Professor Paul Krugman was at it last week when he opined:

For more than three decades, almost everyone who matters in American politics has agreed that higher taxes on the rich and increased aid to the poor have hurt economic growth ... But there’s now growing evidence for a new view - namely, that the whole premise of this debate is wrong, that there isn’t actually any trade-off between equity and inefficiency. Why? It’s true that market economies need a certain amount of inequality to function.

Follow up:

Before you start thinking that our favorite liberal economist has switched sides - he went on to argue against this premise - "Goodbye, trickle-down; hello, trickle-up." I personally am not a fan of trickle up or down - trickling only works in theory. I am a fan of trying to push forward equality - but realizing total equality is a theoretical hypothetical state. There will always be kids born in privileged homes, and those born in poorer homes in any society, whether it is a capitalistic or socialistic system.

What can be equalized is access to education, food, shelter, clothing, good jobs, and credit. Then whatever inequality results is more of a natural order than true inequality. Still, a society is only as strong as its weakest link - and safety nets remain necessary.

Part of Professor Krugman's rant was based on his premise that inequality correlates with economic growth - inequality up, growth down. Unfortunately, the supporting study reference to this premise noted:

We should also be cautious about drawing definitive policy implications from cross-country regression analysis alone, of course. We know from history and first principles that after some point redistribution will be destructive to growth, and that beyond some point extreme equality also cannot be conducive to growth. And causality is difficult to establish with full confidence. And we also know that different sorts of policies are likely to have different effects in different countries at different times.

There is no evidence in this referenced study that the USA needs to make adjustments for inequality. But arguing so is the nature of Political Economists - who are trying to explain away poor economic performance when their party is in control. There is no question the USA economy is under-performing, and it is unlikely inequality per se has a significant impact to the current predominant economic dynamics. There are a lot of elements in this current economic "expansion" that are terrible - and discussions generally point to the obvious: Economists know little about economic dynamics (even though they have a lot of opinions based on little fact). At the heart of the matter may be that most economists trying to express opinions about dynamics (which by its very name infers change) starting from assumptions that the economy is (mostly) in equilibrium.

GDP was designed to measure final consumption. If one uses GDP as the metric for economic growth, then the consumer is the cause of poor economic growth (as the consumer represents over 2/3rds of all consumption in the USA). So the question is really "what is the cause?"

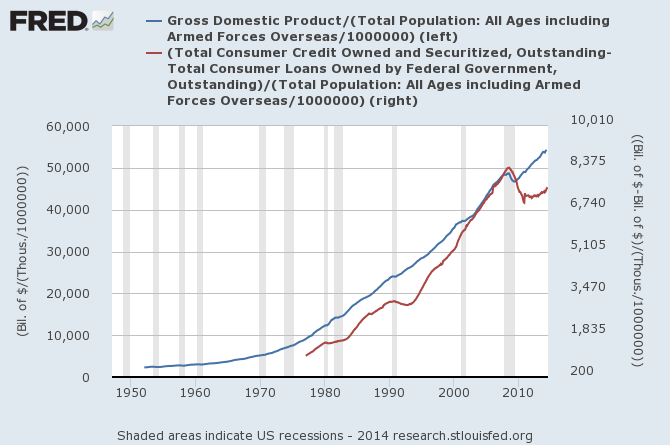

Recently the Federal Reserve issued their consumer credit data for June showing a credit expansion of 6.5% - with consumer credit expanding 4.0% removing student loans. The red line in the graph below shows consumer credit (excluding student loans) expanding much slower than the historical rate of growth.

The USA over the last 50 years has expanded on the back of consumer credit. Could it be that the consumer is tapped out with credit, and with such low inflation is more unwilling to borrow (as the loans cannot be repaid with inflated dollars)? Could it be that the zero interest rate policy (ZIRP) of the Federal Reserve is damaging the ability of the economy to expand as ZIRP may be deflationary? Does an economy require a moderate amount of inflation to be able to use credit to expand the economy?

Or are the USA consumers simply resetting. I consider that most consumer consumer credit is buying things today, and reducing one's ability to buy in the future when future income goes to paying back loans. If there is truth in the opinion that this is a reset of consumer credit to more of a cash basis - then lower credit expansion will continue to constrain GDP growth now - but reduce what would have been future limits imposed had more debt been assumed now.

There WAS good reason for ZIRP at the start as the Great Recession was a financial crisis (and the economy needed an influx of cheap money as a prescription) - but now the economic growth may possibly be damaged by the continuation of this policy. Inequality in the USA is NOT helping economic growth - but there are other dynamics (such as ZIRP and low credit expansion) which may be restraining economic growth significantly more.

Other Economic News this Week:

The Econintersect Economic Index for August 2014 is showing our index at a 3 year high. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income and expenditures growth are similar. The GDP expansion of 4% in 2Q2014 is overstated as 2.1% of the growth would be making up for the contraction in 1Q2014, and 1.7% of the growth is due to an inventory build.

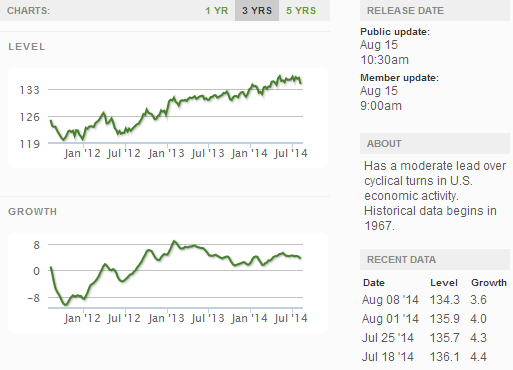

The ECRI WLI growth index value has been weakly in positive territory for almost two years. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

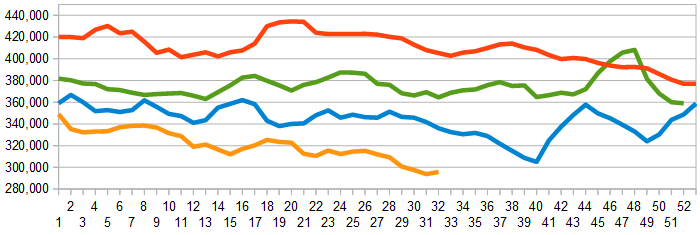

The market was expecting the weekly initial unemployment claims at 295,000 to 300,000 (consensus 295,000) vs the 311,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 293,750 (reported last week as 293,500) to 295,750.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: None

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: