“Inflate it Away” Stock Market (and Sentiment Results)…

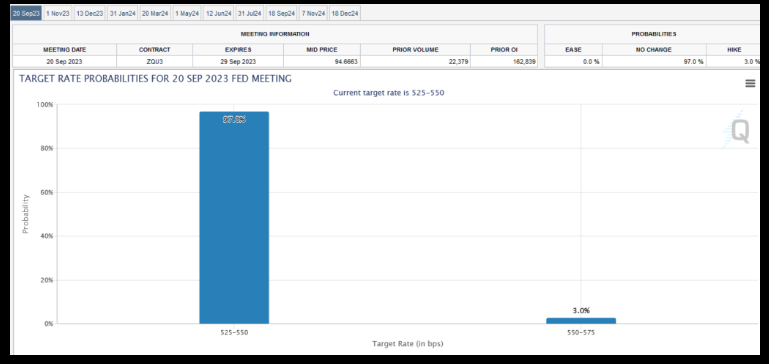

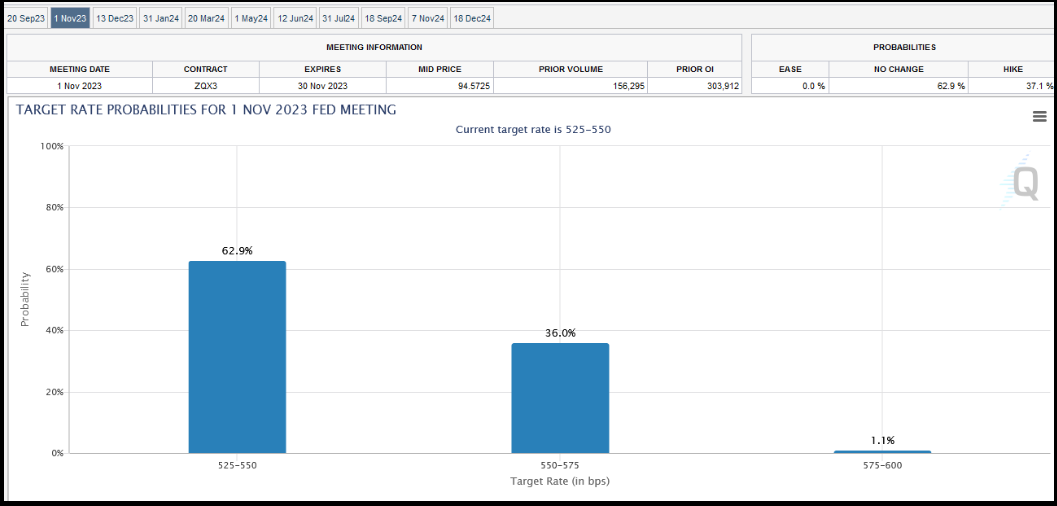

Yesterday the inflation numbers came out. The good news is it did not change expectations for a pause in Fed hikes next week. November expectations – while recently as high as ~50% – are now showing a more moderate 36% probability:

In other words, we buy some time to get more data before the November meeting.

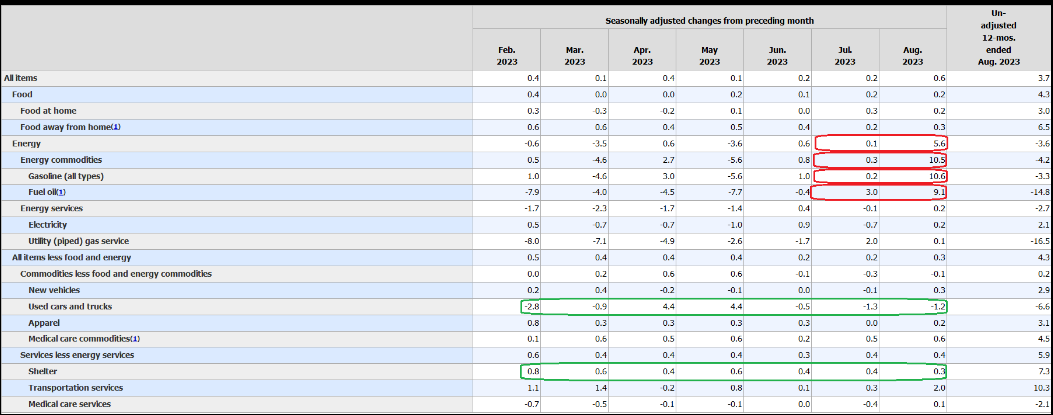

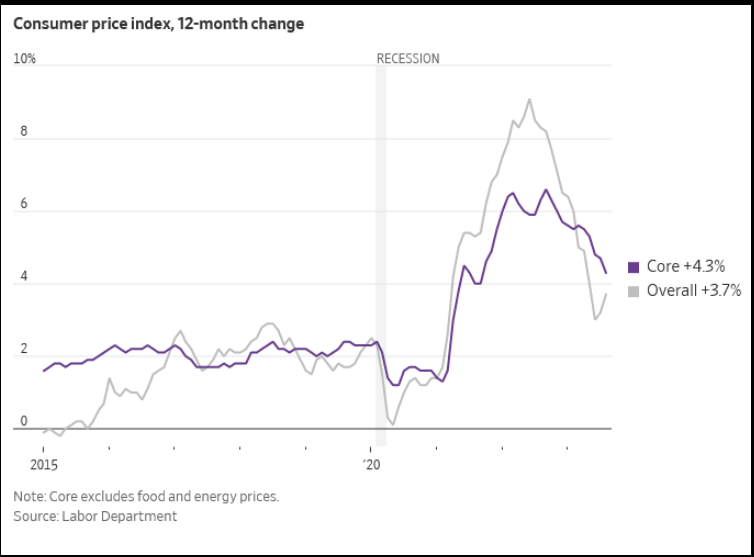

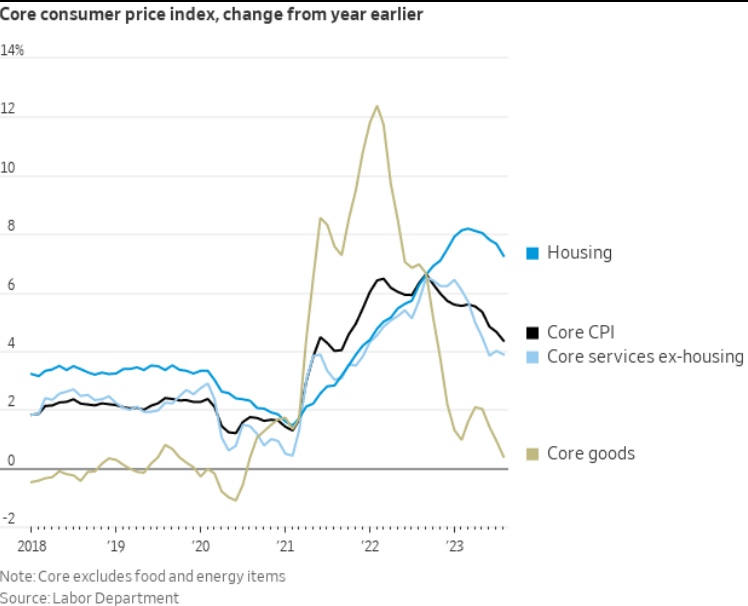

The .6% gains in headline inflation were largely attributable to food and energy – while shelter and used car prices continued to moderate. The left number is actual, middle is estimates, right is last month:

