The USD/JPY is mounting a rally from 113.87.

DESCRIPTION

The USD/JPY is currently trading at 114.308 after investors defended the price from falling below the first support, which is on 113.87, the July 10 low. The pair is gaining some momentum and we expect the price to push towards 130.72, the 200 week MA or even the second resistance which is on 115.10, the cloud shadow and the March 14 high. The last resistance of the day will be on 115.51, the March 10 high. However, if the price falls below 113.87, we expect the second support at 113.69, the July 5 high and the last support at 113.47, the July 6 high.

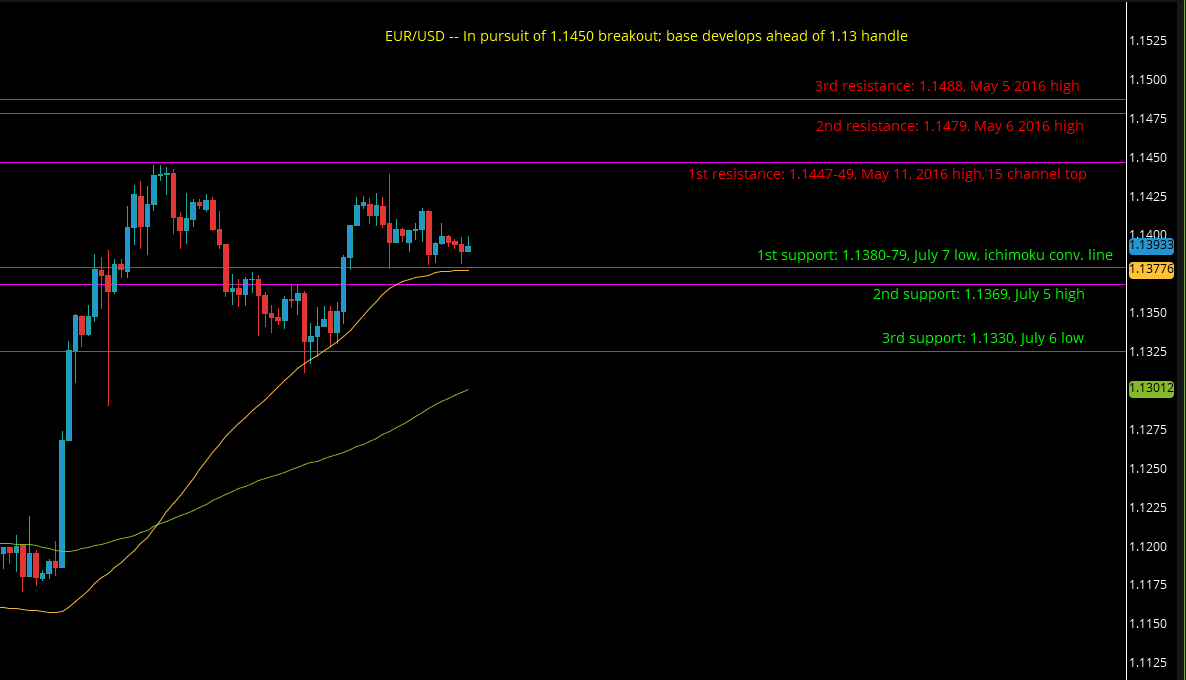

The EUR/USD is yet to fall below 1.1380

DESCRIPTION

Investors refuse to give up the first support level which is on 1.1380, the July 7 low and the Ichimoku conversion line. If the price breaks down below the first support and also the 50 day moving average, we expect a second support on 1.1369, the July 5 high, and the last support on 1.1330, the July 6 low. The first resistance is on 1.1447, the May 11, 2016 high. The second resistance is on 1.1479, the May 6, 2016 high whereas the third resistance is not far away, which is on 1.1488, the May 5, 2016 high.

GBP/USD: Slight downtrend can be observed from the Sterling chart with a spot price at 1.2917.

DESCRIPTION

With a recent fluctuation, the latest bar has crossed the 1st resistance level at 1.2920-31. If another crossover occurs, higher highs at the 2nd resistance level could be reached at the price of 1.2984 or higher, back above 1.30 at 1.3030. The bearish side looks quite narrow with the 1st support located at 1.2829. The 2nd one is located slightly after at 1.2829 and the 3rd one is right next to it at 1.2810.

