Investors should start paying attention to gaming stocks as the third and fourth quarters of 2018 get underway. The decision of the Supreme Court to legalize sports betting is an interesting development that could activate short-term momentum for stakeholders in the industry. Market experts have already started predicting an uptrend in the revenue and margins of the gaming industry as the market adjusts to the news.

In a recent note to investors, Shaun Kelly of Bank of America Merrill Lynch (NYSE:BAC) observed that they "expect operator margins to be low but see upside for all of regional gaming, while gaming tech could be a key beneficiary." This piece examines the fundamentals of three high profile gaming stocks while making inferences about how the growth of the indie gaming community might impact on their long-term prospects.

Indie Game Developers Are Coming Up Strong

Indie game developers don’t have the financial muscles to challenge the big gaming firms, but they are turning to the strength of numbers to raise money from crowdfunding platforms. Crowdfunding is designed to be a fundraising solution that provides financial backing to entrepreneurs and causes that would have been underserved or unserved by Wall Street. Interestingly, the crowdfunding market is gradually tending towards providing funding to cliqued industries and causes.

The music, film and video and games industries have the highest number of funded projects on Kickstarter. Curiously, the gaming industry appears to be the most-loved industry in the crowdfunding market. On Kickstarter, the number of game projects that raised between $100K to $999,999 currently stands at about 1,152. The gaming industry also boasts the largest number of projects that have successfully raised more than $1M.

Now, a blockchain-solution, Game Protocol wants to make it exponentially easier for indie developers to crowdfund the financing for their projects. Using a proprietary GameStarter platform, Game Protocol is working on becoming a one-stop-shop for crowdfunding gaming projects. A decentralized platform dedicated to crowdfunding gaming projects removes much of communication and marketing headwinds that indie developers face when trying to raise funds from traditional crowdfunding platforms.

The company is also building a vibrant developer ecosystem where developers can leverage its software development tools to develop games easily. In addition, indie developers become a part of a community where they can collaborate with other developers and create the best games possible. With Game Protocol, developers can be sure that they are appealing to a targeted and highly-motivated set of gaming enthusiasts, many of whom don’t frequent generic crowdfunding platforms. The people who back the games in turn gets to access the best online games, obtain special benefits, make-in game purchases at a discount, and promote the adoption of cryptocurrency in the gaming markets.

3 Gaming Stocks To Watch

Analysts Are Bullish Nvidia

NVIDIA Corporation (NASDAQ:NVDA) is not a core gaming firm but it is an undeniable stakeholder in the global gaming market. The firm produces graphics processing units (GPUs) for the gaming markets in addition to manufacturing chips for the mobile and automotive markets. A bullish wave in the core gaming markets often translates into bullish tailwinds for Nvidia because core game makers tend to ramp up orders of its chips. It is worthwhile to note that there’s pent up demand for new gaming chips from the company because it hasn’t introduced a new gaming chip in the last two years.

Analysts at Raymond James recently reaffirmed their “Outperform” rating on the stock. In a note Chris Caso revealed that “we have increased conviction that the October quarter will benefit from a new gaming product cycle, which we expect to be a catalyst and potential source of upside.”

The shares of Nvidia are up around $239 a piece but the Raymond James analysts have a $300 price target on the stock by the end of the year.

EA To Leverage Game As Service

Electronic Arts (NASDAQ:EA) is one of the leading core gaming firms on Wall Street, the firm is easily the second-largest gaming company by revenue and market cap both in America and Europe. One of the key drivers of bullish sentiment on EA is that investors believe that it has the potential to become the Netflix (NASDAQ:NFLX) of the gaming industry as it prepares to launch its Origin Access Premier PC gaming subscription service.

In a recent noted to investors, Laura Martin of Needham & Co. submits that EA is starting to focus on a gaming demography that might prefer to rent rather than buy games. In her words, “it is our view that millennials want to rent content (e.g. Spotify, Pandora, Netflix, Hulu) rather than own it…” she believes the offering games-as-a-service could help EA unlock more upside potential from programming, e-commerce, and ad revenue.