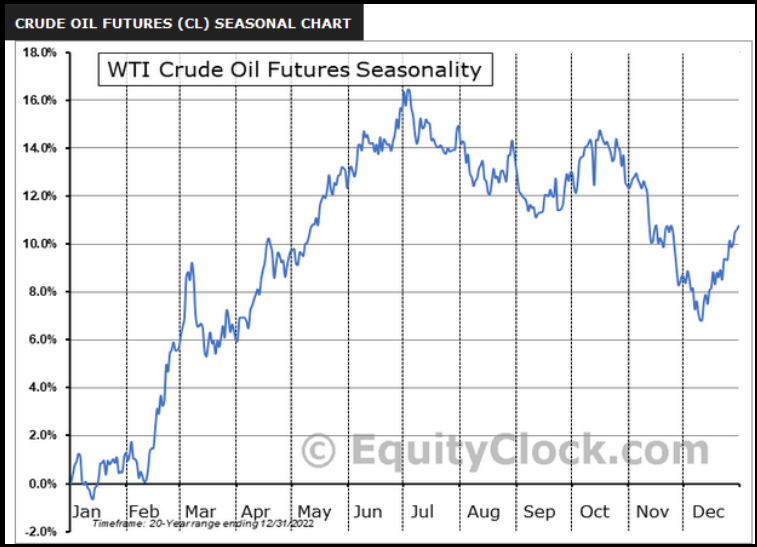

While the Saudis are in a position of strength and can continue to cut production, their counterparts (Russia, Iran, Venezuela) may be more inclined to pump in coming months.

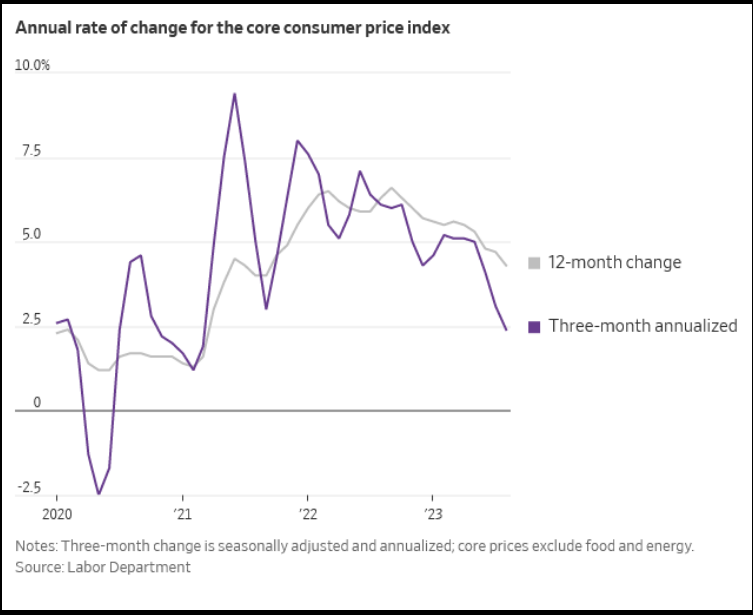

As headline CPI has had a short-term energy induced (counter-trend) bounce, core inflation (the Fed’s focus) continues in the right direction:

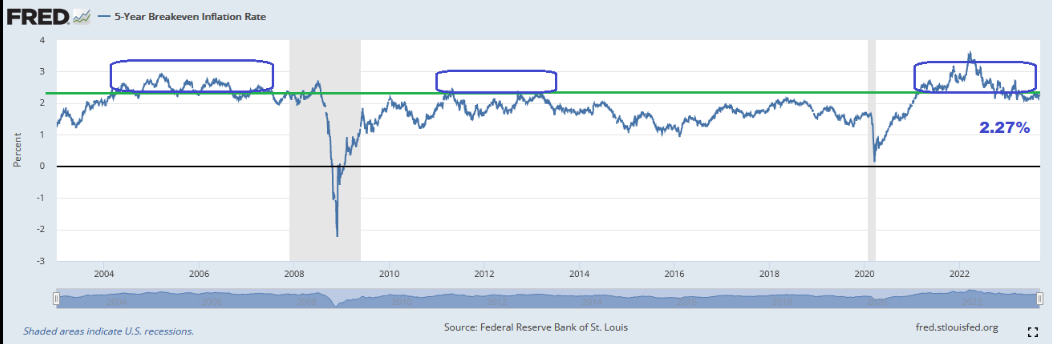

Of further note is that fact that inflation expectations have moderated to levels seen pre-pandemic and more than a decade ago. This is the most important “target” for the Fed. Future expectations (about price) is what drives current behavior. Future expectations remain moderate:

