Now that we can stop focusing on the imminent destruction of wealth in the stock market, for at least right now (I am underwhelmed at yesterday's rebound on light volume), we can get back to something that matters: inflation.

The chart below shows a straight, unweighted average of core or median inflation in the US, Europe, Japan, the UK, and China. (The chart looks similar if we only include the US, Europe, and China and exclude the recent ‘outlier’ Japan and UK experiences).

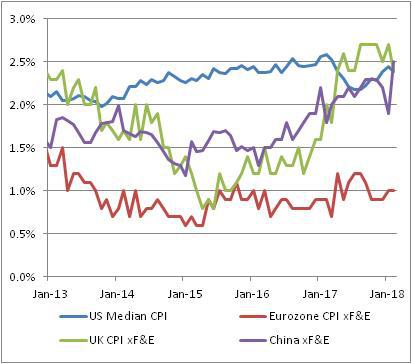

We know that, in the US, measured inflation is going to be rising at least until the summer, as the one-offs from 2017 drop out of the data. The prior decline, and the current rise, obscure the underlying trend…which is for steady acceleration in prices. But it’s important to realize that this is not merely a US trend, caused supposedly by ‘tight labor markets’ or somesuch. It is a much broader phenomenon. The chart below shows four of those five countries.

In the US, inflation has been rising steadily (other than that one-off burp caused by cell phones etc) since 2013. In the UK, China, and Europe, inflation has been rising since ~2015, to lesser or greater degree.

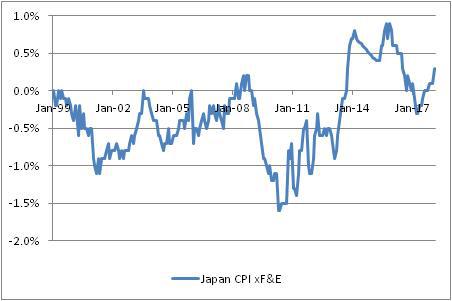

In the UK, core inflation is showing some signs of topping as the Brexit-related spike fades, and the trend is less convincing in Europe so far. In Japan (see below), inflation has been rising since 2010, but the tax-induced spike in 2014 has messed up the steadiness of the trend. And of course, it is worth pointing out that 0.3% is only high relative to the average of -0.3% since 1999!

I point out these trends because inflation is less of a concern if it happens in one country than if it happens as part of a global inflation process. Imagine that inflation is represented by the proportion of the sand on a beach that is wet rather than dry. There are two ways that sand can get wet: because of random wave action that comes and goes, or because the tide is coming in.

Where you build your sand castle depends on which of these two – tide or waves – is responsible for wetting the sand on the beach.

This isn’t an idle question or speculation. In 2005, two researchers at the ECB [1] discovered that the first principal component of inflation in the G7 countries accounted for about 60-70% of the inflation in those countries. They theorized that this factor was a “global inflation” process and that FX rates compensated for the accumulated idiosyncratic inflation in each country pair. (Enduring Investments subsequently confirmed their work and we actually use this insight to drive some of our strategy models). It makes sense that there is an inflation “tide,” since central bank behaviors as well as fiscal behaviors (and cross-border interactions such as trade liberalization) are somewhat synchronized globally. Over the last decade, everyone has been easing monetary policy and running stimulative fiscal policy. Since the early 1990s, until lately, everyone was liberalizing trade policy and reaching more free trade agreements. So it isn’t a stretch to think that to at least some degree, the global inflation cycle should be synchronized as well.

(Indeed, I would argue that if there had been less synchronization in policy, then the idiosyncratic factor of an aggressively easing Japanese central bank would probably have led to a much weaker yen and higher inflation in Japan than we have seen. Easy monetary policy is only inflationary in the short-term if there is an FX response – the waves that impact inflation idiosyncratically – which don’t really happen when everyone is doing it.) In the long-run, of course, excessively easy monetary policy changes the tide level. And, like the tide, it isn’t that easy to reverse.

The signs suggest the tide is coming in. Place your sand castle accordingly.

[1] M. Ciccarelli & B. Mojon, “Global Inflation”, ECB Working Paper N⁰537, October 2005.