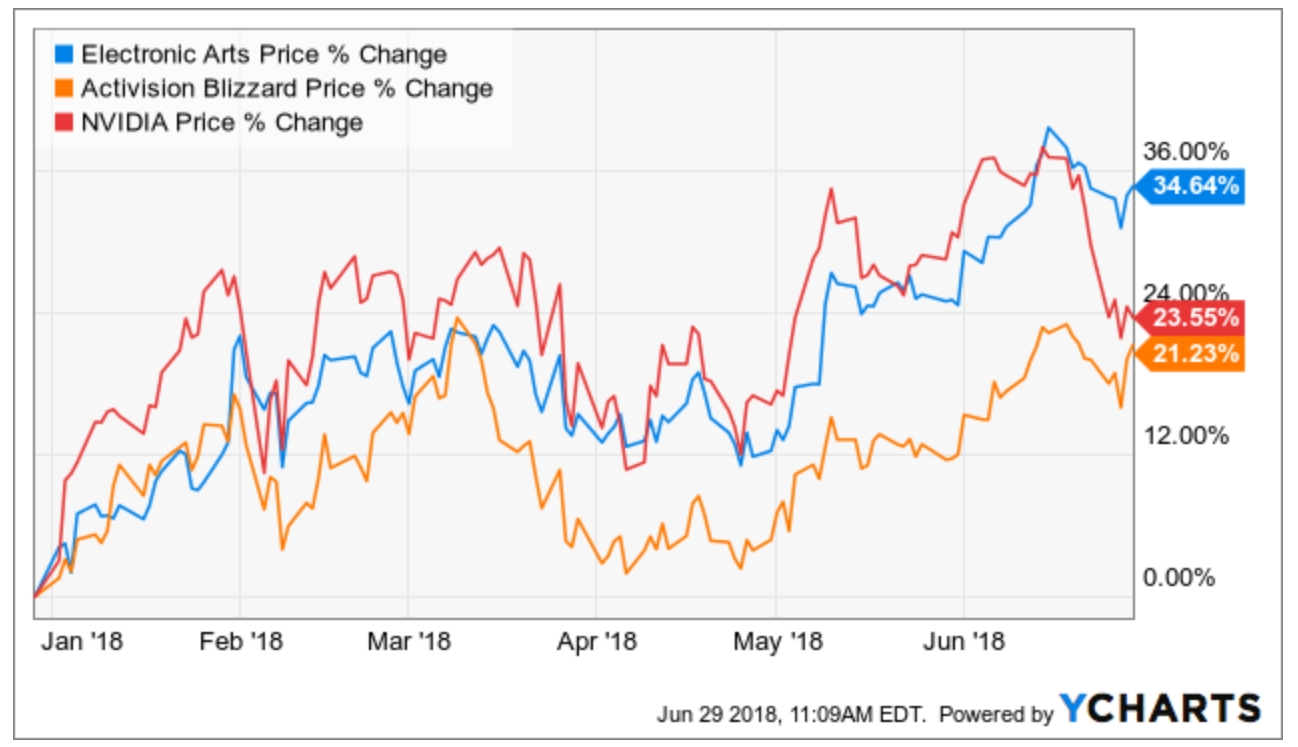

EA is an interesting bullish uptrend after gaining 34.44% in the year-to-date period. EA’s solid uptrend is justified and well-deserved as the firm outperformed market expectations in the last two quarters.

Activision Blizzard’s Gamble With eSports Is Paying Off

Activision Blizzard (NASDAQ:ATVI) is a well-known player in the global gaming industry – the firm delivered the iconic Call of Duty, World of Warcraft, and the mobile sensation called Candy Crush. Activision delivered a 75% uptrend last year and many investors started this year with fears of a massive pullback, however; the decent 20% YTD gains on the stock has laid most of those fears to rest. The key bullish driver for the company right now is its significant presence in the esports market segment.

The firm made a bold plunge into esports with the introduction of its Overwatch League and it has succeeded in selling its first 12 teams for $250. The firm is already working on plans to expand the league to 28 teams down the road.

Interestingly, Bernstein analyst, Todd Juenger thinks that video game stocks such as Activision Blizzard could be a potential acquisition target for giant media companies such as Walt Disney and 21st Century Fox. In his words, “Video game publishers are net cash (as opposed to highly levered), put forth an entertainment product which is perfectly suited for young people and growing in engagement (as opposed to the opposite), (and) have secular tailwinds driving revenue growth and margin improvement (as opposed to the opposite).”