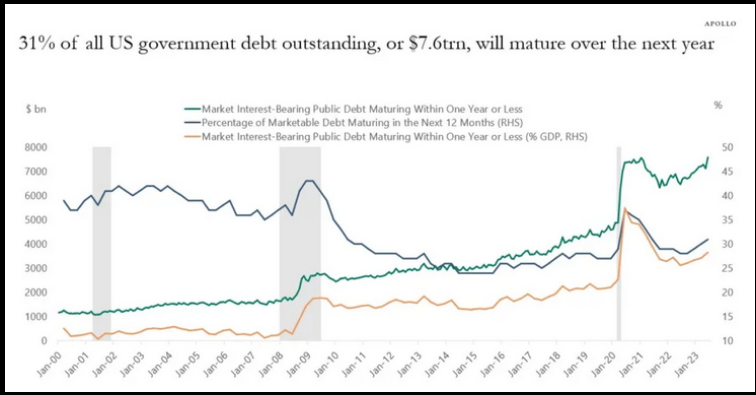

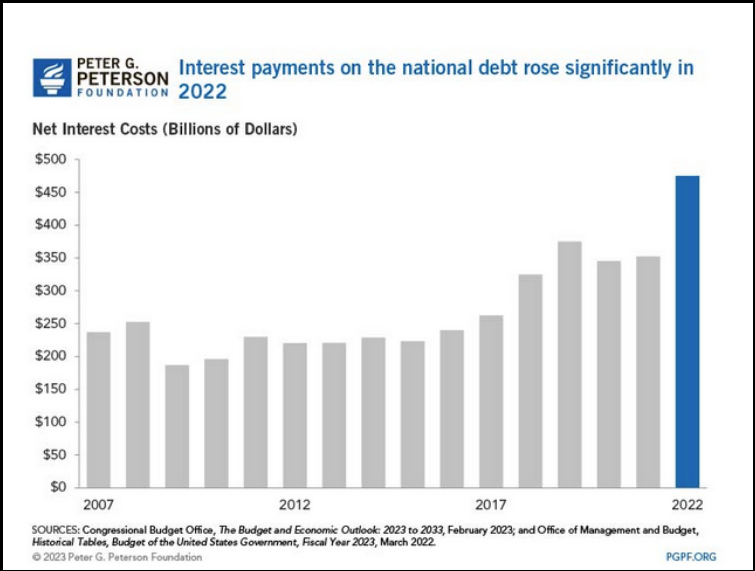

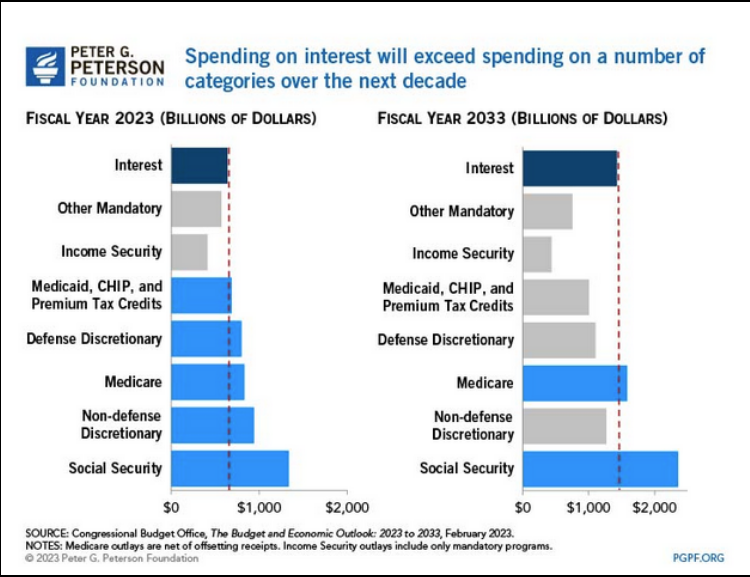

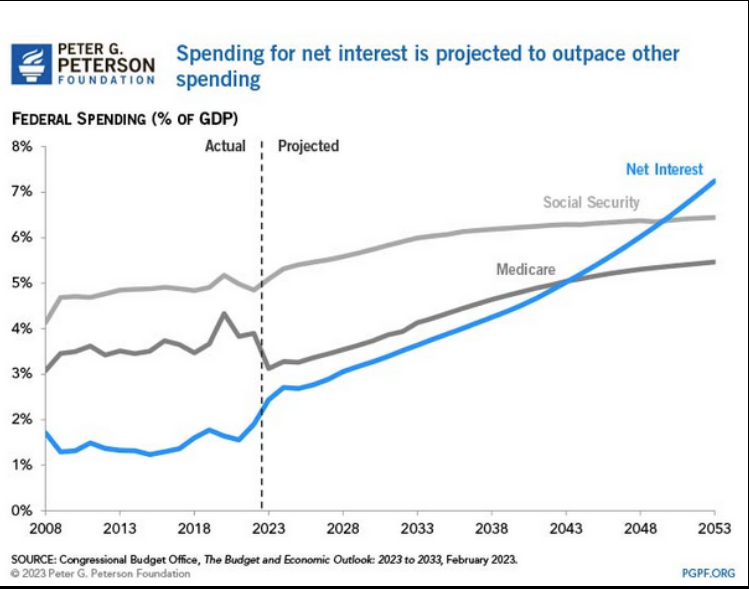

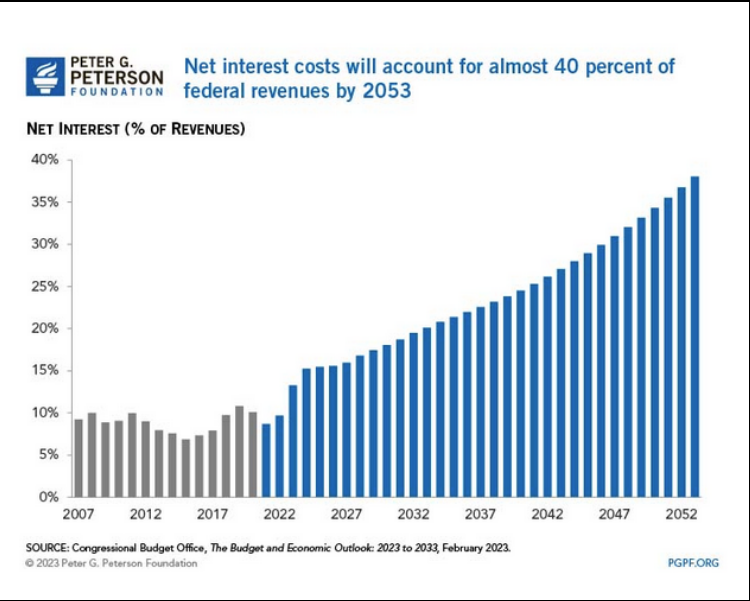

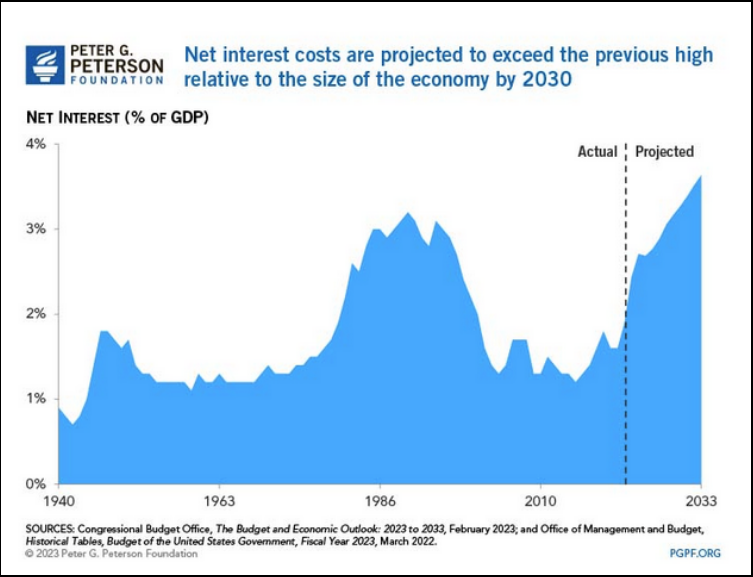

This is especially important as the bill is coming due for the excessive tightening. Not only can we not afford to refinance $7.6T of US Government debt at current rate levels, but hiking more becomes entirely out of the question:

