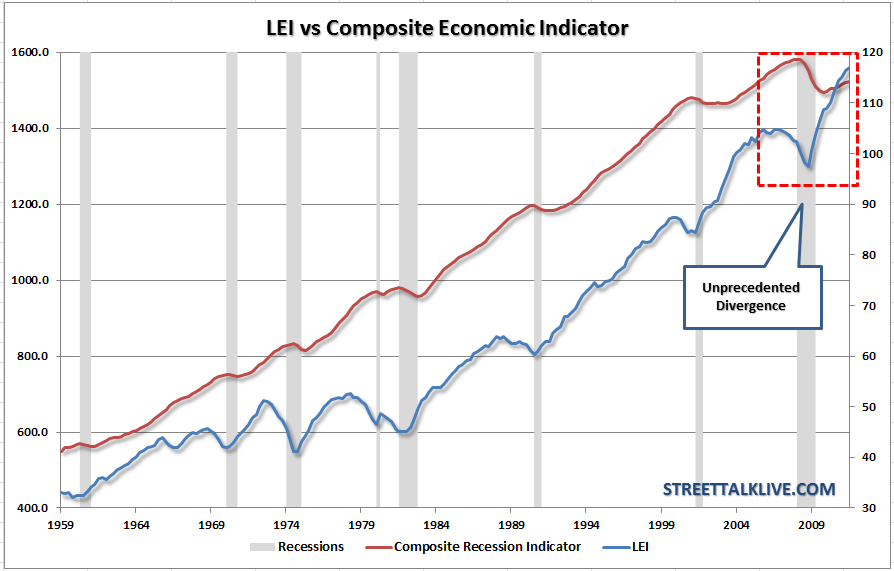

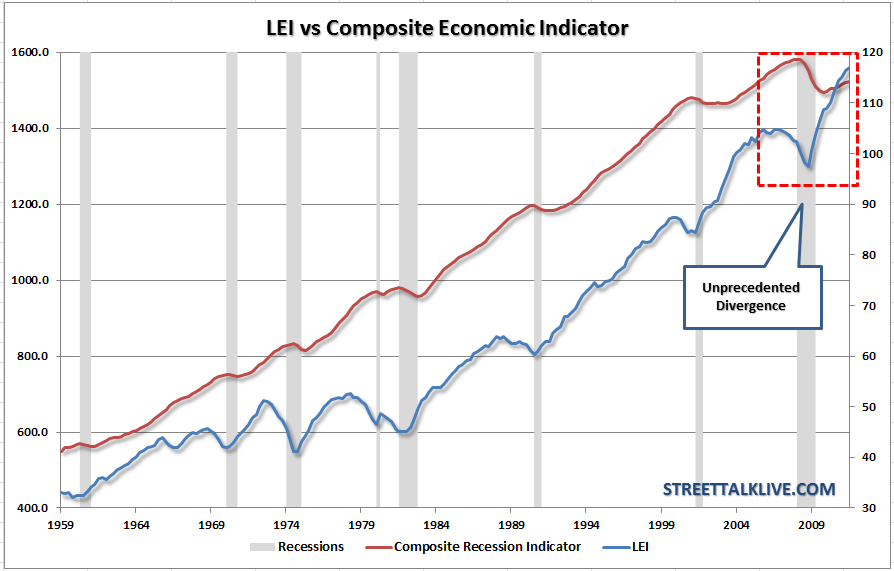

For the last several months I have been scratching my head about the Leading Economic Indicator Index (LEI), as published by the Conference Board, due to the divergence between it and other leading indicators that we watch. The LEI has risen extremely sharply while real indications of the economy such as changes to employment, industrial production, incomes and personal consumption expenditures have not. While the immediate conclusion is the manipulation of the yield curve and money supply are responsible for the disparity - the reality is that those two indicators alone do not account for the magnitude of the deviation.

[Geek Note: The Composite Recession Indicator is a weighted average of the changes to employment, industrial production, incomes and personal consumption expenditures.]

Furthermore, the sharp rise in the index from recessionary lows without the confirming rise of economic growth to new highs, as witnessed post every previous recessionary trough, has been a perplexing mystery given the fact the ECRI Weekly Leading Index and others have been showing leading indications of economic weakness. So, what does industrial production have to do with this?

