The entire bond market is focused on one thing: inflation. Will the Fed raise rates 3 or 4 times to prevent it? Is the Fed already behind the curve is stalling inflation? Will rising commodity prices stall this economic expansion? Tight labor markets have to raise employment costs, right? There are many other versions of these questions out there. It is hard to see actual inflation every day though.

Sure the oil price rise is noticeable and the reaction at the gas pumps. But that happens before every summer driving season. But my grocery bills are steady, my Starbucks coffee is the same, technology prices keep falling. So where is this monster we are so afraid of? A look at the CRB Index gives some of the story.

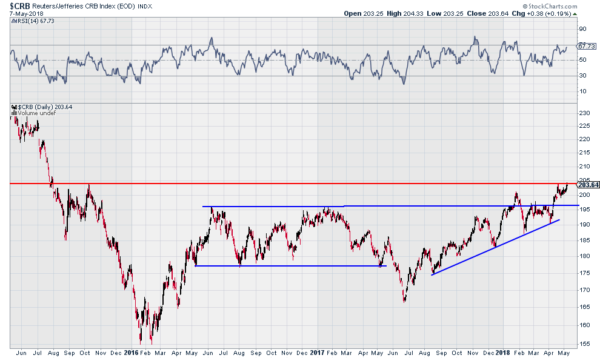

The chart above shows the CRB Index, a measure of 19 commodity futures prices, over the last 3 years. And it does show the potential for prices to rise. They have been creeping higher since June last year. In April they finally broke a range that held prices for 2 years. And now the CRB Index is pushing back at price levels not seen since October 2015. Continued movement to the upside would confirm a major reversal higher in commodities prices.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.