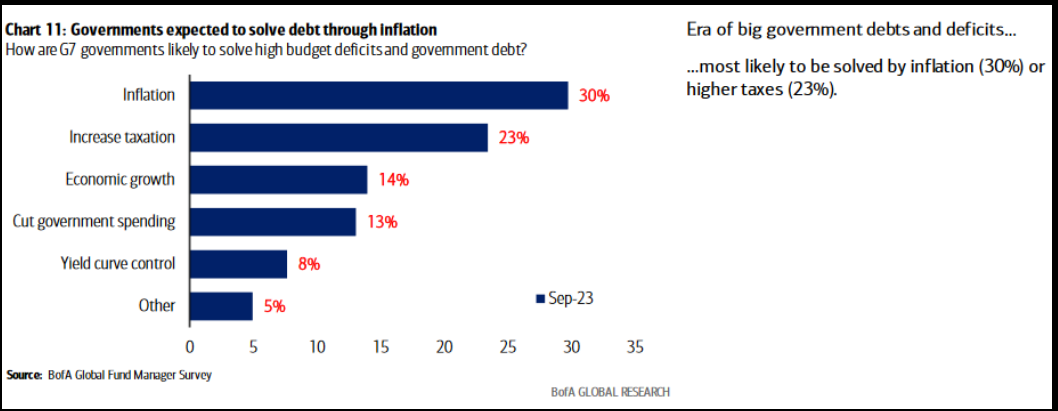

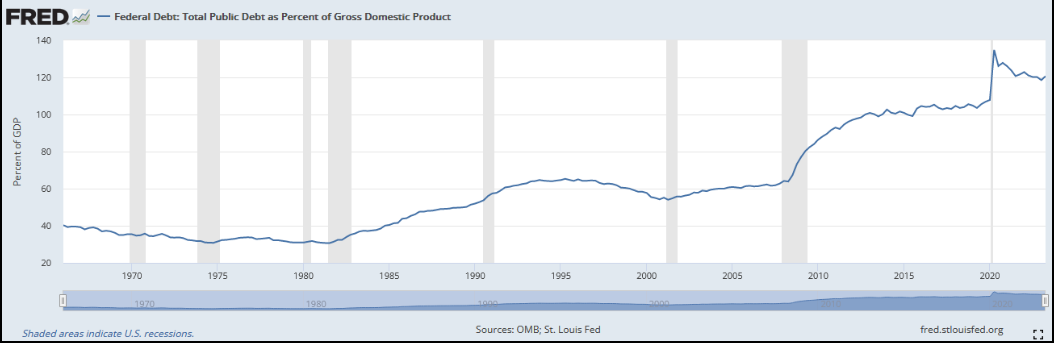

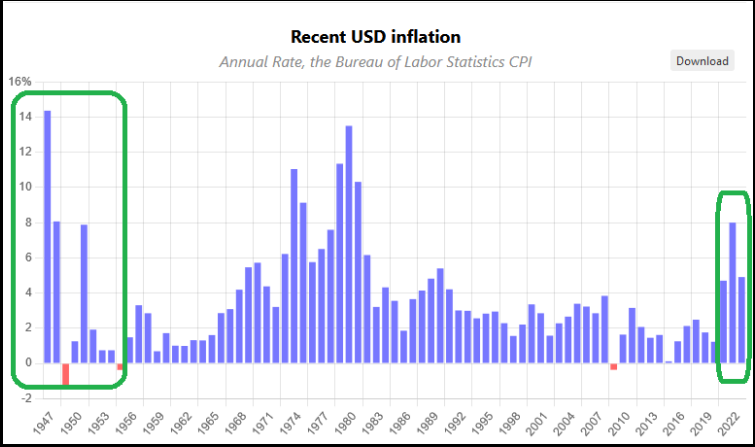

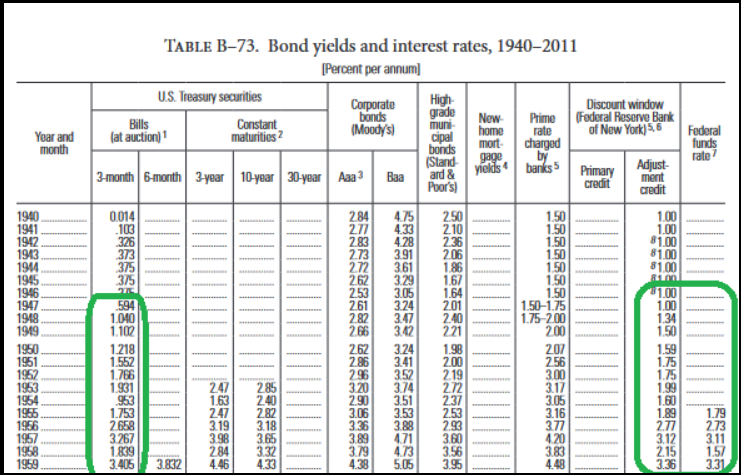

With Debt:GDP at levels not seen since the late 40’s, the only option is to “inflate it away.” As you can see in the top table in this article, institutional managers expect the Fed to do just that.

The Fed should be hoping they can continue to keep inflation ABOVE TREND without stoking expectations that it will remain ABOVE TREND – so they get the best of both worlds: Inflate away this ratio by letting nominal GDP run hot, while not causing a wage price spiral. They are delicately threading a needle to an extent not seen since the 1945-1956 period:

So how did Debt:GDP drop from 119% in 1946 to 61% in 1956? Just look at the inflation rate on average over the 10 years and you’ll have your answer. The debt was INFLATED away:

They kept rates LOW and tolerated short term inflation to “normalize” the country’s balance sheet:

The Fed is buying time in hopes they can do the same. They will eventually have to bring rates down a bit to meet that objective. In the meantime, all they have is managing expectations with hawkish talk until they can start to moderate rates. The one problem they will not be able to solve without major pain and devastation is DEFLATION if they stay too tight for too long.

I referenced this article on Monday when I joined Charles Payne on Fox Business.