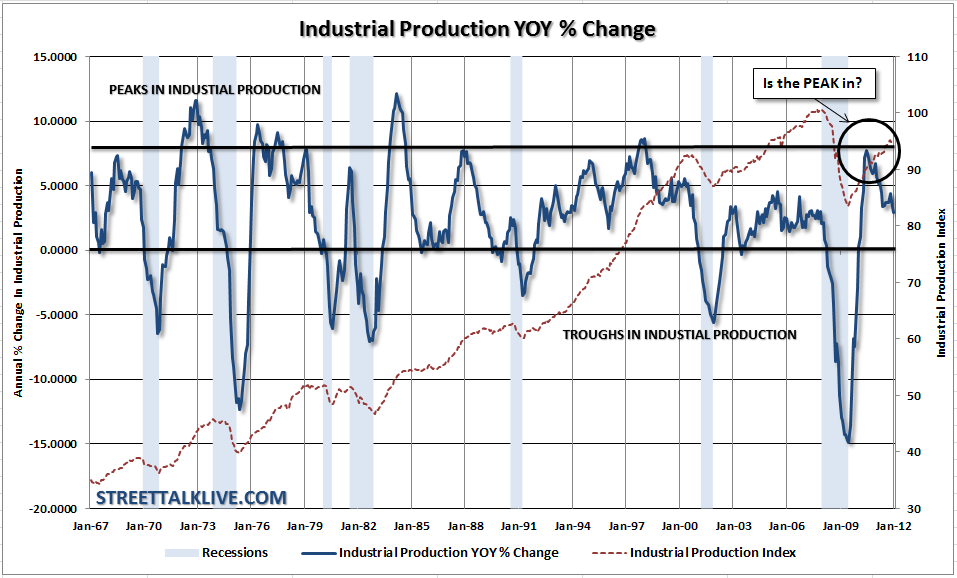

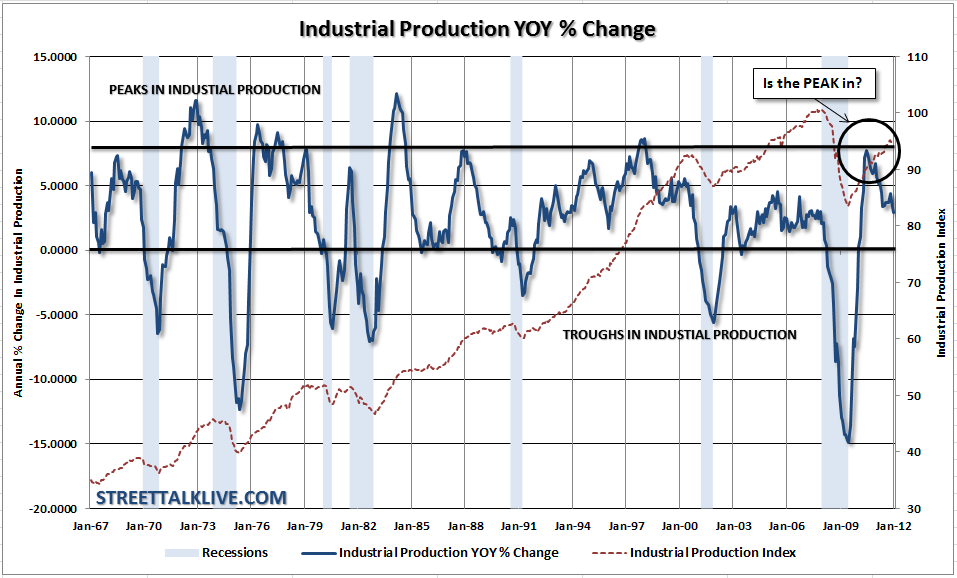

The release of industrial production yesterday showed a 0.4% advance over the last month. On the surface this sounds positive but in reality it goes further to confirm the LEI conundrum. While the LEI has soared off to the moon, industrial production has not only failed to attain a new high in this post-recessionary recovery but has peaked and begun to decline.

That decline is important. Historically when industrial production has peaked on a year-over-year basis, particularly at the levels we witnessed in May of 2010, it has been a precursor to economic weakness ahead. While it is not a great economic recession timing indicator for the media which tries to market time economic cycles - it has been a very good warning sign that the trend of economic growth will be weaker, rather than stronger, in the quarters ahead.

So, you can now see why my consternation has been trying to reconcile the "moonshot" in the LEI with the real economy. Not only has industrial production not attained a new high but neither has the "real" economy. The good news is that the Conference Board has apparently come to the same conclusion.

