On Thursday, the Bureau of Economic Analysis (BEA) will report on Personal Consumption and Personal Income (as well as the difference between those two, the Personal Savings Rate). Accompanying the economic figures will be the usual estimates for consumer prices, in this case the Federal Reserve’s preferred inflation gauge the PCE Deflator. There isn’t expected to be much good news for policymakers, though it is for struggling consumers.

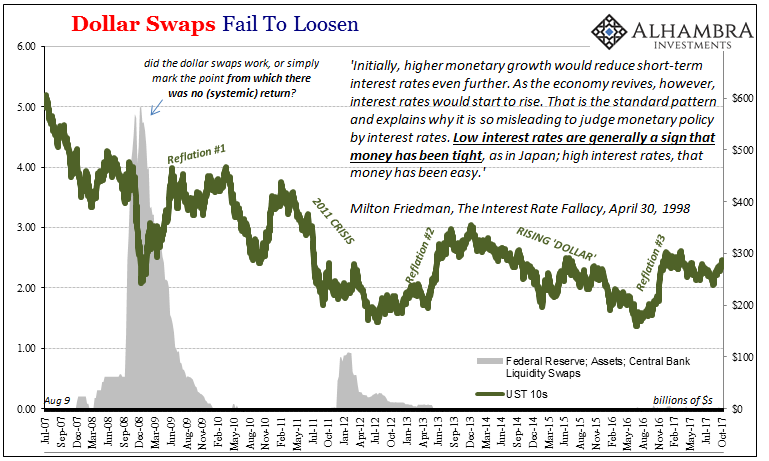

If inflation was about to explode higher especially in the form of wage rates due to the extremely low unemployment rate, it is quite interesting that not one market is pricing that scenario. Long-term bond rates as well as the eurodollar futures curve all suggest more of the same moribund economic conditions continuing well off past the foreseeable future.

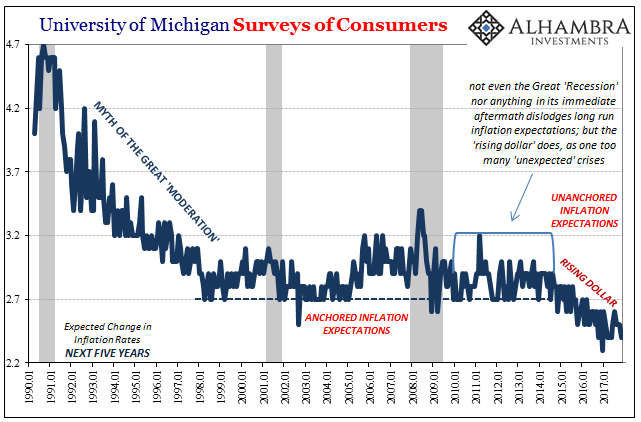

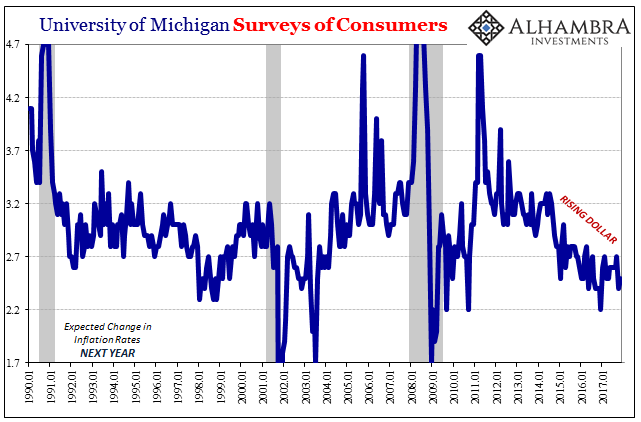

Surveys of consumers point in the same direction, not that laypeople appreciate and understand the monetary dynamics of eurodollars to GDP, more so that they provide an unfiltered view of basic economic conditions on the ground (as opposed to economists who only see what they want to see). On the count of inflation, consumer attitudes more than roughly mirror market-based indications of this woeful economic baseline.

