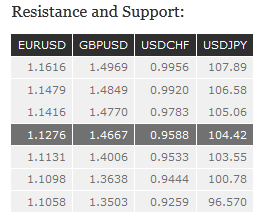

The Risk Today

EUR/USD EUR/USD is trading higher. Yet, without massive impulse. Hourly resistance can be found at 1.1416 (09/06/2016 high). Hourly support is located at 1.1237 (22/06/2016 low). Expected to further weaken. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD GBP/USD continues to push higher confirming the underlying bullish trend. Resistance at 1.4770 (03/05/2016 high) has been broken but the pair has failed to hold above it. Hourly support is located at 1.4643 (intraday low). Strong support is located at 1.4013 (16/06/2016 lower. Expected to further increase. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY's recent strength has thus far been unimpressive. As a result, the technical structure continues to favour a second leg lower. Monitor the test of the hourly support at 103.55 (16/06/2016 low). An hourly resistance stands at 105.06 (21/06/2016 high). The medium term momentum is clearly oriented downwards. Expected to continue weakening. We favour a long-term bearish bias. Support is now given at 103.56 (28/08/2014 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now very unlikely. Expected to monitor support at 103.56.

USD/CHF USD/CHF's volatility lowers. The pair is below former resistance at 0.9679 (13/06/2016 high). Hourly support is given at 0.9593 (intraday low). Expected to show growing selling pressures. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.