Economists expect higher inflation based on rising producer prices. But will producer prices feed consumer prices? When?

Do producer prices eventually feed into consumer prices? If so, what's the lead or lag time?

The Wall Street Journal article Why the Inflation Picture Looks Starkly Different for Businesses and Consumers got me thinking about these questions and I do not believe they came up with the correct answer.

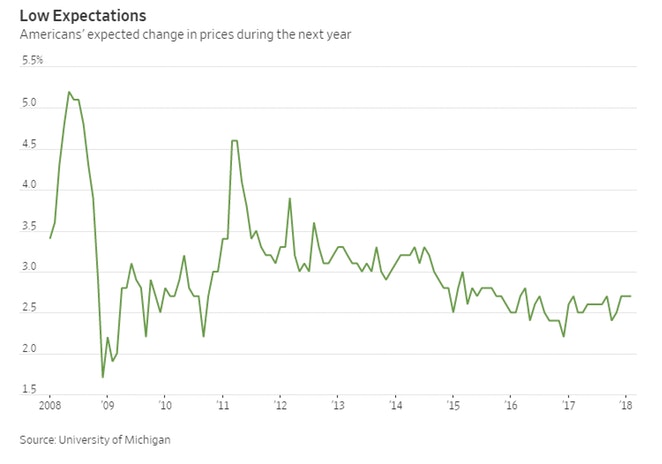

This month consumers said they expected a 2.7% rise in inflation over the next year, a level unchanged since December, according to the University of Michigan’s latest sentiment survey.

Other survey data indicate businesses are feeling inflationary pressures. Take, for instance, the rising percentage of executives in the Institute for Supply Management’s manufacturing survey who say they’re paying higher prices for materials: In January, 46.6% reported higher prices, up from 42% a year earlier.

Households’ inflation expectations tend to lag behind the behavior of inflation itself, which means as consumer prices rise, inflation expectations for this group should rise, too, said Michael Pearce, economist at Capital Economics.

“We’ve seen pickups in producer-price inflation before that haven’t really fed through to higher consumer prices, but there are good reasons to expect that the story this time around could be a bit different,” Mr. Pearce said. This, he said, is because a whole slew of factors are converging to put pressure on business prices and ultimately consumer inflation, a divergence from some past patterns when oil was the main driver.

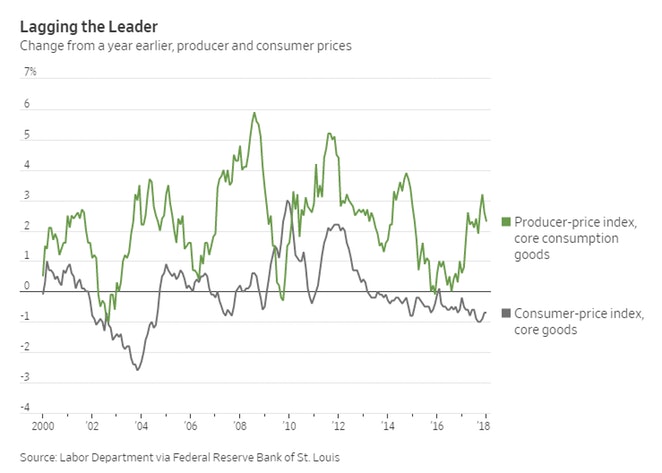

Lagging the Leader or Noise?

