Buy SGB1058 (May 2025) vs SGBi3109 (May 2025) @ 179bp. P/L: 160/194bp

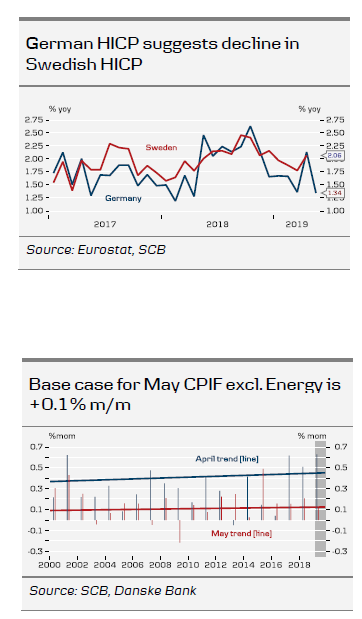

The Riksbank expects inflation, depending on the measure, to stay unchanged or rise in May. We are of the opposite opinion, expecting all measures to drop. The big question, however, is by how much. As falling electricity should cancel out rising car fuel and mortgage rates are essentially unchanged, all focus is on the behaviour of CPIF excl. Energy.

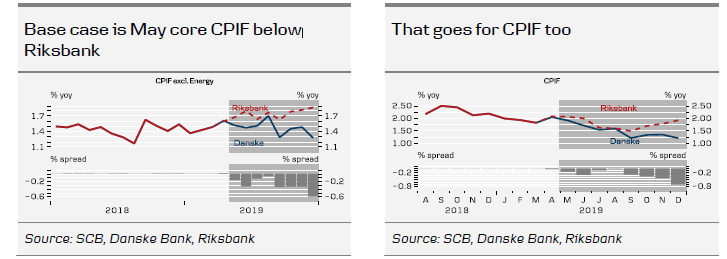

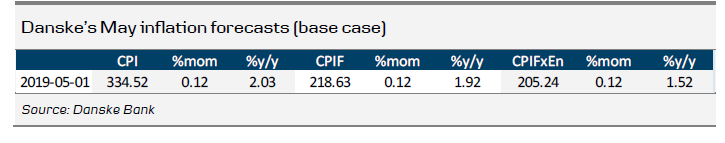

A ‘normal’ CPIF excl. Energy print for May would be +0.1% m/m (see chart on the right), which is also our base case. There are seldom big price swings in May, with the exception of international airline tickets and charter packages. Quite often, these move in different directions, balancing each other out. This is what is in our base case, which puts our three forecasts for CPI, CPIF and CPIF excl. Energy 0.1-0.2 percentage points below the Riksbank’s forecasts.

There are, however, worrying indications that charter prices may actually decline instead of rise. That, if it materialised, could pull inflation prints down another 0.2 percentage points below our base case and, hence, some 0.3-0.4 percentage points below the Riksbank’s. For instance, charter packages have shown a very strong correlation with Travelmarket’s flight price index in the past five months (see charts below).