Changes Coming To The LEI

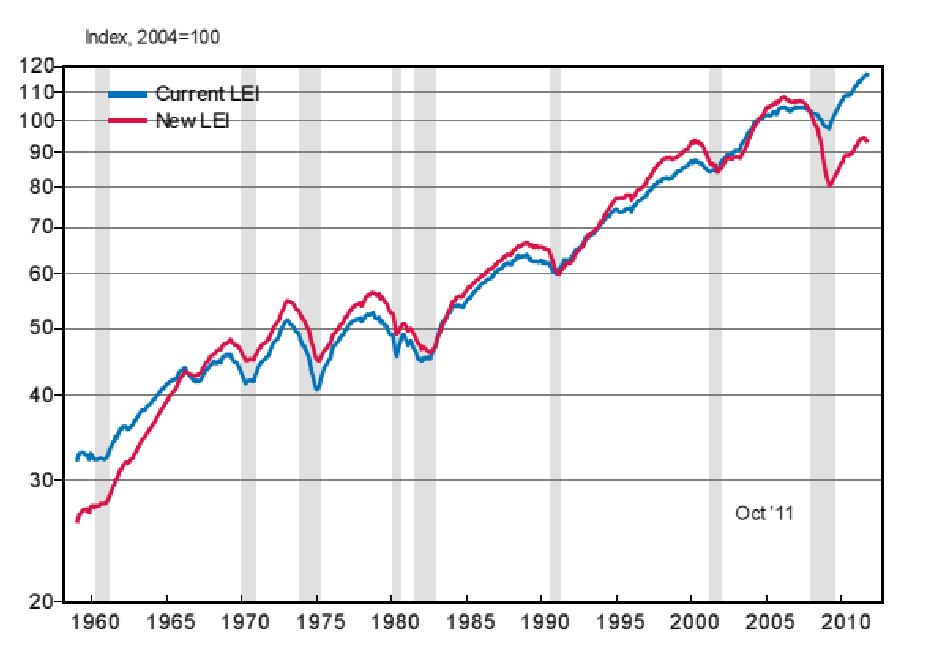

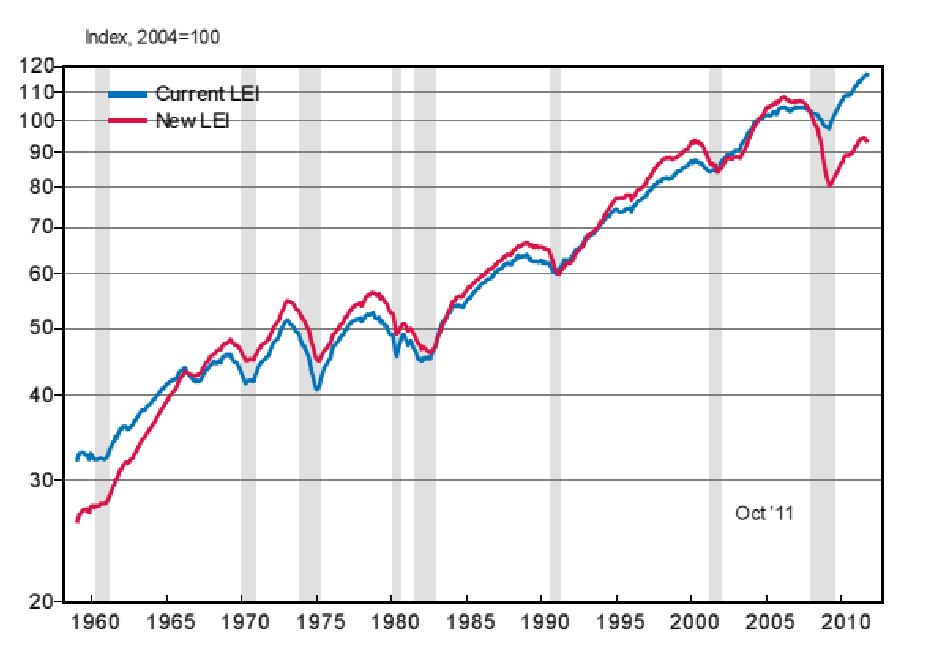

In a December 2011 abstract from the Conference Board: "Following an extensive reevaluation of existing indicators included in the Conference Board Leading Economic Index for the United States, we propose a comprehensive revision of the composite index."

The new revisions to the data will not be released until January 26th. As soon as the data becomes available I will provide a complete breakdown and comparative analysis. However, in the meantime, the abstract yielded a chart of the NEW LEI versus the old. The immediate takeaway is that our consternations over the index have been validated and the new LEI now corresponds much more closely with our economic composite indicator. The new LEI has not only NOT achieved a new high in the post recessionary cycle but has also turned down recently showing some potential for economic weakness ahead.

