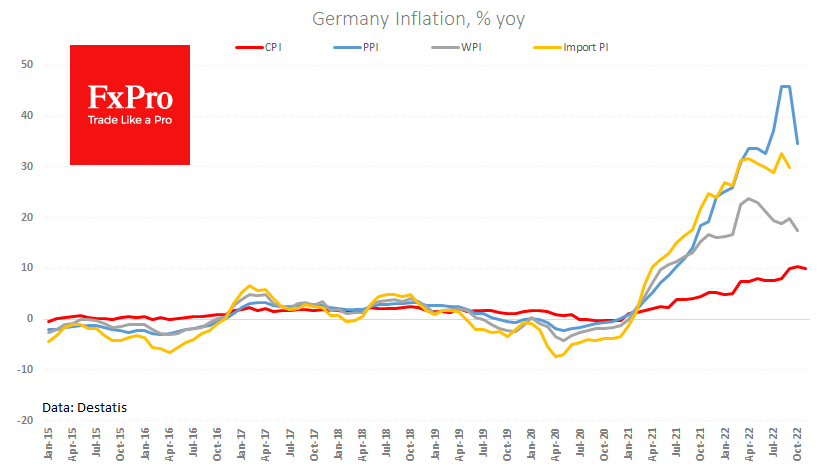

Germany's consumer price index fell by 0.5% in November, slowing the year-on-year gain to 10.0%, according to the published Destatis preliminary estimate. The fall exceeded the expected 0.2% m/m decline and maintained the year-over-year rate at 10.4%.

We previously pointed out that the October data was the peak of inflation in the eurozone. Fresh data from Germany strengthens this hypothesis. However, this reversal will draw more attention to the ECB's stance. Is this data a reason to lower the rate hike step? Recent comments from ECB members suggest that this is unlikely.

Central banks in the G7 are working to contain the unwinding of inflation. By starting too late, they have faced a rise in core inflation, excluding volatile and problematic food and energy, rising 21% and 38.4% y/y, respectively. In such circumstances, monetary policy at the central bank must remain restrained for an extended period.

That means raising rates above neutral (around 2% in the eurozone) for an extended period. History has ample examples where policy easing too early led to repeated inflation shocks, which further strengthened consumer confidence in perpetually high inflation and changed consumer behavior accordingly.