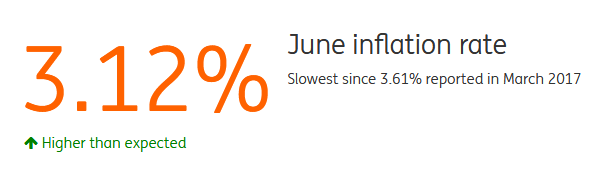

June inflation of 3.12% was the slowest since March 2017. As a result, we've now cut our inflation forecast for this year

Inflation slowdown partly due to base effects

June inflation slowed to 3.12% from May’s 3.23% and June 2017’s 4.37%. The slower June inflation is partly due to base effects and slower inflation for most major commodity groups of the consumer price index except for food and transport rates. Food inflation accelerated in June to 4.7% from May’s 4.5% and 2.4% in June 2017. Transport inflation also accelerated to 1.9% in June from May’s 1.7%.

Inflation forecast cut

We expect the positive base effects in the coming months to recede and bring about a reversal of the recent downtrend of inflation. The upward path of inflation in the second half would also be gradual and could likely be a mirror image of the inflation path in the first half. Tighter monetary policy in the past two months which saw policy rates rise by 100 basis points would moderate demand pull inflation and assist in moderating the price impact of a weak Indonesian rupiah (IDR). Monetary policy will continue to pursue a stabilization of the IDR, not only to help protect the financial system but also to keep inflation within target rate. We expect full-year 2018 inflation to average at 3.3%, slower than our previous 3.5% inflation forecast and close to the central bank's point inflation target of 3.5%.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.