The "Struggle Through" Economy

The rallying cry of mainstream economists is that of the "muddle through" economy. It is akin to the "Goldilocks Economy" that was espoused in 2007 and early 2008. The reality is that economies do not "muddle" - they either grow or contract. The good news is that the economy is currently growing BUT is "struggling" to grow at a very slow rate.

Unfortunately, that rate of growth is not fast enough to meaningfully correct the employment situation or meaningfully reduce the deficit. It is also not strong enough to shield the overall economy from external shocks and financial downturns. This is why the Eurozone remains a real threat to our domestic economy.

While there are many hopes of a strong and lasting economic rebound in the quarters ahead the real data ultimately discounts that probability. With incomes stagnant, as food and energy costs consume more than 22% of wages and salaries, the consumptive capabilities of Americans are being restricted. Add to this the diversion of incomes to delever the household balance sheet, at the same time home values deflate, and it makes for weak drivers of future economic growth.

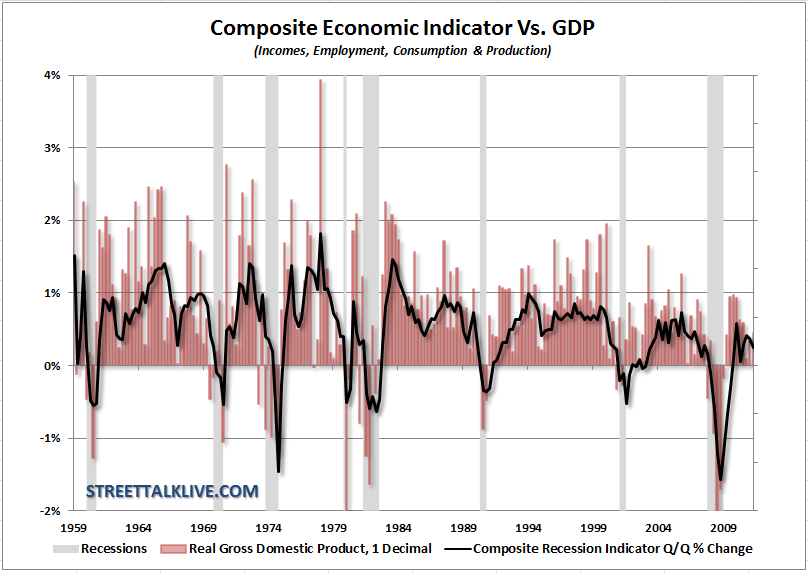

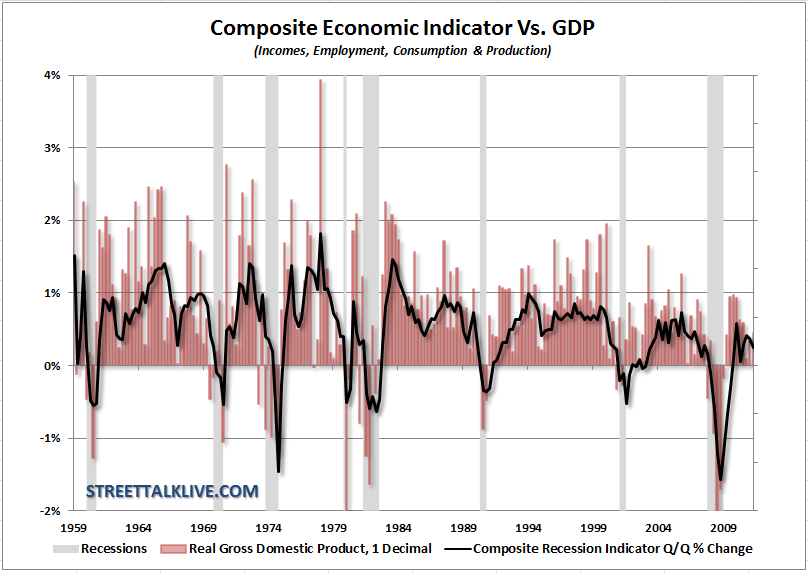

This is evident with the quarter-over-quarter change in the composite economic indicator already showing typical peaks of a post recessionary recovery. Unfortunately, these peaks have been at consistently lower levels post each recessionary recovery since 1980. While "hope" springs eternal by economists of economic growth of 3.5% and higher over the coming years ahead - the reality is that the world is not currently in a position to generate that.

