The Bank of England’s latest Quarterly Inflation report saw sterling push higher as Carney and the other members of the MPC amended forward guidance. So, with the Bank of England unable to meaningfully target unemployment for interest rate increases, it seems that “forward guidance” is now closer to “forward suggestion.” The plan remains in that rates will be kept low after the unemployment threshold has been hit – much like the Federal Reserve’s forward guidance has changed in the past few months as it has become clear that job increases have come on quicker than had been expected.

The argument for not putting a de facto target in sand is obvious; just as much as they have met this 7.0% unemployment threshold in double-quick time that is not to say that another threshold would be met within the MPC’s timeframe. Unfortunately the inherent lack of a target with the Bank’s revised plans now leads to a different question; how are everyone from City economists to households and businesses expected to interpret this? Increased communications from the Bank of England will be the key. Carney is relying on the soft sell.

This report also included some bullish news; the Bank of England is forecasting that the UK economy will grow at 3.4% in 2014. This figure is 0.6% higher than had been forecast in November and is double forecasts for German growth for the same period. 2015’s growth estimate has also been revised higher – from 2.3% to 2.7%. As a reminder, growth in the UK through 2013 has been initially estimated at 1.9%.

The inflation picture is interesting however with CPI seen below target in 3yrs time; something that the Bank could lean on in the short term so as to guarantee lower rate expectations. The Bank of England is an inflation targeting body after all, despite all the bells and whistles of guidance. The recent strength of the pound will have helped that. Sterling is 10% higher on a trade weighted basis since last March, and while this will keep pressure on UK export focused companies, should allow inflation to be kept low, balanced recovery be damned.

The overall picture is one of a recovery but a recovery that in the words of the Bank of England Governor ‘isn’t balanced or sustainable’ – growth is very contingent on consumption and housing spending this year. While that happens however, rates are not going anywhere anytime soon.

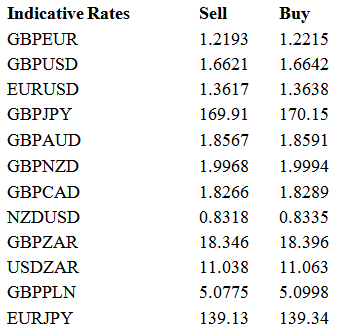

Sterling moved higher across the board through the day while the yield on the 10yr gilt rose to 2.8189%, the highest since the Central Bank of the Republic of Turkey hiked rates amid the emerging market wobble in late Jan.

Eurozone news took the single currency lower yesterday morning as another indicator disappointed. Industrial production fell by 0.7% in December against a -0.3% expected fall and, although we saw growth of 0.5% compared to this time last year, the momentum of any recovery may have disappeared.

Comments from an ECB member also wobbled the single currency a tad. Benoit Coeure, the Bank of France Governor, said in a speech yesterday that the ECB is seriously considering a negative deposit rate at its next meeting. Coeure also commented on the German constitutional court’s decision to refer the legality of the ECB’s OMT decision to the European Courts of Justice by saying that “the status of the OMT is not changed. It is ready to be used but it is highly unlikely it would have to be used at the moment”.

Euro volatility could be seen today in response to a meeting between Italian PM Letta and a challenger from his own party, Matteo Renzi. A vote of no confidence in the Letta government would throw Italian bonds back into the spotlight following months of mediocre economic expansion. The meeting takes place at 14.00 GMT.

German inflation this morning has come out as expected, down by 0.6% on the month but 1.3% higher compared to this time last year.

Today will be dominated by US retail sales at 13.30 GMT with the market looking for limited growth following a strong December. Of course, there is a lot to be said for the resistance of the retail sector but the polar vortex weather could have easily seen people stay indoors. Yellen also speaks again, this time in front of the Senate, but we expect limited vol from that.