The University of Michigan’s most recent Survey of Consumers finds once again very low, historically speaking, expectations for inflation in the near as well as intermediate terms. An unemployment rate of 4.1% aside, there just aren’t any expectations for things to change even almost two years after the last serious downturn (the one that produced these low inflation expectations).

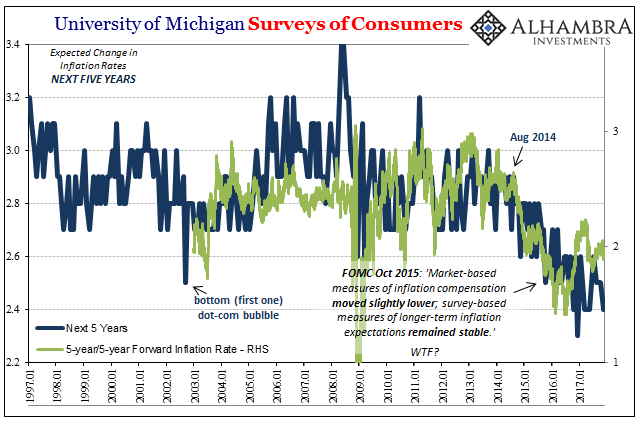

In fact, TIPS trading became slightly more optimistic than these consumer surveys at least until earlier this year. Peaking in February, the 5-year/5-year forward inflation rate was sideways for a few months before trading back lower again right around the time oil prices sank rather than surged.

The parallel, roughly, alongside oil prices isn’t surprising given that the 5-year/5-year forward rate is derived from TIPS, those derived from stubborn UST yields and the CPI. What that means is very straightforward – markets and these private consumer surveys do not expect any significant changes to forward inflation in any form.

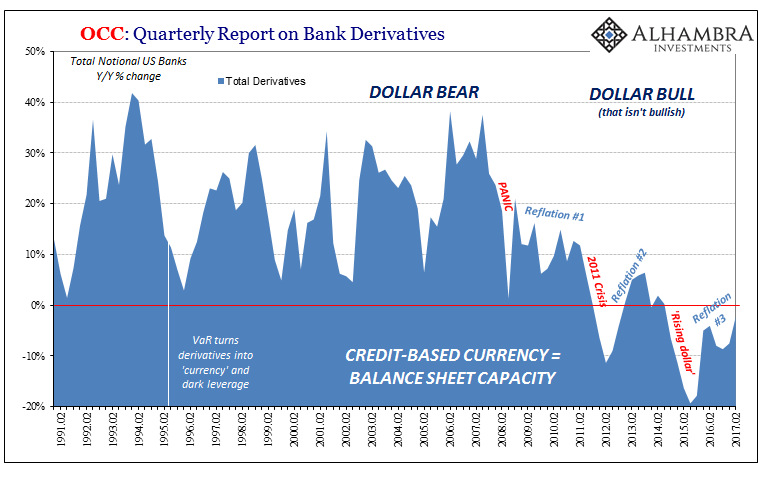

This is not some purely academic argument, where the most consequential result is the exchanging of competing research papers among central bank staffs trying to make sense of where they are all wrong (again). It is of consequence to all the same malaise, and how that stagnation (not at all secular in the proffered sense) will not yield despite so much time underneath it already.