While we wait on the Conference Board to make their revisions to their data it is important to keep a watch on the things that really matter in the economy. The media is quick to dismiss rumors of a potential "recession" because it hasn't occurred yet. However, the REAL risk to investors is not the actual start or end date of a recession - it is when the market begins to adjust the pricing of "risk" that matters. The economy will cycle and current indications are that the economy is far weaker than most realize. While recent data shows some recovery - it is nascent at best and easily subject to reversals.

The forthcoming changes by the Conference Board to the LEI index will be welcome. Hopefully the changes will provide us with a more economically sensitive and realistic indicator to add back into our arsenal to predict future turning points in the economy.

[Geek Note: The Composite Recession Indicator is a weighted average of the changes to employment, industrial production, incomes and personal consumption expenditures.]

Furthermore, the sharp rise in the index from recessionary lows without the confirming rise of economic growth to new highs, as witnessed post every previous recessionary trough, has been a perplexing mystery given the fact the ECRI Weekly Leading Index and others have been showing leading indications of economic weakness. So, what does industrial production have to do with this?

The release of industrial production yesterday showed a 0.4% advance over the last month. On the surface this sounds positive but in reality it goes further to confirm the LEI conundrum. While the LEI has soared off to the moon, industrial production has not only failed to attain a new high in this post-recessionary recovery but has peaked and begun to decline.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

That decline is important. Historically when industrial production has peaked on a year-over-year basis, particularly at the levels we witnessed in May of 2010, it has been a precursor to economic weakness ahead. While it is not a great economic recession timing indicator for the media which tries to market time economic cycles - it has been a very good warning sign that the trend of economic growth will be weaker, rather than stronger, in the quarters ahead.

So, you can now see why my consternation has been trying to reconcile the "moonshot" in the LEI with the real economy. Not only has industrial production not attained a new high but neither has the "real" economy. The good news is that the Conference Board has apparently come to the same conclusion.

Changes Coming To The LEI

In a December 2011 abstract from the Conference Board: "Following an extensive reevaluation of existing indicators included in the Conference Board Leading Economic Index for the United States, we propose a comprehensive revision of the composite index."

The new revisions to the data will not be released until January 26th. As soon as the data becomes available I will provide a complete breakdown and comparative analysis. However, in the meantime, the abstract yielded a chart of the NEW LEI versus the old. The immediate takeaway is that our consternations over the index have been validated and the new LEI now corresponds much more closely with our economic composite indicator. The new LEI has not only NOT achieved a new high in the post recessionary cycle but has also turned down recently showing some potential for economic weakness ahead.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The "Struggle Through" Economy

The rallying cry of mainstream economists is that of the "muddle through" economy. It is akin to the "Goldilocks Economy" that was espoused in 2007 and early 2008. The reality is that economies do not "muddle" - they either grow or contract. The good news is that the economy is currently growing BUT is "struggling" to grow at a very slow rate.

Unfortunately, that rate of growth is not fast enough to meaningfully correct the employment situation or meaningfully reduce the deficit. It is also not strong enough to shield the overall economy from external shocks and financial downturns. This is why the Eurozone remains a real threat to our domestic economy.

While there are many hopes of a strong and lasting economic rebound in the quarters ahead the real data ultimately discounts that probability. With incomes stagnant, as food and energy costs consume more than 22% of wages and salaries, the consumptive capabilities of Americans are being restricted. Add to this the diversion of incomes to delever the household balance sheet, at the same time home values deflate, and it makes for weak drivers of future economic growth.

This is evident with the quarter-over-quarter change in the composite economic indicator already showing typical peaks of a post recessionary recovery. Unfortunately, these peaks have been at consistently lower levels post each recessionary recovery since 1980. While "hope" springs eternal by economists of economic growth of 3.5% and higher over the coming years ahead - the reality is that the world is not currently in a position to generate that.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

While we wait on the Conference Board to make their revisions to their data it is important to keep a watch on the things that really matter in the economy. The media is quick to dismiss rumors of a potential "recession" because it hasn't occurred yet. However, the REAL risk to investors is not the actual start or end date of a recession - it is when the market begins to adjust the pricing of "risk" that matters. The economy will cycle and current indications are that the economy is far weaker than most realize. While recent data shows some recovery - it is nascent at best and easily subject to reversals.

The forthcoming changes by the Conference Board to the LEI index will be welcome. Hopefully the changes will provide us with a more economically sensitive and realistic indicator to add back into our arsenal to predict future turning points in the economy.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.