Fox Business

Thanks to Charles Payne, Kayla Arestivo, Nick Palazzo and Haadya Khan for having me on Fox Business this Monday to discuss to discuss Stock Market, Earnings, Outlook, Goldilocks, Fed, Picks and more. You can find it here

Sentiment

This Tuesday, Bank of America (NYSE:BAC) published its monthly “Fund Manager Survey.” I posted a summary here:

Here were the 4 key points:

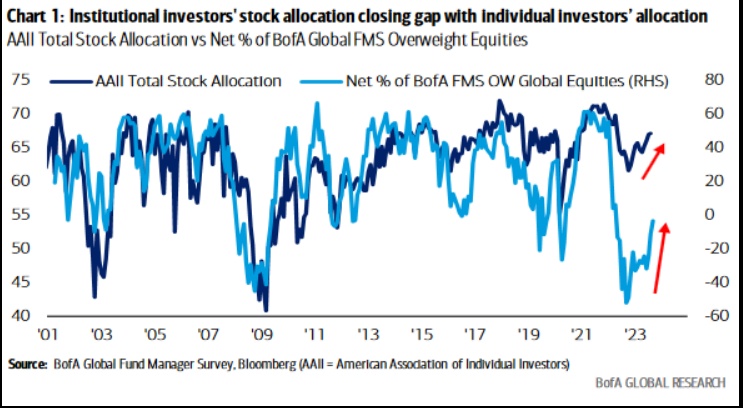

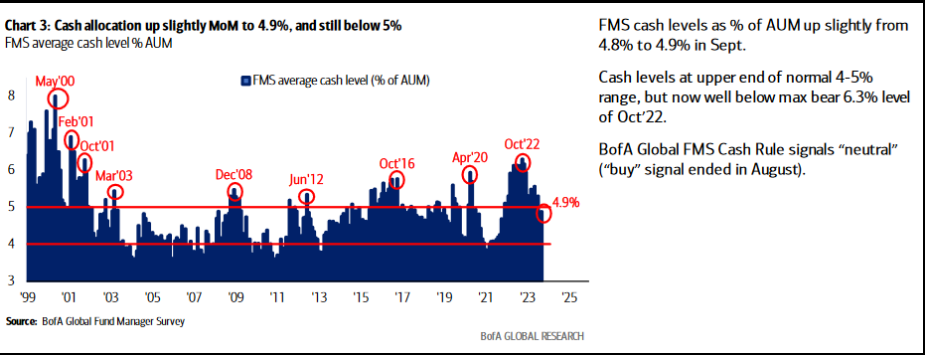

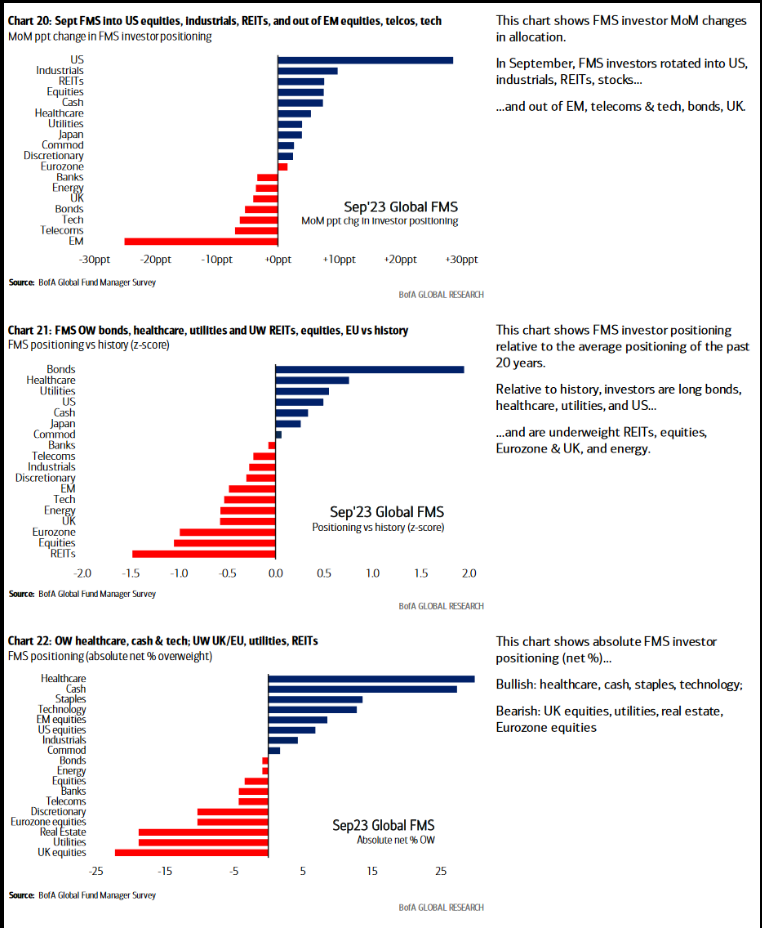

1. Managers have only STARTED to play catch up to retail traders who caught some of the rally off the October lows:

