Lead futures in London Metal Exchange (LME) and India’s Multi-Commodity Exchange (MCX) continues to trade positive despite an uncertain US economy and eurozone debt crisis due to steady growth in automobile battery demand in Asia Pacific, especially India and China.

On Tuesday lead inventories decreased by 3075 tons to 327950 tons suggesting tightness in the market. LME 3-month chart shows solid support for LME-3 month Lead at $2000 and near term support at $2100 per ton levels, according to Sreekumar Raghavan, Chief Commodity Strategist at Commodity Online. LME-3 month copper last traded at $2148 per ton on Tuesday.

Global market for Automotive Lead Acid Batteries is projected to reach US$43.9 billion by 2018, primarily driven by increase in automotive production, particularly in developing markets such as China and India, growing integration of start-stop technology in new age automobiles, and sustained demand from replacement and after market segments. Increasing adoption of electric vehicles also bodes well for the future of this market, according to a new market research report by Global Industryl Analysts.

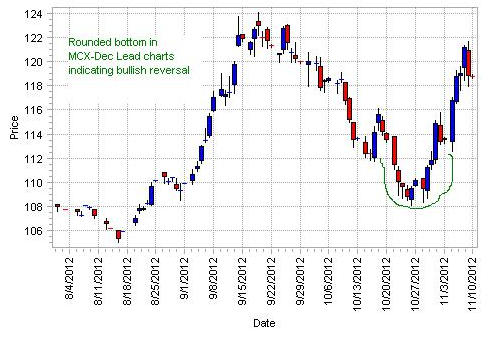

At India’s Multi Commodity Exchange (MCX), Lead December futures have gained 1.10% at Rs 119.70 per kg. Technical charts are suggesting the uptrend to continue on strong automotive industry demand. As can be seen from the MCX Chart for December, a rounded bottom has been formed towards middle of October to November but faces resistance at Rs 122/kg levels. Trade volume above 4000 lots and open interest above 2000 lot levels suggest continue bullish trend.

Strong rebound in China industrial output, exports and retail sales have helped base metals complex to regain from lows while rise in US equities and consumer confidence, re-election of Obama are also quite positive for metals market.

By Sreekumar Raghavan

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Indian Lead Futures Remain Strong, China Demand For Automotive Batteries

Published 11/15/2012, 12:28 AM

Indian Lead Futures Remain Strong, China Demand For Automotive Batteries

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.