Facts

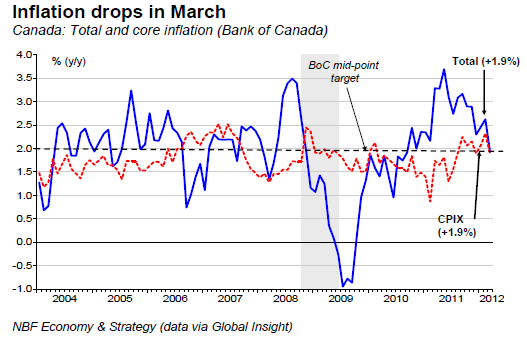

Headline CPI inflation decreased to 1.9% in March from 2.6% in February. Core CPI also drops to 1.9% from 2.3% a month before. On a monthly basis, headline CPI was up 0.4% for a third month in a row. Core prices rose 0.3% after rising 0.4% the month before. On a seasonally adjusted basis, headline CPI was up 0.2% and core prices increased 0.1%.

In February, 3 out of 8 major components were down on the month (s.a.). Clothing & footwear (-0.8%) and food (-0.3%) registered the strongest decrease. On a regional basis, all provinces experienced inflation decrease (y/y), the sharpest drop being observed in Quebec (from 3.2% to 2.1%) and Ontario (from 2.9% t 2.2%).

Opinion

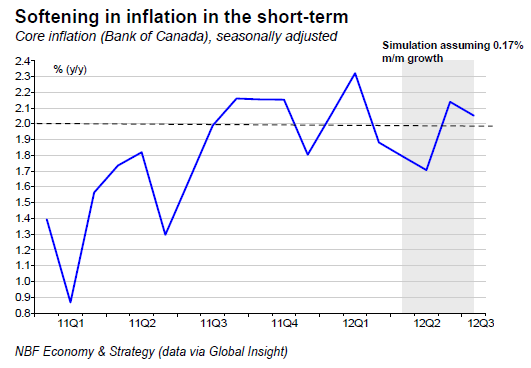

March's inflation report was roughly on consensus. A substantial drop was to be expected in the y/y since a surge in core inflation in March last year (pushed up mostly by core food) was removed in the calculation. As a result, both headline CPI and core CPI are back slightly below the mid range target of the BoC (top chart). Note that base effect should maintain downward pressure on inflation in the short term. Assuming 0.17% m/m increase in core CPI over the next months, y/y inflation would reach 1.7% in May (middle chart). But as soon as June, the preferred measure of the BoC would be back above 2%. Thus, the inflation drop this spring is not a sign of fading price pressure in the Canadian economy.

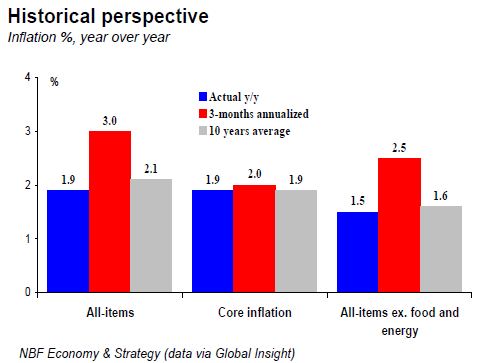

Indeed, 3-months annualized core CPI is running at 2% with significant downward pressure coming from the highly volatile electricity price in Alberta (bottom chart). When you exclude all food and energy components, inflation is still running at a 2.5% rhythm on a 3-month annualized basis. However, inflation is far from being the first concern of the BoC in the actual context. The magnitude of the economic difficulties in the eurozone over the coming months will dictate what happens next.