MetalMiner’s monthly stainless and nickel price index decreased 1.2 percent from January, registering a value of 79.

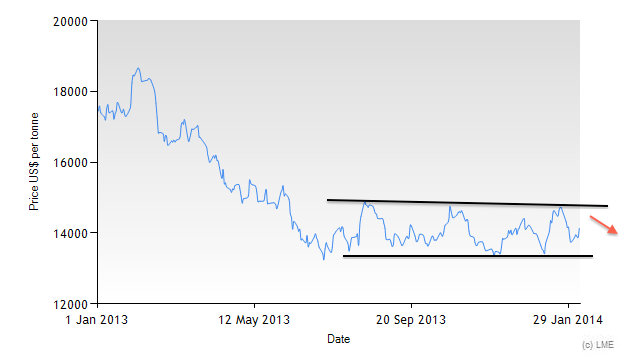

As a considerable component of stainless prices, the 3-month price of nickel on the LME closed the month at $13,740 per metric ton, a 1.8 percent decrease from the previous month. Over the past two months, we have seen many analysts panicking due to the Indonesia export ban.

Some were blaming the export ban and calling for higher prices any time nickel reached a new monthly high. We may argue that those analysts don’t understand the fundamentals of price action and we suggest our readers not make early decisions based on subjective opinions.

The last decrease on nickel prices wasn’t a big surprise for us. Why?

Nickel, like all industrial metals, remains in a long-term downtrend, meaning that prices are likely to keep struggling. During the past six months, nickel prices have remained pretty flat and we expect them to keep trading below $15,000 per metric ton.

What This Means For Metal Buyers

Despite the fact that people have been calling for higher prices due to the Indonesian export ban, nickel remains in a downtrend. We wouldn’t suggest buyers commit to large volumes in a falling market until we see real bullish signals.

Key Price Drivers

At $13,695 per metric ton, the spot price of nickel was down 2.2 percent on the LME. The 3-month price of nickel ended the month on the LME at $13,740 per metric ton, down from $13,990. The price of Chinese primary nickel finished the month by dropping 0.4 percent.

The Allegheny Ludlum 304 stainless surcharge rose 2.6 percent after falling the previous month. After dropping the previous month, the Allegheny Ludlum 316 stainless surcharge prices rose 2.5 percent.

Chinese ferro-chrome remained unchanged. Prices for Chinese ferro-moly remained constant as well. Chinese 304 stainless steel scrap held pat last month. Last month was consistent for Chinese 316 stainless steel scrap. Chinese 304 stainless coil did not budge the entire month. Chinese 316 stainless coil traded sideways last month.

The Stainless MMI® collects and weights 14 global stainless steel and raw material price points to provide a unique view into stainless steel price trends over a 30-day period. For more information on the Stainless MMI®, how it’s calculated or how your company can use the index, please drop us a note at: info (at) agmetalminer (dot) com.

by Raul de Frutos