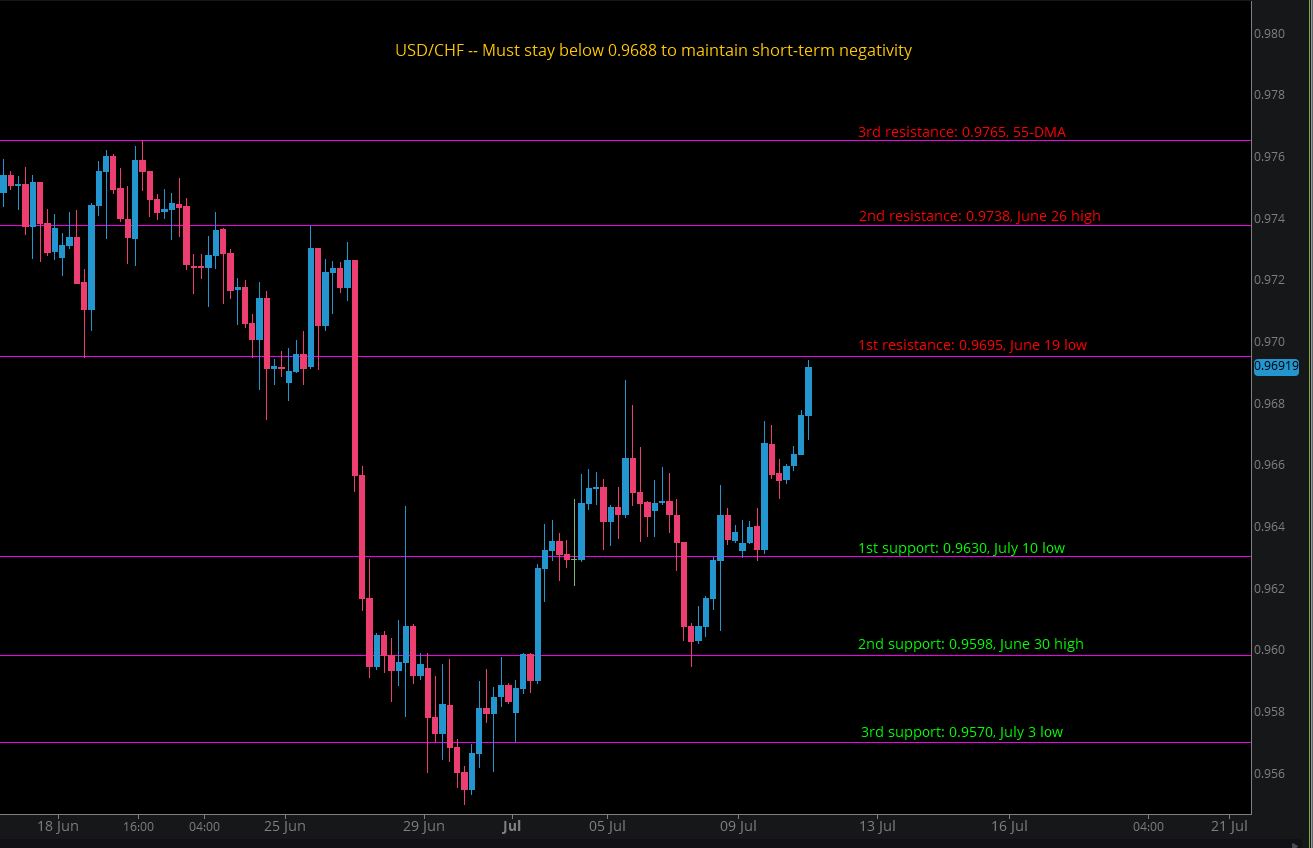

USD/CHF: Dollar shows strength with a fresh 0.9688 level breakthrough now trading at 0.9691

DESCRIPTION

With a shape of an uptrend over the past two weeks, a solid breakthrough at the 1st resistance of 0.9695 is expected. Higher on the bullish side the 2nd resistance awaits at 0.9738 and the 3rd one follows at 0.9765. Alternatively, the 1st support is set at 0.9630. The 2nd and 3rd ones are waiting at 0.9598 and 0.9570 respectively.