Recently the media has been awash in reports about the strength in the underlying industrial production reports.However, one indicator may be signaling that the recent upticks in production may be about to fade.

One of the points that we have been making lately is that the "pop" in economic activity, while still very weak, was most likely derived from the void that was created by the combination of the Japanese disaster trio of tsunami, earthquake and nuclear crisis, the debt ceiling debate in the U.S. and the Euro-Crisis. This caused a coinciding retrenchment of both manufacturing and consumer during the second and third quarter period. As the environment cleared there was a restart of the auto manufacturing and consumption cycle to meet pent up demand. This led to an uptick, again not a strong one, in the late 3rd and 4th quarters of 2011.

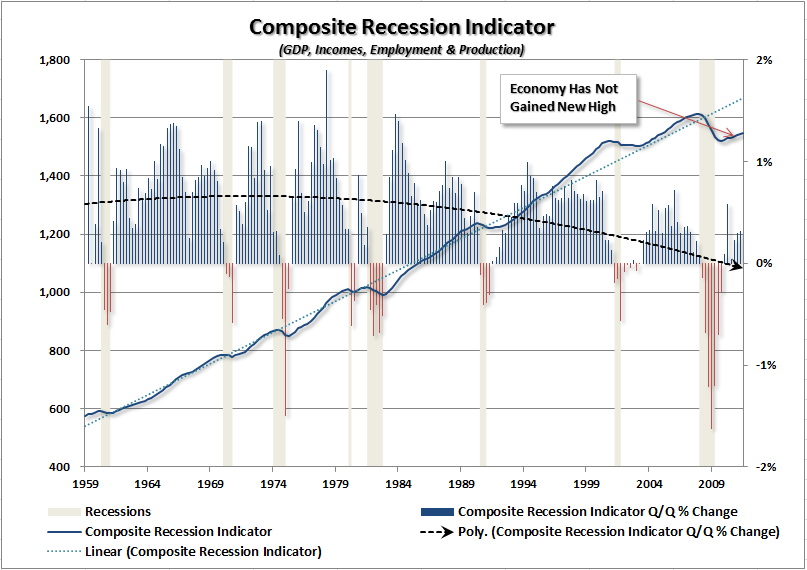

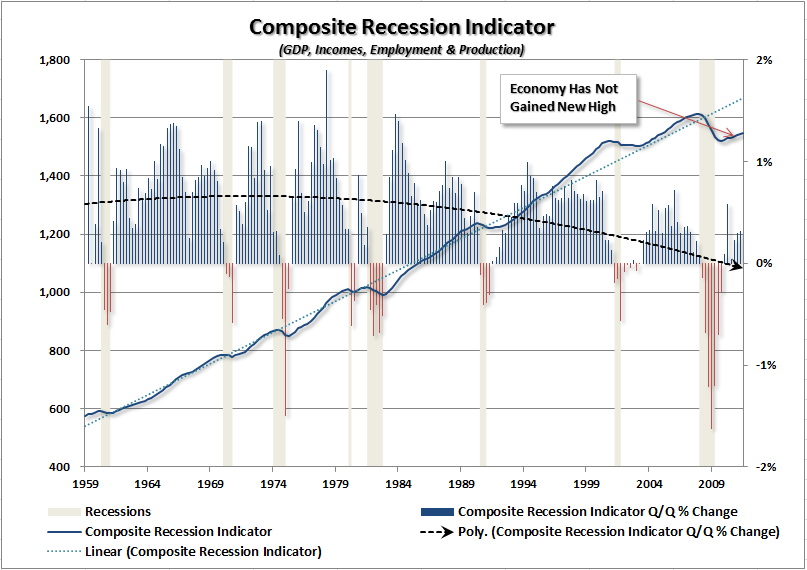

However, our concern has been that the void that was created by the combination of negative forces has now been primarily refilled and weakness will once again likely resurface. Unfortunately, as you can see by our primary composite economic indicator, the economy not only has yet to fully recover from the previous recession by reaching new highs but is by far the weakest recovery on record. Therefore, while we are hopeful of a "struggle through" economy mired between 2-2.5% growth over the next few years, the reality is that economy is extremely vulnerable to another downturn.