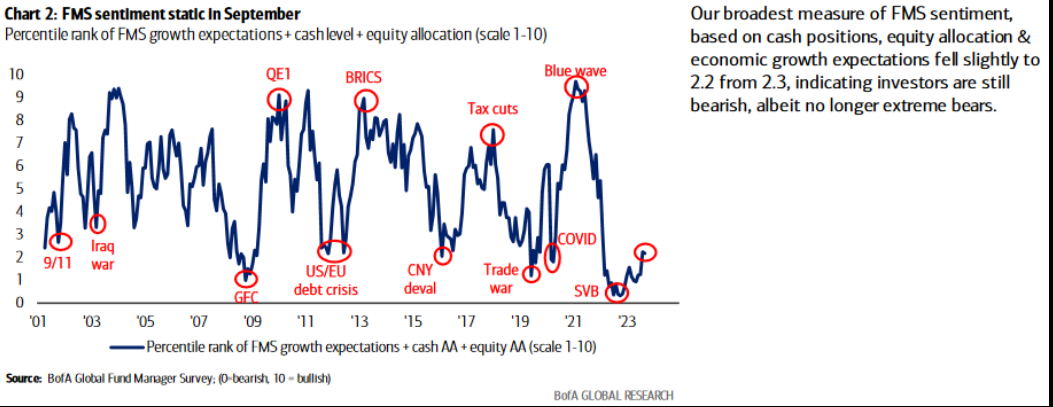

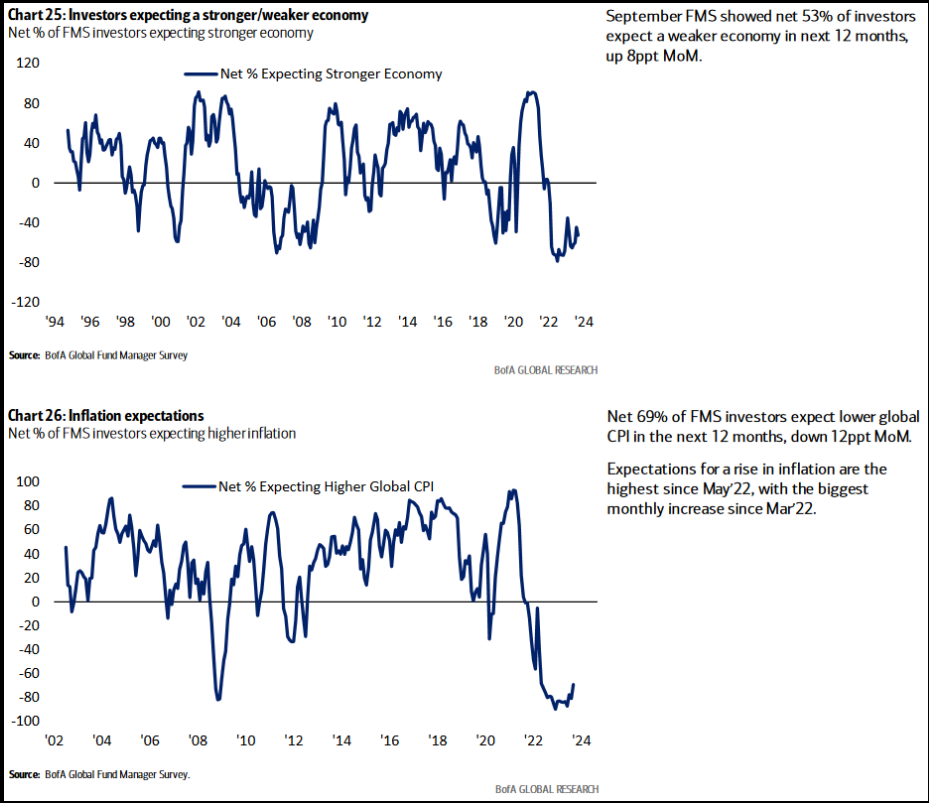

2. Growth expectations and outlook remain near pessimism levels seen at the GFC lows of 2009:

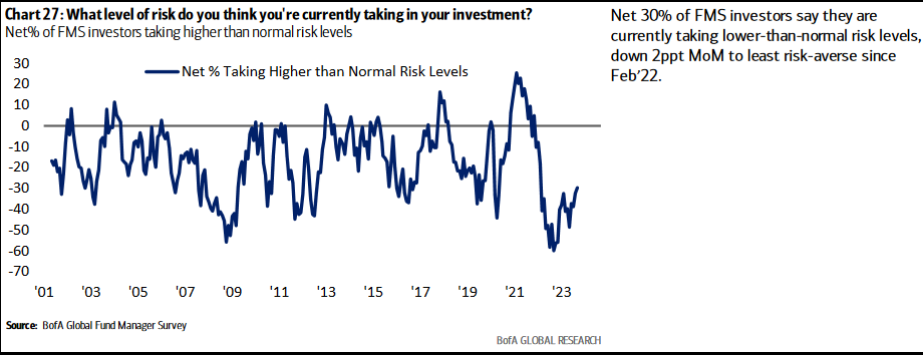

3. Risk levels managers are taking are still near covid and GFC low levels seen just after bottoms:

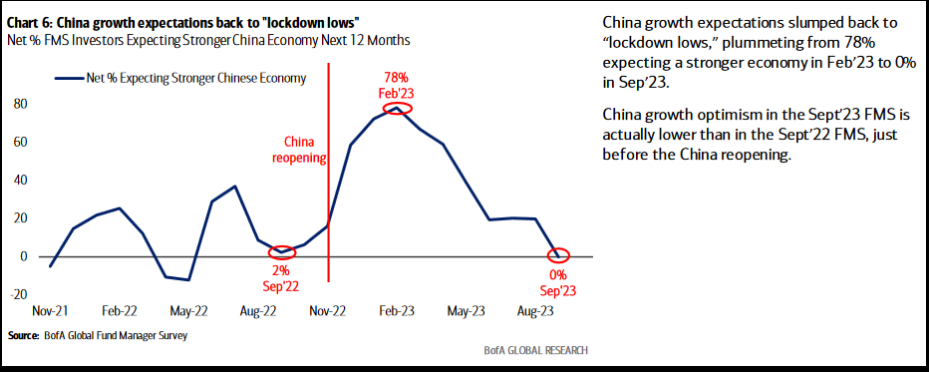

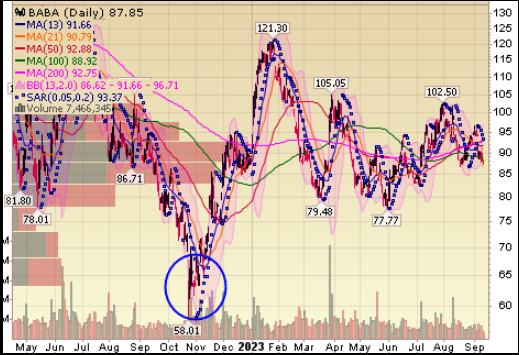

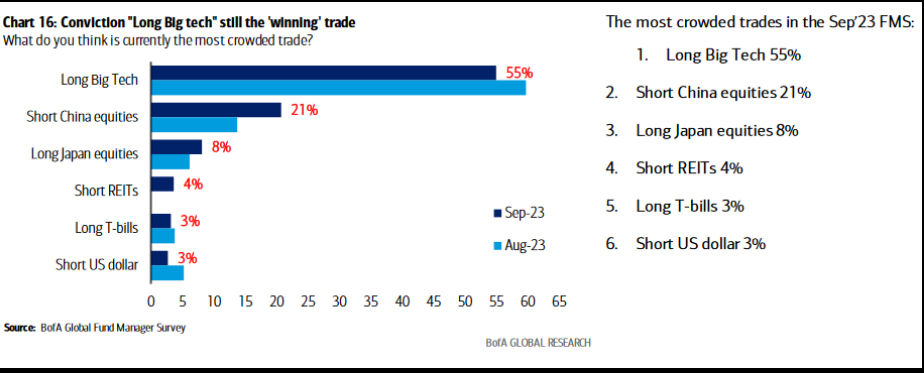

4. Pessimism on China reached levels not seen since Fall 2022 levels – just before Alibaba (NYSE:BABA) doubled from ~$60 to $120 in ~12 weeks:

Outlook Constructive:

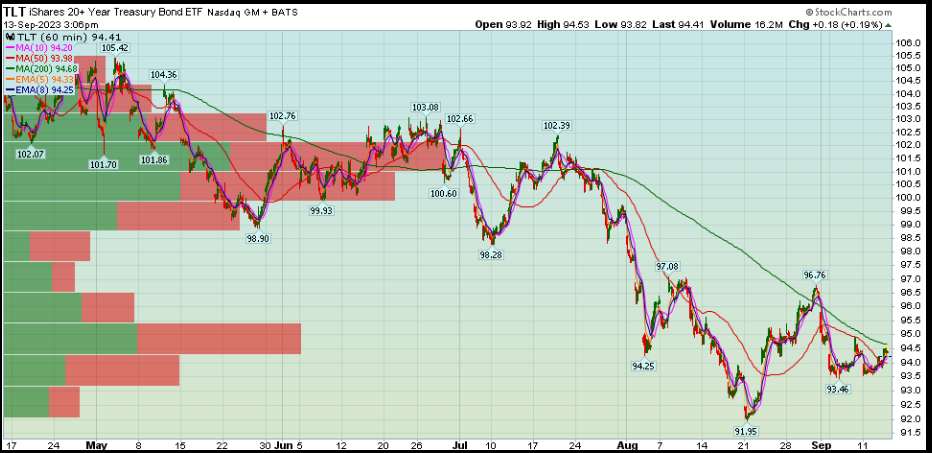

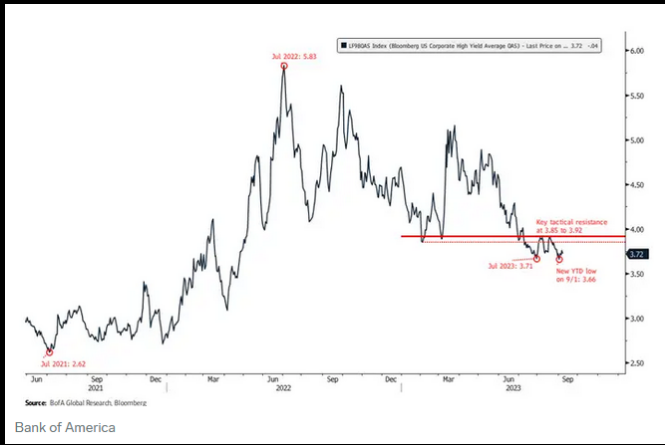

Despite the moderately disappointing inflation numbers yesterday, longer term Treasuries held their lows (from when the major manager announced publicly he was shorting at the exact low). The market still seems to be signaling the Fed is done:

Credit markets are thawing after a heart attack in 2022: The Bloomberg US Corporate High Yield Average option adjusted spread hit a new year-to-date low earlier this month:

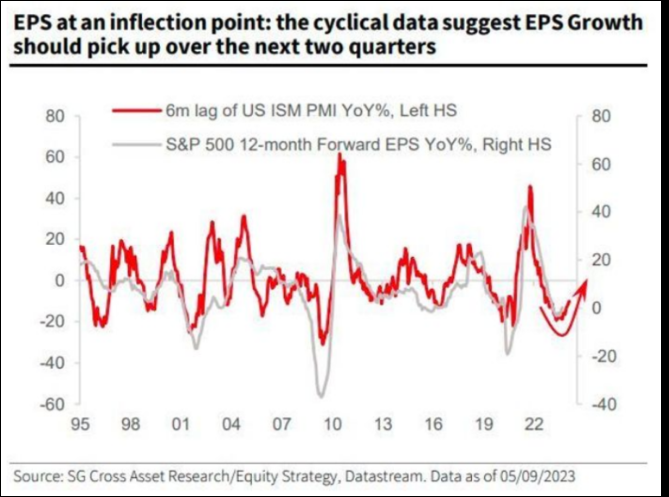

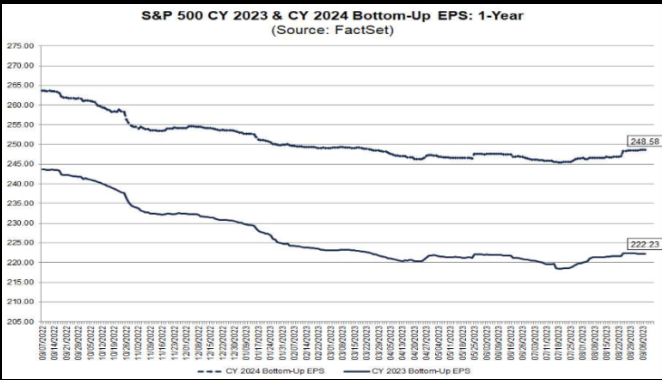

PMIs finally turning up – which could imply EPS estimates are STILL too LOW – despite their recent ascendancy:

Now onto the shorter term view for the General Market:

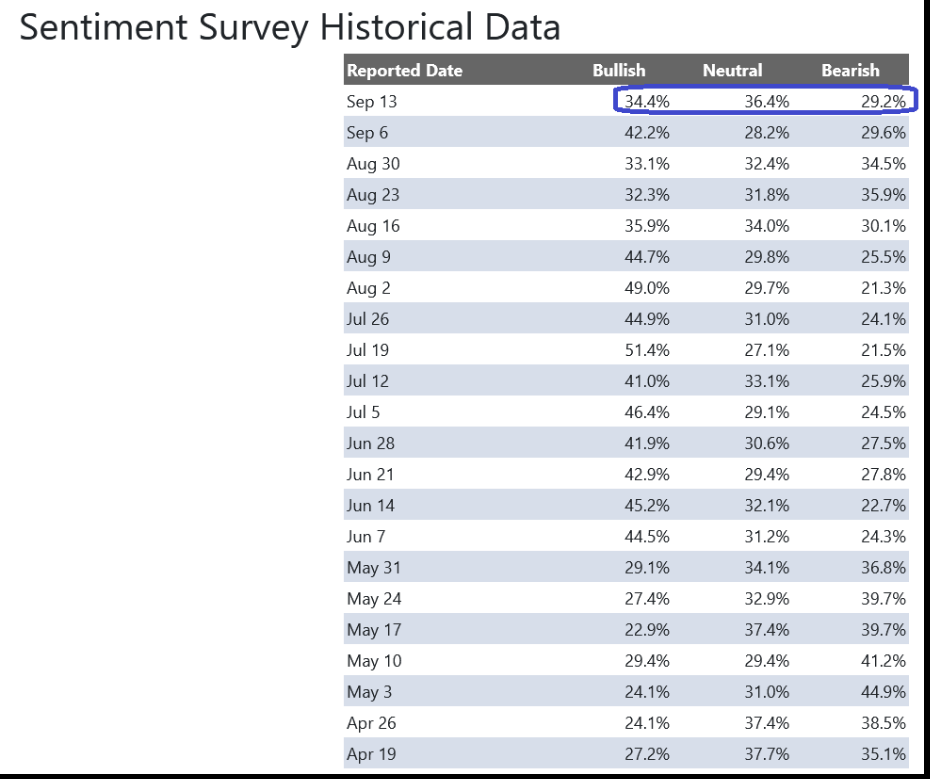

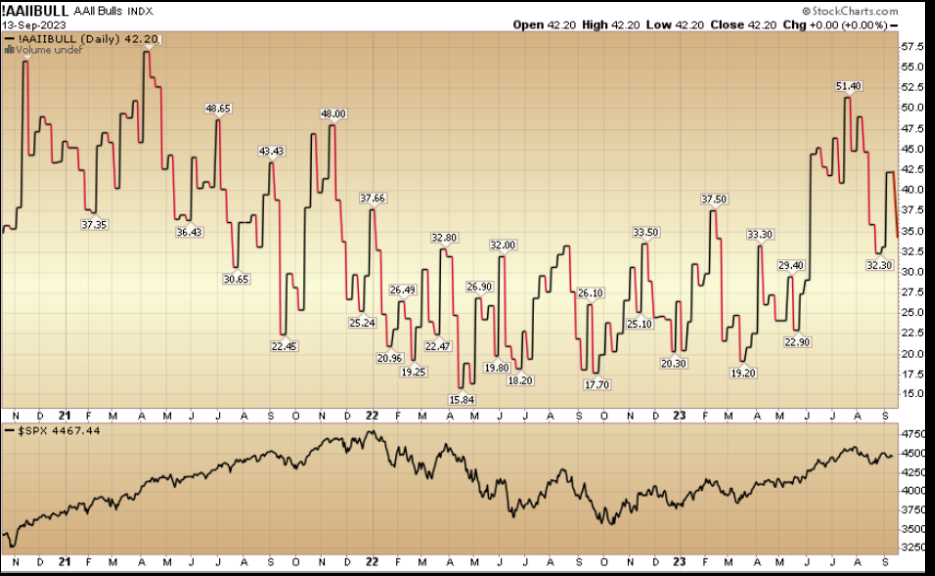

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 34.4% from 42.2% the previous week. Bearish Percent ticked down to 29.2% from 29.6%. The retail investor is neutral at the moment.

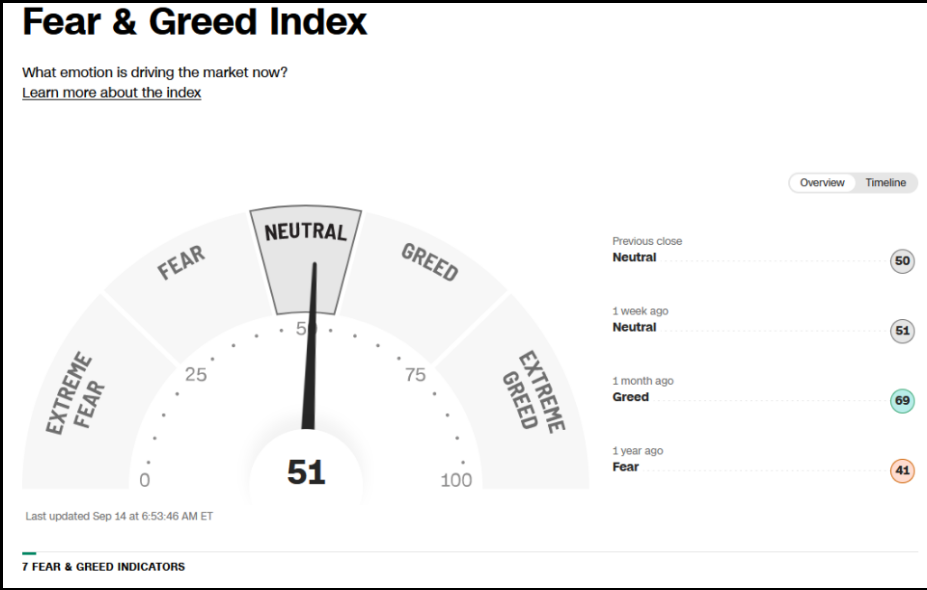

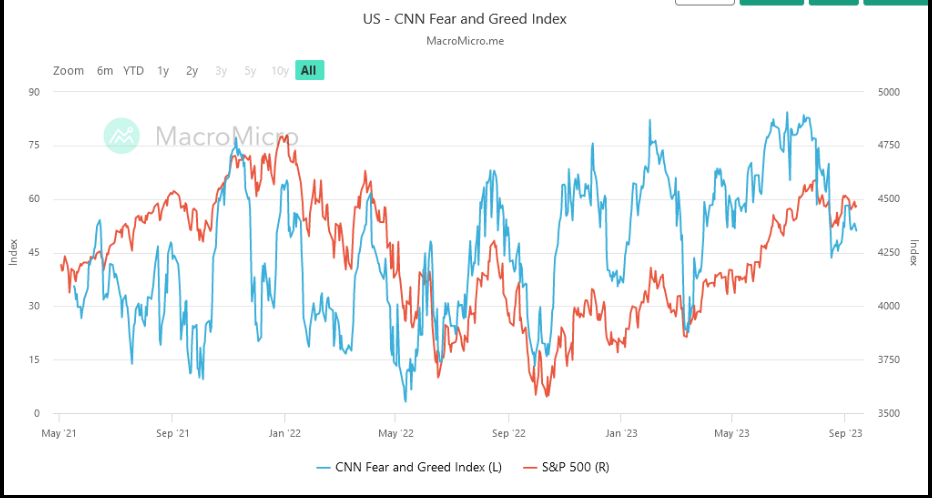

The CNN “Fear and Greed” ticked down from 56 last week to 51 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

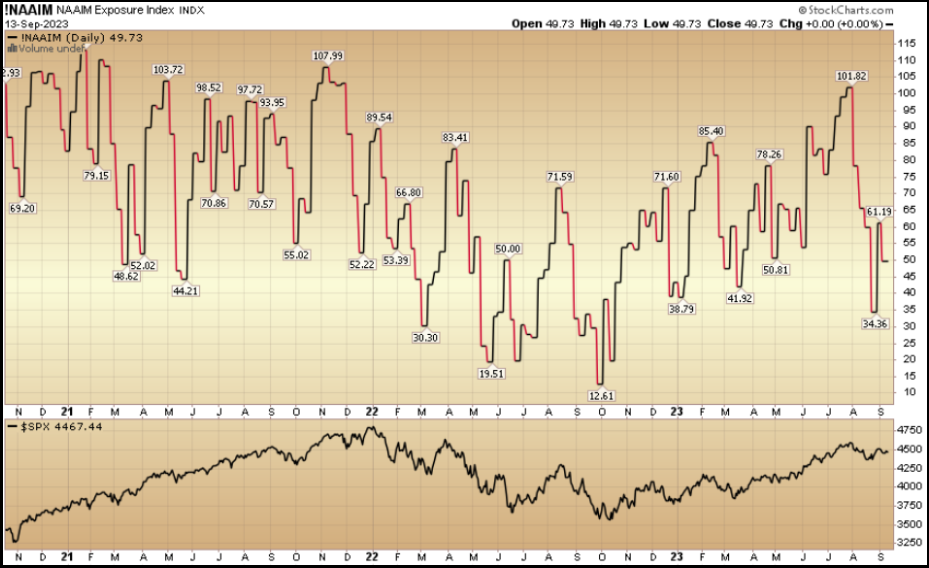

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 49.73% this week from 61.19% equity exposure last week.

This content was originally published on Hedgefundtips.com.