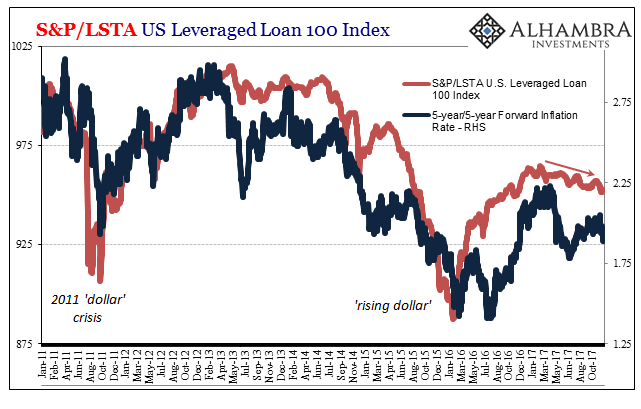

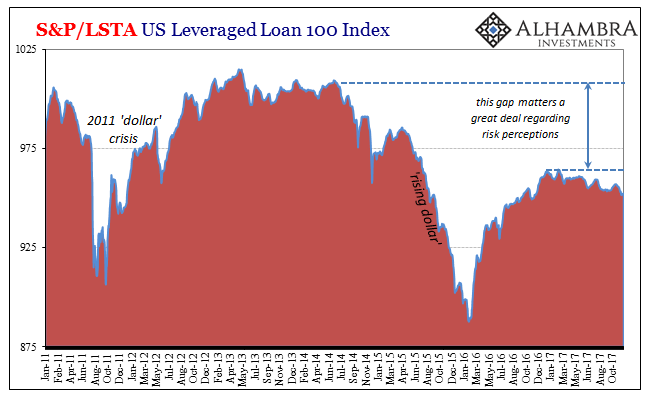

Around the same time inflation expectations rose to their Reflation #3 maximums, some categories of risk prices did, too. The S&P/LSTA Leveraged Loan 100, for example, broke out of its “reflation” uptrend one week before the 5-year/5-year forward rate did. Since that time, a span of now ten full months, this risky debt subset has been trading lower not all at once like during the “rising dollar” period but rather a little here and there; a steady rise in uncertainty underscored the whole time by some degree of unalleviated concern (given that prices never came close to retracing the 2014-16 crash as they did prior after 2011).

The two, inflation expectations and leveraged loan prices, on the surface seem to be related only through WTI. But in recent months inflation expectations as well as leveraged loan prices (and even junk bonds in general) have clearly bucked the rising trend in oil prices. One way to interpret that is through geopolitical risks probably contained in oil since summer, but even so there is a consistency in the macro part of each equation that compels fuller appreciation.

In other words, if inflation expectations (surveys as well as market-based) are right then that is a very different future than the one described by the Fed and played out all over the mainstream. It says instead that the unemployment rate is misleading bunk, and that the economy remains in a very precarious position.

That’s a much riskier proposition for risky markets than if inflation was about to surge in accordance with so-called full employment. In that more optimistic scenario, all the possible downside potential these kinds of questionable securities are pushed off much farther into the future. An economy that after ten years of uneven stagnation suddenly starts to recover is one of much less risk for places like junk bonds and leveraged loans. That was the potential given by “reflation”, a set of more optimistic probabilities that junk investors appear to be re-evaluating especially in light of this dramatic difference over inflation expectations (mainstream narrative vs. everything else).

We can reasonably infer that if investors in the riskiest markets are having second thoughts about those risks, then the same process is surely being played out in more basic economic ways (such as wholesaler and retailer inventory levels ahead of what is actually expected to be a restrained Christmas shopping season). The Fed being wrong about inflation isn’t strictly about deflators, academic debates, or even oil prices; it’s a far more fundamental proposition that is itself self-reinforcing in the negative.

There is broad-based consistency here where the Fed is making the same mistakes as it always does, not in “tightening” their way to the next recession since effective monetary tightness has been apparent for more than ten years already. It’s market and survey confirmation that what I wrote yesterday is increasingly appreciated outside of the media:

For the first time since perhaps the Great Inflation, there is an unnerving official, mainstream sense that monetary policy and effective monetary conditions may not be at all the same thing.

Once you stop believing that the Fed, or any mainstream economist for that matter, has any idea what’s going on in money and economy there are left no conundrums. The point of yesterday’s discussion was to point out that some substantial clique of monetary officials even inside the US central bank aren’t so sure of themselves anymore, either. You are free, of course, to act as Economists most often do and choose more religious devotion to pedigree over market evidence, but that’s the path officials have taken consistently since February 2007.

It’s exactly how we got here, where “here” is more and more accepted to be the same pitiful place – heading (though never in a straight line) toward another future downturn, this one to be #4.