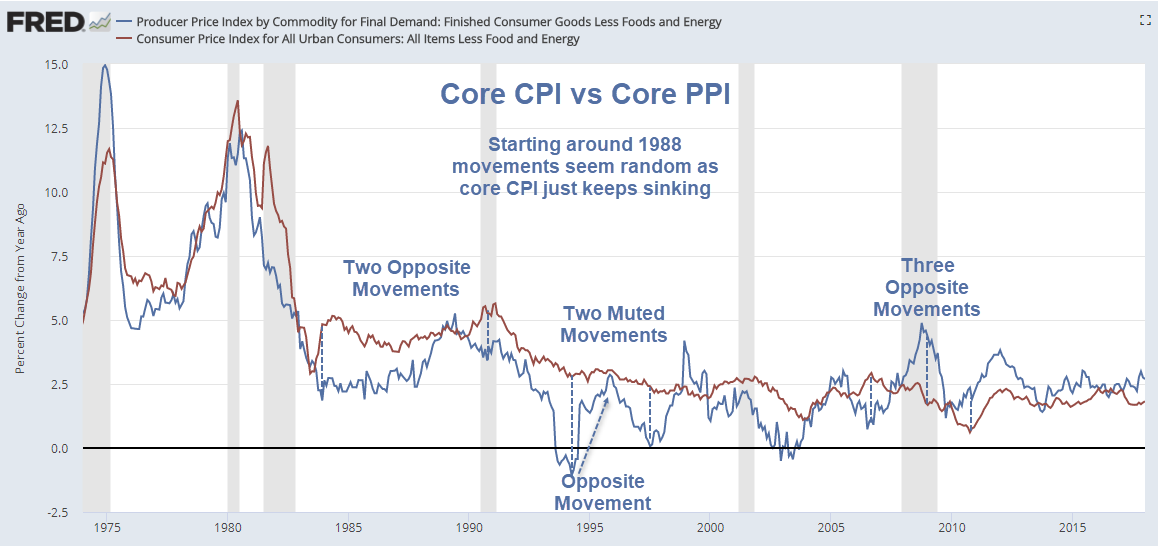

The above chart is easily creatable in Fred. Here is a longer term view.

The overall correlation seems easy to spot but it was far stronger prior to 1988. Since then movement seems somewhat random.

I expected the divergences to be oil-related but they do not all seem to be.

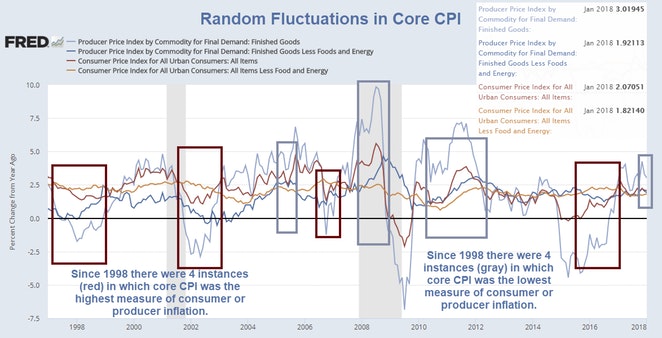

Random Fluctuations in Core CPI

The above chart compares four measures of inflation: Core CPI, Core PPI, All PPI, All CPI.

If there is a lead-lag effect on core cpi vs core PPI, I sure do not see it. Core CPI has been remarkably steady.

Highs and Lows

There were four instances in which core CPI was the highest measure of inflation and four instances in which it was the lowest.

The one pattern that holds is that core CPI was at the lowest when overall PPI was the highest, and vice versa.

However, the trends do not alternate.

Three of the four instances where core CPI was the lowest followed the great recession, and three of the four instances where core CPI what the highest were prior to the great recession.

Regarding Inflation

The above discussion pertains to inflation as the Fed and BLS sees it, not as the average guy on the street attempting to buy a house or pay off student loans sees it.

Inflation is rampant in asset prices, and the Fed cannot see it.

My definition of inflation is as follows "Inflation is an increase in money supply and credit, with credit marked to market".

This is how the real world works in a fiat credit-based system.

My definition is not easily measurable, but neither is the CPI.

There is no such thing as an average basket that makes any sense, especially when the basket excludes home prices and assets.

Based on my definition, inflation is high and rising even if we cannot put a specific value on it.

It's been rising since March of 2009 when the FASB suspended mark-to-market rules.

Why marked-to-market?

Even if it is not directly measurable, banks know if they are capital impaired. In such cases they will not lend. If they do not lend, the credit bubble dies and deflation ensues.

Looking Ahead

When the next recession hits, asset prices will collapse and loans based on those assets will sink if not collapse. Consumer prices will likely follow.

Once again, this is how the real world works in a fiat credit-based system.

The Austrians, in general (not this one) made a huge mistake in believing the expansion of money and credit would lead to higher consumer prices.

However, the Austrians are correct in that the seeds of demise have been planted.

Meanwhile, the monetarists at the Fed and the Keynesians who seek still more stimulus are oblivious to the entire discussion.

Debt Deflation Coming Up

I expect another round of asset-based deflation with consumer prices and US treasury yields to follow.