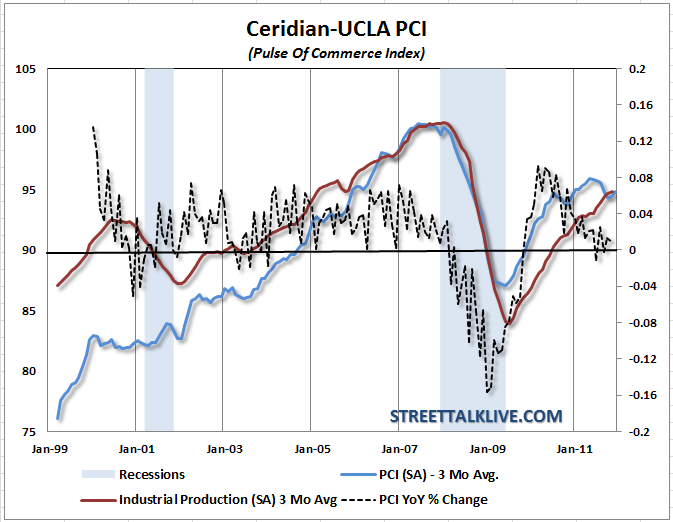

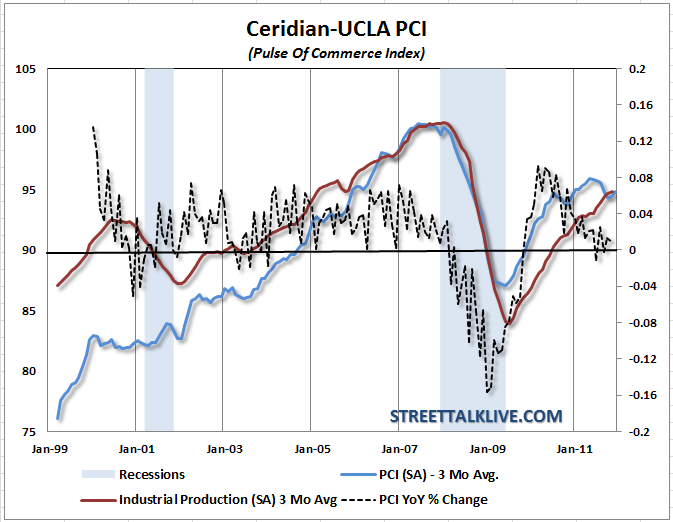

What caught our attention today was the Ceridian-UCLA Pulse of Commerce Index. This index, while not having a lot of history to draw off of, did a very good job of predicting both the beginning and end of the last recession. The 3-month average of the seasonally adjusted PCI index tends to lead the 3-month average of the industrial production index. With the 3-month PCI index having turned down in the last two months it could well be signaling that we could begin to see weakness show up in the production sector of the economy.

More importantly, the year-over-year change in the PCI index has declined sharply from it's 2010 peak of 9.27% to a meager 0.9% annual change at the end of November 2012.Declines of this magnitude occurred just prior to the last two recessions.

While we are hopeful that the nascent signs of economic strength are truly the initial sprouts of the long awaited recovery. However, we have to remain focused on the downside risks as they relate to portfolio management. As we stated previously, the economy remains extremely weak and is vulnerable to external shocks which could come at anytime from a resurgence of the debt crisis to a sharp rise in gasoline prices. Furthermore, it is highly unlikely that our production cycles can escape the gravitational pull of the drag in the Eurozone considering roughly 1/5 of U.S. exports and profits coming from that region.With the PCI indicator potentially forecasting a slowing of production here in the U.S. in the coming months it may well pay heed to remain a bit cautious heading into the new year.

One of the points that we have been making lately is that the "pop" in economic activity, while still very weak, was most likely derived from the void that was created by the combination of the Japanese disaster trio of tsunami, earthquake and nuclear crisis, the debt ceiling debate in the U.S. and the Euro-Crisis. This caused a coinciding retrenchment of both manufacturing and consumer during the second and third quarter period. As the environment cleared there was a restart of the auto manufacturing and consumption cycle to meet pent up demand. This led to an uptick, again not a strong one, in the late 3rd and 4th quarters of 2011.

However, our concern has been that the void that was created by the combination of negative forces has now been primarily refilled and weakness will once again likely resurface. Unfortunately, as you can see by our primary composite economic indicator, the economy not only has yet to fully recover from the previous recession by reaching new highs but is by far the weakest recovery on record. Therefore, while we are hopeful of a "struggle through" economy mired between 2-2.5% growth over the next few years, the reality is that economy is extremely vulnerable to another downturn.

What caught our attention today was the Ceridian-UCLA Pulse of Commerce Index. This index, while not having a lot of history to draw off of, did a very good job of predicting both the beginning and end of the last recession. The 3-month average of the seasonally adjusted PCI index tends to lead the 3-month average of the industrial production index. With the 3-month PCI index having turned down in the last two months it could well be signaling that we could begin to see weakness show up in the production sector of the economy.

More importantly, the year-over-year change in the PCI index has declined sharply from it's 2010 peak of 9.27% to a meager 0.9% annual change at the end of November 2012.Declines of this magnitude occurred just prior to the last two recessions.

While we are hopeful that the nascent signs of economic strength are truly the initial sprouts of the long awaited recovery. However, we have to remain focused on the downside risks as they relate to portfolio management. As we stated previously, the economy remains extremely weak and is vulnerable to external shocks which could come at anytime from a resurgence of the debt crisis to a sharp rise in gasoline prices. Furthermore, it is highly unlikely that our production cycles can escape the gravitational pull of the drag in the Eurozone considering roughly 1/5 of U.S. exports and profits coming from that region.With the PCI indicator potentially forecasting a slowing of production here in the U.S. in the coming months it may well pay heed to remain a bit cautious heading into the new year.