Inflation has finally risen, but the Fed will remain dovish. Gold can continue its upward march.

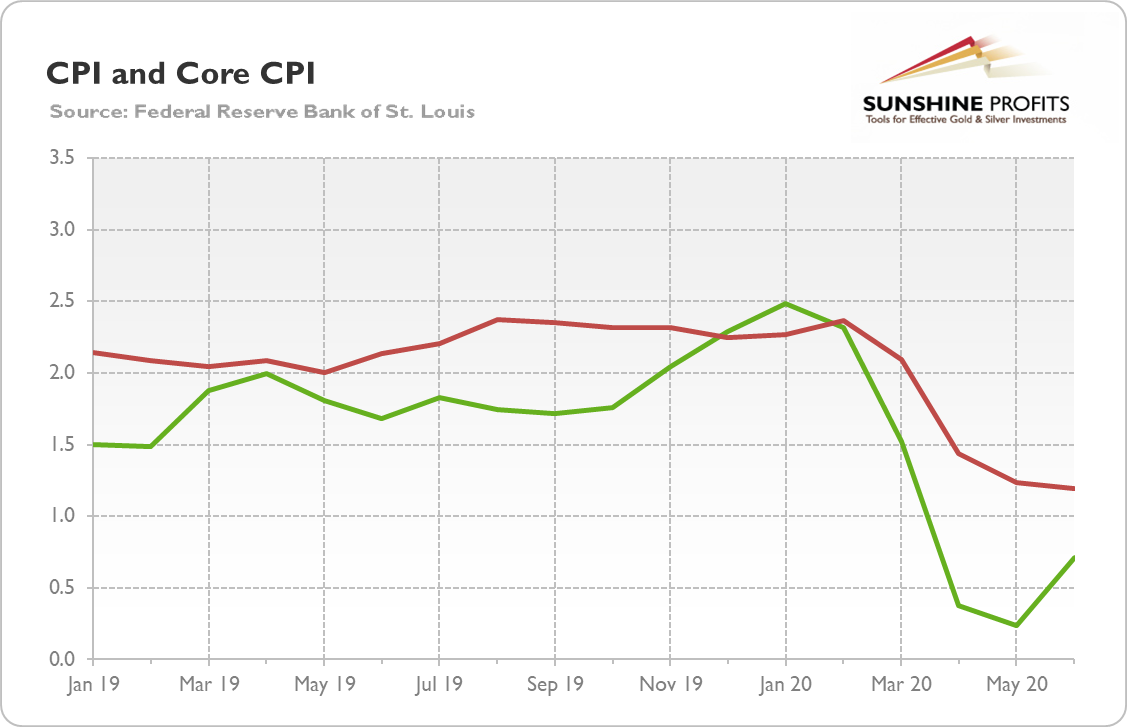

US CPI rose 0.6% in June, following a 0.1% drop in May. It was the first increase in four months and the biggest jump since 2012. The move was mainly driven by higher energy prices (the energy index increased 5.1% in June as the gasoline index rose 12.3 percent). The core CPI rose 0.2%, following a 0.1% drop in May. It was also the first increase since February, as the prices of apparel and transportation services have finally risen.

On an annual basis, headline CPI increased 0.7% (seasonally adjusted), following a mere 0.2% increase in May. However, the core CPI rose 1.2%, the same as in the previous month (or actually a bit less if we abstract from rounding). So, as the chart below shows, inflation remains very low, but the period of disinflation has possibly ended. We mean that although we do not expect the outbreak of high inflation in the near future, inflation rate could have reached the bottom, at least for some time.

Implications for Gold

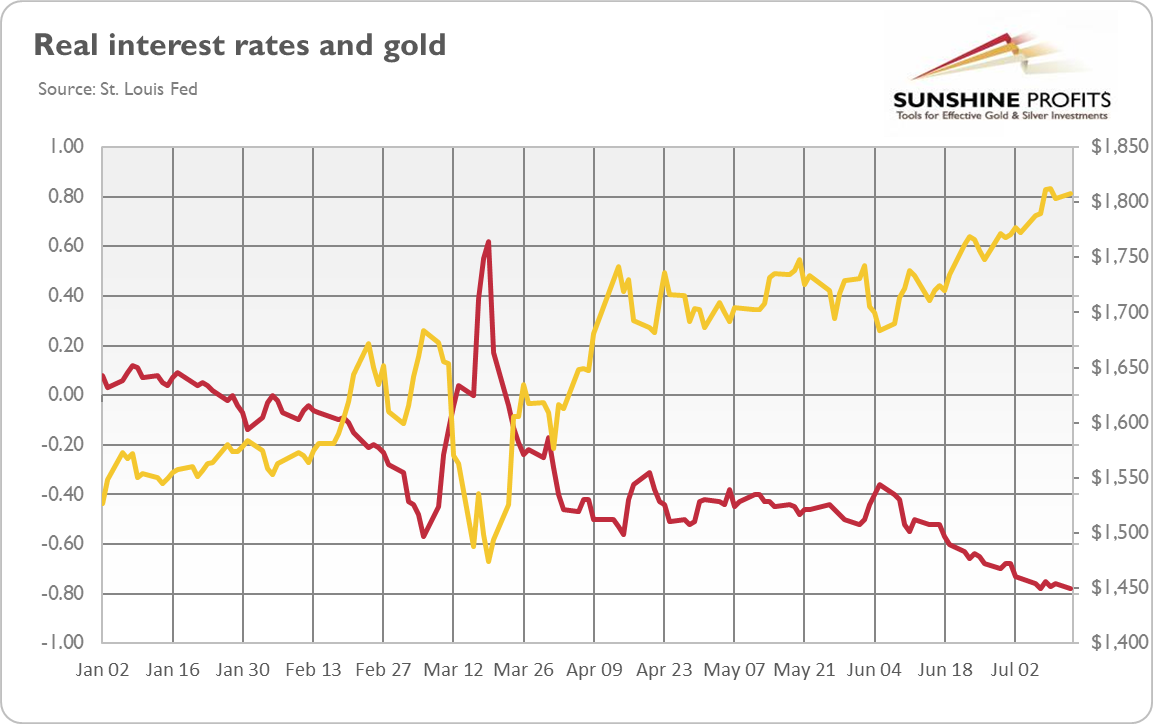

What does it mean for the gold market? Well, on one hand, higher inflation could increase the demand for gold as an inflation hedge. On the other hand, the rebound in inflation could theoretically push the Fed to adopt a more hawkish stance, which would be negative for the gold prices. However, inflation remains very low, so the US central bank is not likely to change its ultra dovish stance for months, if not years. The Fed will not hike the federal funds rate, ending its Zero Interest-Rate Policy, anytime soon, so the real interest rates will stay at their very low, negative level, supporting gold prices (see the chart below).

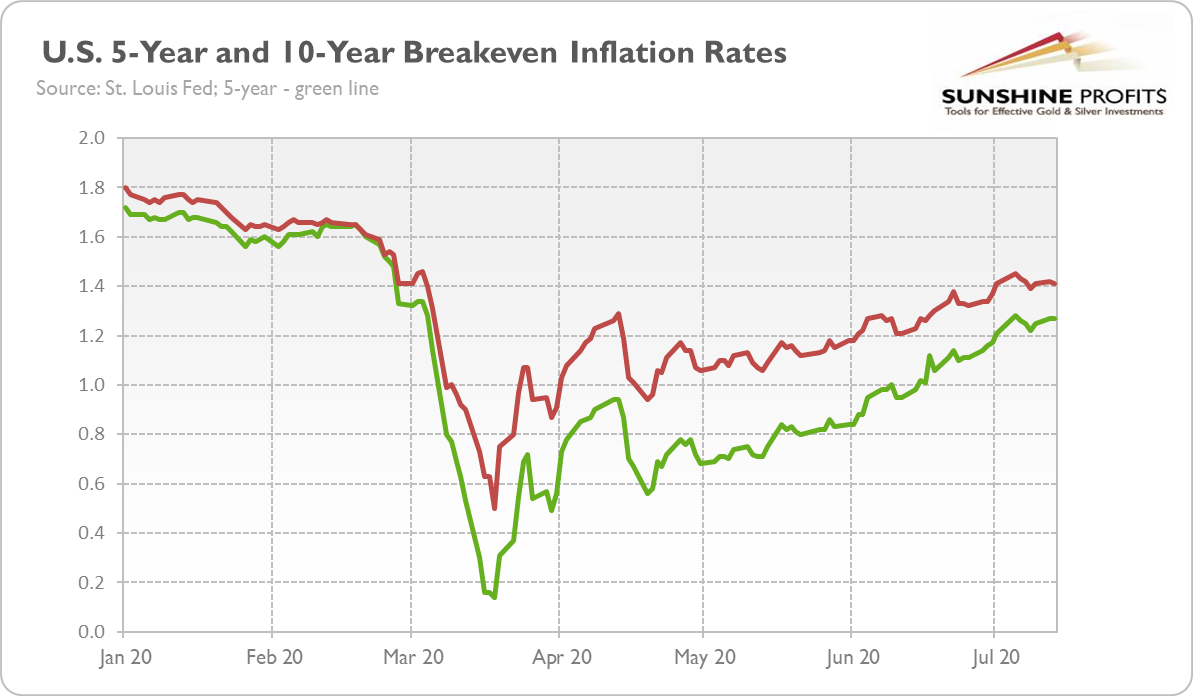

Given the resurgence in the COVID-19 cases and the slowdown in the pace of the consumer spending and economic recovery, inflation may decline again in July. However, what is really important, is that the rising number of cases and reopening rollback have not yet impacted long-term inflation expectations, as the chart below shows. This is good news for the gold market, as the higher inflation expectations, the lower real interest rates.

Of course, there is a risk that real interest rates would rebound one day, putting downward pressure on gold prices. However, with expectations that the Fed will implement the yield-curve control, capping interest rates, this risk is limited. As Fed Governor Lael Brainard said this week: "There may come a time when it is helpful to reinforce the credibility of forward guidance and lessen the burden on the balance sheet with the addition of targets on the short-to-medium end of the yield curve".

So, it's not surprising that gold has been rising in such a macroeconomic and geopolitical environment (there are renewed tension between the United States and China), jumping even above $1,800. After all, even if the pandemic is ultimately contained, the economy is likely to face important headwinds, which limits risk-appetite among investors.

For example, three of the largest US banks said this week that they had set aside $28 billion for loan losses. Indeed, the economic pain from the coronavirus, including corporate bankruptcies and banks' problem, is still to come. Importantly, gold showed ability to return above $1,800 after some normal profit-taking, which suggests that price declines are now viewed as buying opportunities and that the yellow metal can go further north in the long-run.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.