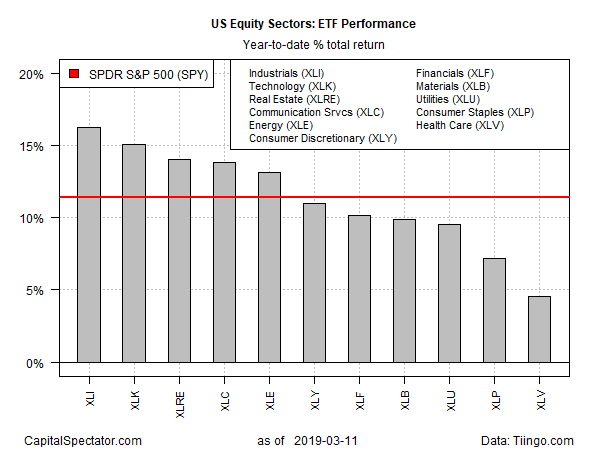

Industrial companies remain the strongest-performing sector for the US stock market year to date, based on a set of exchange-traded funds. Although all the major equity sectors are posting gains so far in 2019, industrials are holding on to a first-place finish as of trading through yesterday’s close (Mar. 11).

Industrial Select Sector SPDR (XLI) is up 16.3% in 2019. The ETF’s performance is modestly ahead of the second-strongest sector advance via Technology Select Sector (XLK), which is ahead by 15.1%.

XLI’s leading return this year is all the more impressive when you consider that the ETF’s top holding is Boeing (NYSE:BA), which has fallen sharply in the wake of news that several countries have suspended operation of the firm’s 737 Max aircraft, which suffered a second fatal crash in less than five months on Sunday.

The weakest sector performer this year is health care. Health Care Select Sector SPDR (XLV) is up a comparatively modest 4.5% year to date.

The stock market overall continues to post a strong year-to-date return, based on an ETF proxy. SPDR S&P 500 (SPY) is up 11.4% through Monday’s close.

Reviewing sector ETF performance through a technical lens as a proxy for momentum reveals that only four funds are currently posting relatively strong upside biases, based on comparing a set of moving averages. By that score, real estate (XLRE) and utilities (XLU) are red hot, based on 50-day averages well above 200-day averages. Note, too, that both funds closed at new highs yesterday.

The 50-day averages for health care (XLV) and consumer staples (XLP) also closed above their 200-day averages on Monday, but just barely, suggesting that positive momentum is relatively fragile for these ETFs at the moment vs. XLRE and XLU.