Investing.com’s stocks of the week

We all have heard it said before: “inflation is a tax.” It seems that when most people say it, they seem to mean that it’s painful, like a tax is. That both inflation and taxes hurt the little guy, more than the big guy. That the other political party is responsible for bad things, and these are both bad things, so they imply the same thing: vote for me!

When Milton Friedman said it, he meant inflation is a tax.

We recently have seen in an uncommonly explicit way just what this means. It isn’t something vague but an actual tax. It takes money from you, but it doesn’t stop there—it transfers that money to government coffers.

I thought of this recently when I saw a headline about how government receipts were breaking records. The headline seemed to think this was great news, but I am a taxpayer so my natural reaction was: dang it. Indeed, receipts at all levels of government are way up for a bunch of reasons. Incomes are higher, so income taxes are higher. Corporate earnings are higher, so corporate taxes are higher. Retail prices are higher, so sales tax collections are higher. And real estate prices are higher, so real estate taxes are higher.

To the extent that these things are higher because of higher real activity, it isn’t a bad thing—but at least part of the increase in receipts is due to inflation. Buy the same item today as you did last year and the price is going to be roughly 8-9% higher on average, which means that your sales tax will also be 8-9% higher.

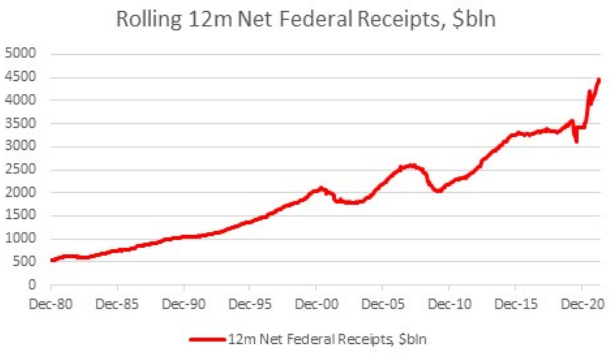

If your restaurant bill is 10% higher this year; so is the tax…and the tip, which is income. So it shouldn’t be a terrible surprise that overall federal receipts over the last twelve months are up. By about 27%, actually, compared to the twelve months ended in March 2021.

To be sure, the 12 months ended in March 2021 included a lot of the shutdown, although you can see in the chart that the shutdown didn’t really hurt receipts that much. But to make a better comparison: the first three months of 2022, compared to the first three months of 2021, federal receipts were +18.8%. It’s good to be the king, in inflationary times. At least until the rabble figures out where their money is going.

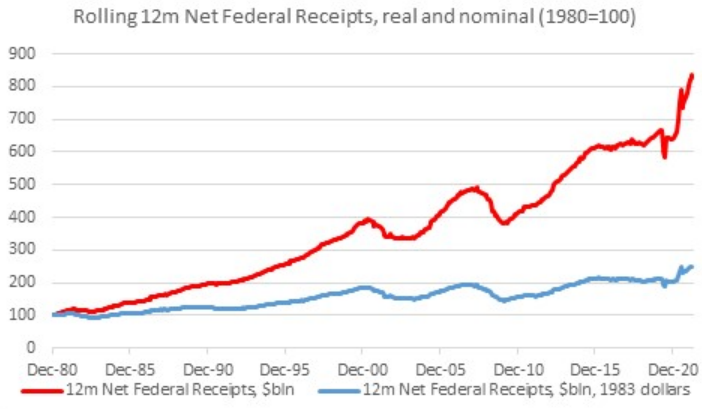

How much of the overall increase in tax collections is inflation? Over a long period of time, most of it, although you are correct in your visceral sense that the pound of flesh has become more like 2.5 pounds of flesh over time.

The chart above shows rolling 12-month tax receipts, indexed to 12/31/1980. The red line is nominal receipts; the blue line is taxes adjusted for inflation. Since 1980, taxes have still gone up about 150% in real terms, about 2.25% per year. That’s not far from what the real growth rate of the economy has been, although to be fair about 22% of that is since the beginning of 2021.

[As an aside: if the “inflation truthers” are right about inflation really being about 5-6% higher per year than the government admits to, since the early 1980s, then either tax burdens have been going dramatically lower in real terms or the government is also lying about government receipts which must actually be orders of magnitude higher. You see how absurd this argument gets?]

So the government gets more revenue when you produce more, but it also gets more just because prices go up. Inflation is a tax.

While it isn’t directly illustrated in the charts above, this is one way that inflation contributes to inequality. It takes more from the less-well-off than it does from the well-heeled. Inflation is not only a tax—it is also a very regressive tax.